To the delight of the Swiss and the Swiss economy, CHF has been systematically losing value in relation to the euro or the dollar for several weeks. Being precise, the EUR/CHF exchange rate climbs up the fourth week in a row, reaching the levels last seen in October. Meanwhile the Swiss franc slips in relation to the dollar to its lowest level since January 2017.

A weak franc is good for the Swiss economy due to the fact that its depreciation may raise inflation in a country where interest rates are at a negative level. Thanks to the weaker franc, you should pay more for foreign products, and this helps in the increase in prices, which is generally very much desired by all major central banks in the world. Inflation in Switzerland is still below 1 per cent, even despite the intense SNB measures and dovish monetary policy.

The franc depreciation started after verbal intervention, when the EUR/CHF exchange rate fell to the lowest level since summer holidays in 2017. It awakened SNB representatives. There were statements that if there is a need, rates in Switzerland could be reduced even more, and intervention on the foreign exchange market is still possible.

Swiss franc is still highly valued, making SNB’s readiness to intervene in FX markets and negative interest rates very important - said SNB President Thomas Jordan this weekend. He added that SNB can cut interest rate further at any time.

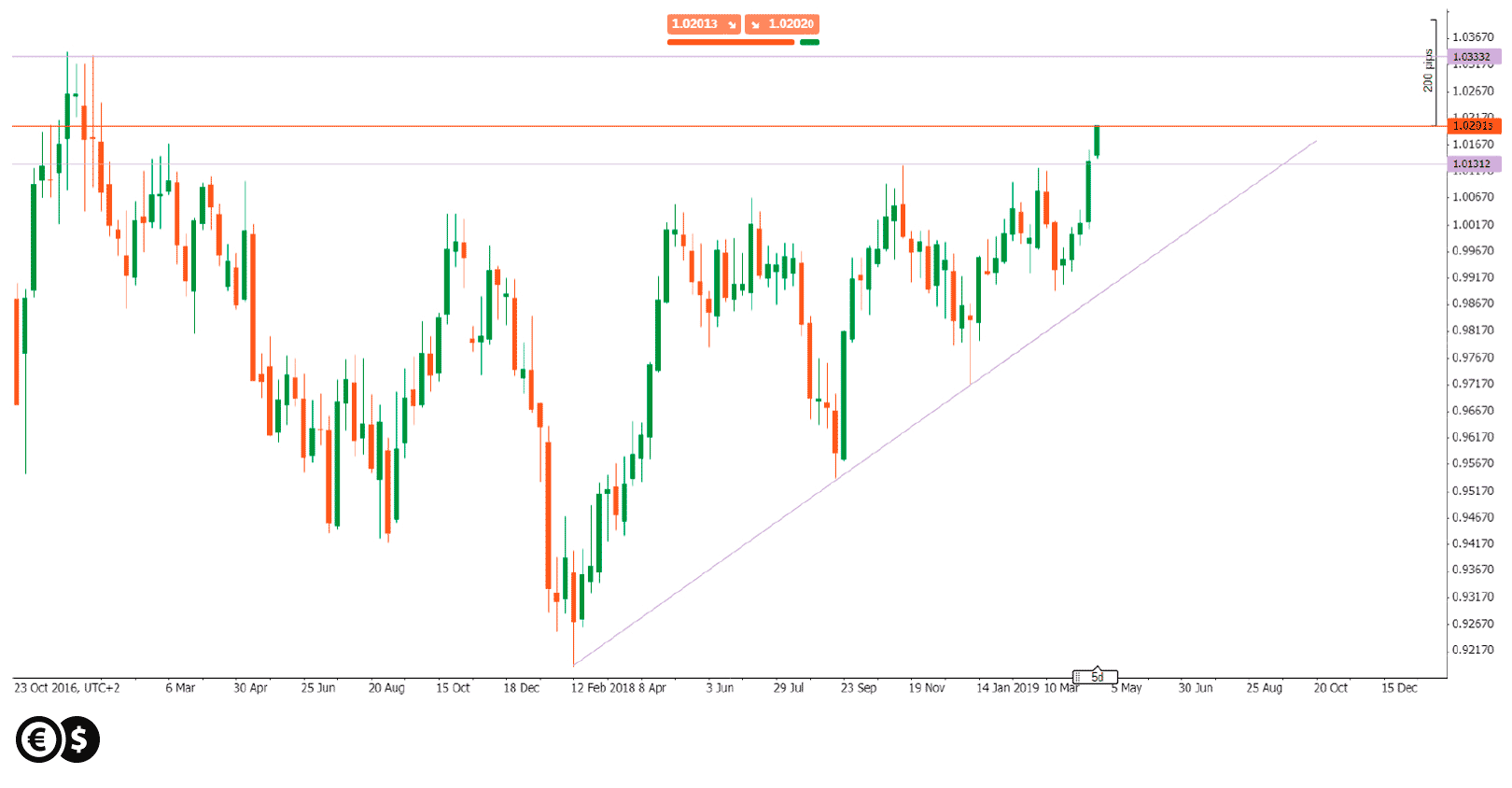

Chart: USD/CHF, W1. Conotoxia trading platform.

Looking at the chart we can spot that an important resistance (previous tops) at 1.0131 has been broken. As a result, this level may be the first important support for the market. From the technical point of view the nearest resistance may be located at 1.0333 (the tops from December 2016).

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.