Goldman Sachs, which is popular institution among traders, positively speaks about the Australian dollar. Reason? There is a chance that the slowdown in China will not be strong or permanent, which will increase the optimism among investors.

The bank in its note indicates that the Australian dollar could gain in particular against the New Zealand dollar, the Canadian dollar or South African rand. These cross-pairs, AUDNZD, AUDCAD, AUDZAR, give the best exposure to the improvement of sentiment in relation to China with low sensitivity to global sentiment to risk factors or commodity prices - adds Goldman Sachs.

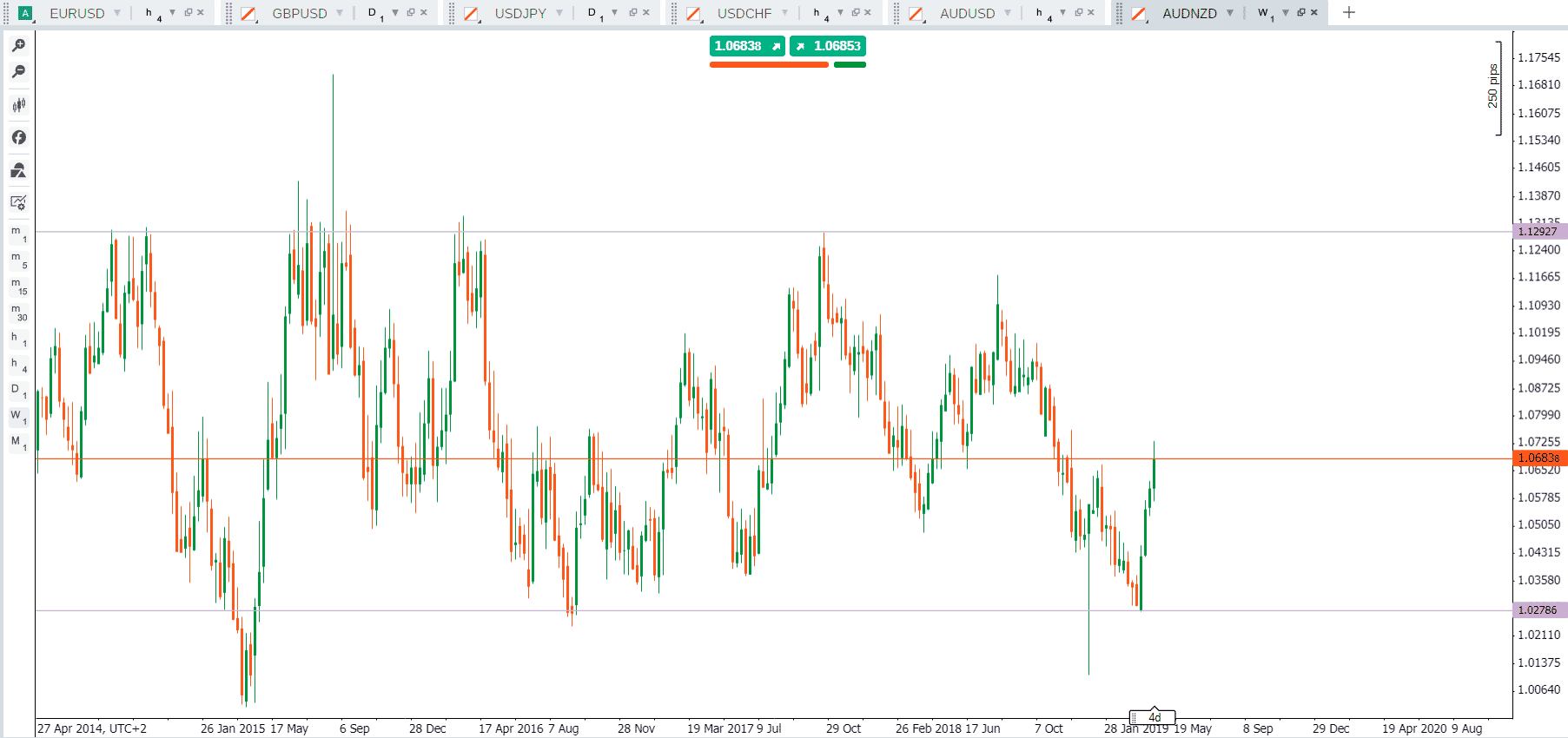

Chart: AUDNZD. Conotoxia trading platform.

Looking on the AUDNZD chart, we observe a fourth week of the strengthening of AUD in a row. In Goldman’s bullish scenario the pair may increase to the upper limit in a long-term range.

Chart: AUDCAD. Conotoxia trading platform.

AUDCAD also turned back from the lower range of recent long-term sideways trend, although here the road towards the middle of the consolidation is still far away. Theoretically, this pair has more to catch up to.

Nevertheless, one must remember that apart from China for Australia and AUD, another important thing is what will happen with interest rates. Recent data indicate that the RBA may cut rates around the holidays, which could hold AUD away from higher appreciation.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.