The inflation data from the Australian economy published tonight may bring the central bank (RBA) closer to making a decision to lower interest rates. The market has priced such a possibility for some time, but the expected period of the RBA`s activities was supposed to be the holiday period. At present, the chances of cutting rates have already increased in May.

CPI inflation in Australia fell from 1.8 to 1.3 per cent in the Q1 2019, year-on-year. Market expectations were at 1.5%. It was the lowest reading from the Q3 2016. In turn, in quarter-on-quarter terms, prices have not changed, which is the weakest reading in the last three years. The market estimated inflation at 0.2 per cent.

Such weak data on inflation strongly influenced the change in expectations regarding the moment of interest rate cuts in Australia. And so, according to JP Morgan, Citi or RBC, the first interest rate cut may already appear in May. This means a shift in expectations from the holiday period when, in the opinion of these institutions, there may be a second rate cut this year. As a result, the main RBA percentage rate may drop from a record low of 1.5 per cent to 1 per cent after holidays.

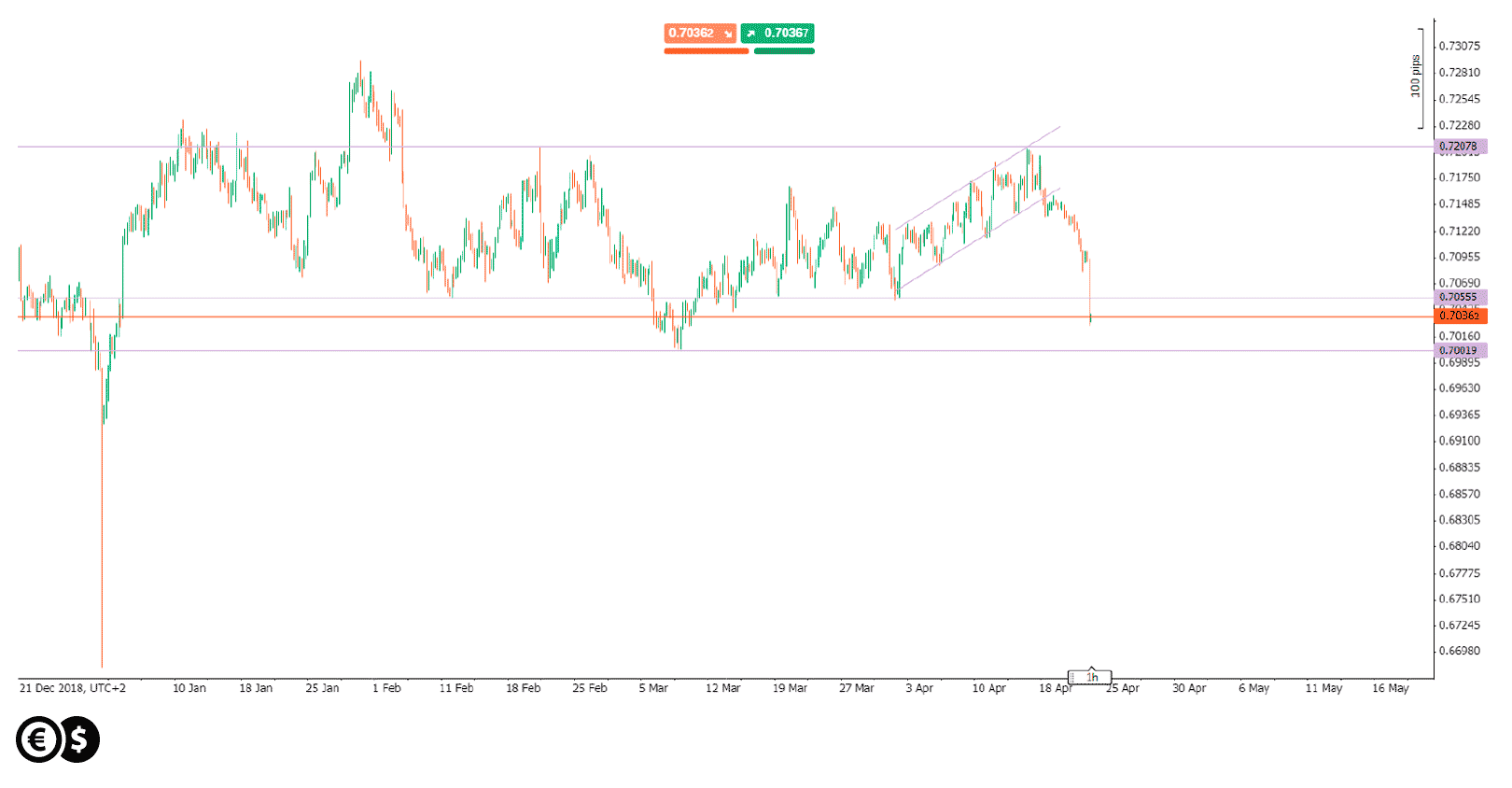

Chart: AUD/USD, H4. Conotoxia trading platform.

As a consequence of such significant changes, the AUD/USD dipped about 1 per cent tonight to the lowest level since the first half of March. Thus, the risk of decline may have increased, towards key support at a round 0.7000. Its defeat would mean the possibility of breaking out from multi-month consolidation.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.