It would seem that the Canadian dollar should be one of the stronger currencies this year due to the solid rally of oil prices, of which Canada is an exporter. So in theory - the higher the price of oil, the better for Canadian companies and the entire economy. Nevertheless, USD/CAD rate rose to the highest level since January.

This may be a consequence of what is happening with interest rates or what is to be happening with interest rates in Canada and how the market reacts. During yesterday's decision of the Bank of Canada the central bank abandoned its tightening bias. The rationale is that Canada's economy grapples with a slowdown, which at the moment may exclude any interest rate hikes. The Bank of Canada will observe developments in the crude oil market, household expenses or global trade policy, and will be able to take further decisions on this basis. After yesterday's meeting, the interest rate in Canada is still 1.75 percent.

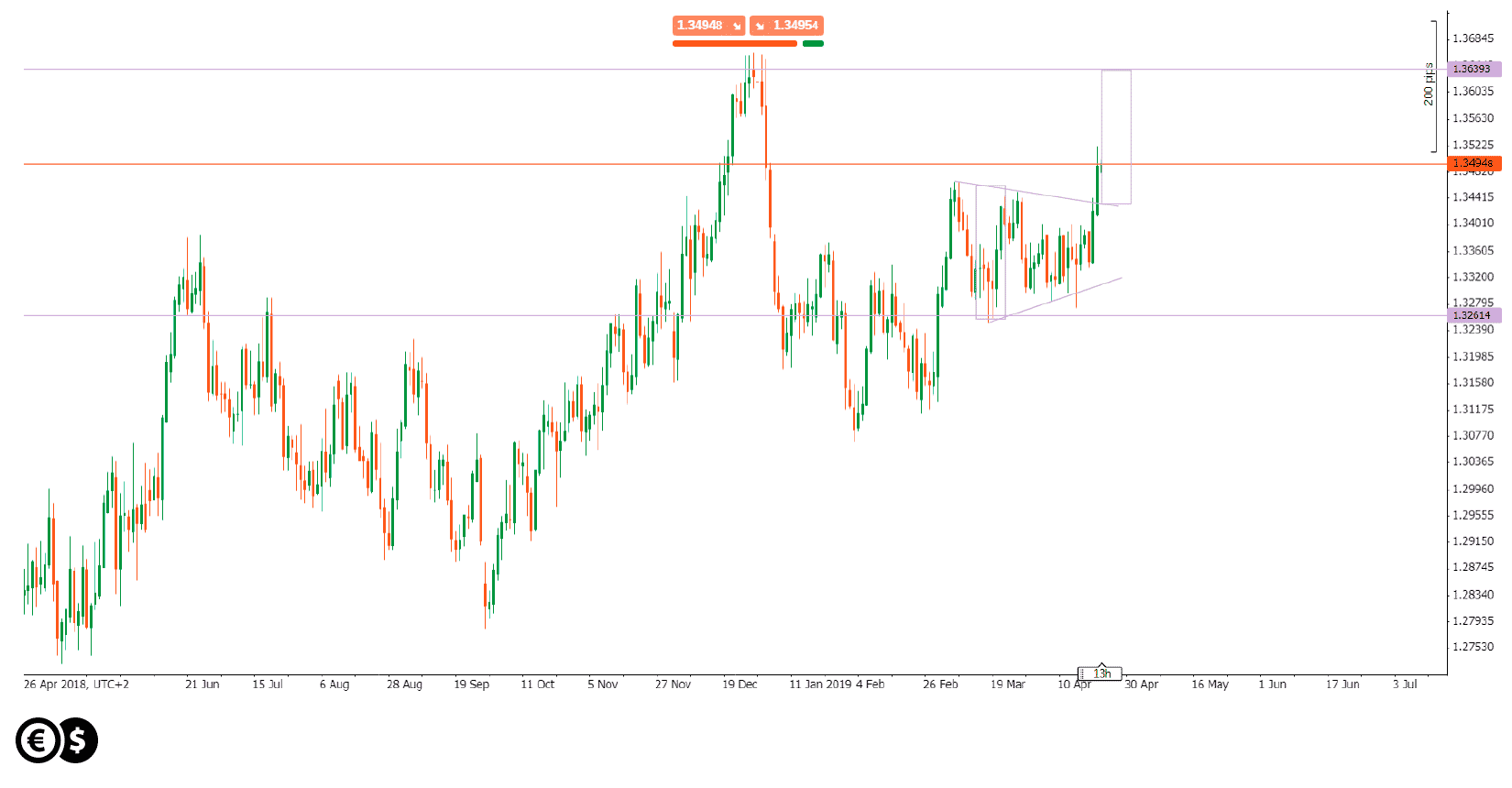

Chart: USD/CAD, D1. Conotoxia trading platform.

After yesterday's decision of the Bank of Canada, the USD/CAD rose as much as 0.7%, breaking the upper limit in a symmetrical triangle pattern. This is usually a trend continuation pattern, which took place this time. The textbook target after breaking out of such a formation is located near peaks from beginning of the year at 1.3639. The nearest support for the market may be located at broken upper limit in the pattern.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.