The rebuilding of the positive sentiment on Wall Street after the poor last quarter of 2018 led to the fact that we`ve had more records. During yesterday`s session, the NASDAQ 100 index went to a new historical level.

The end of the reduction of the balance sheet total by the FED, suspension of the cycle of interest rate increases, optimism related to reaching an agreement in US-China talks led to an unprecedented quick recovery in stock market indices - especially in the US.

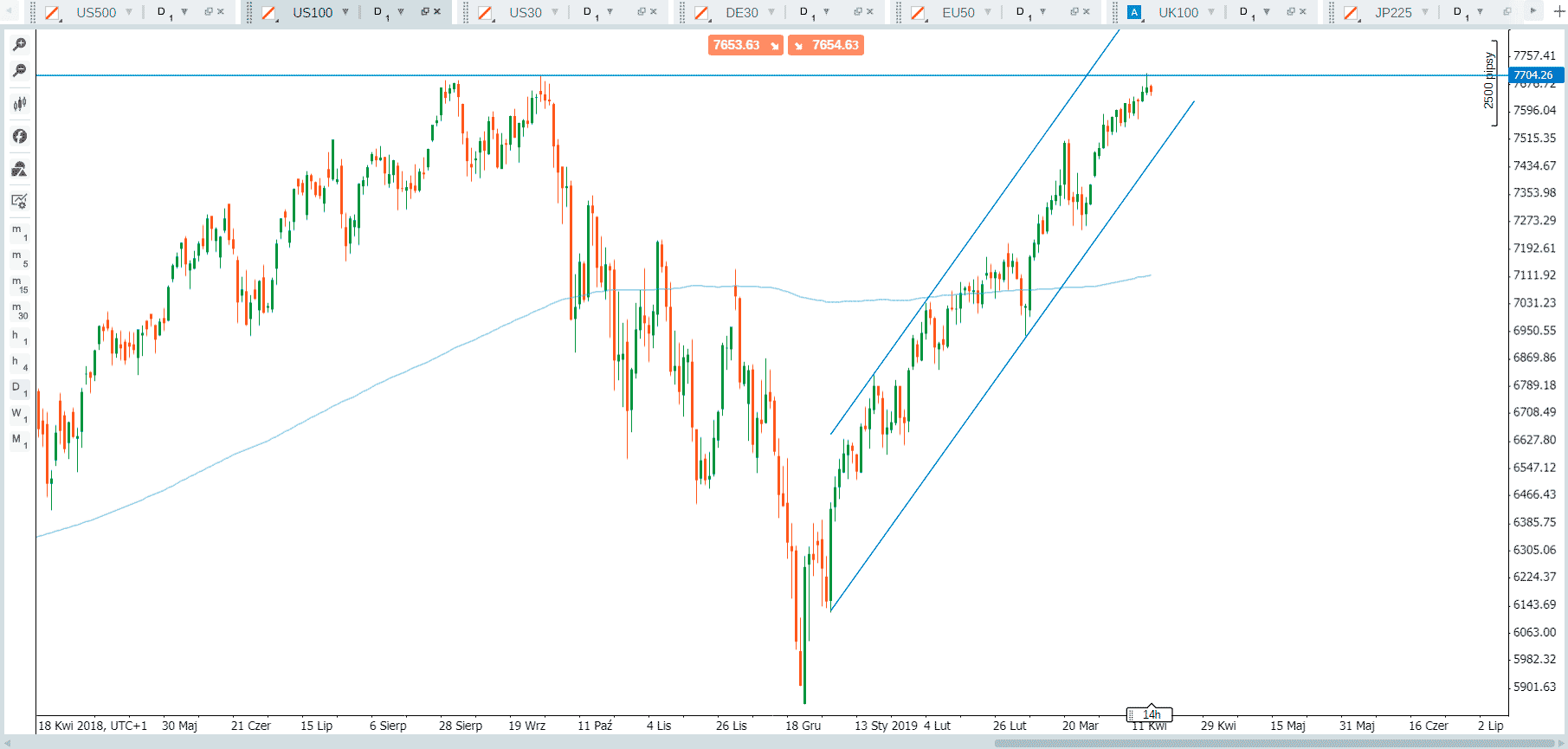

Chart: Nasdaq 100. Conotoxia trading platform.

Nevertheless, one should still remember the risk factors in the form of a flat yield curve, where short-term securities bear similar interest rates to long-term ones, systematically cut economic forecasts for global GDP growth or that volatility ratios once again are at relatively low levels with large positioning for their further drop. What's more, according to data from Bank of America, fund managers have been moving towards cash for several months.

In this context, such a significant optimism of bulls may be undermined, and subsequent sessions will show whether the record on the NASDAQ 100 will be permanently defeated and whether the remaining main indexes in the US will be able to do the same. The bulls may be cautious after all because the season of quarterly results is not over yet, and there may be some kind of disappointment in it.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.