The main factor that has been affecting the British pound for a long time is Brexit. Specifically, will Great Britain be able to avoid a hard Brexit, will it be possible to keep the new exit date from the European Union, will Prime Minister Theresa May’s plan eventually receive support or will a cross-party agreement be reached?

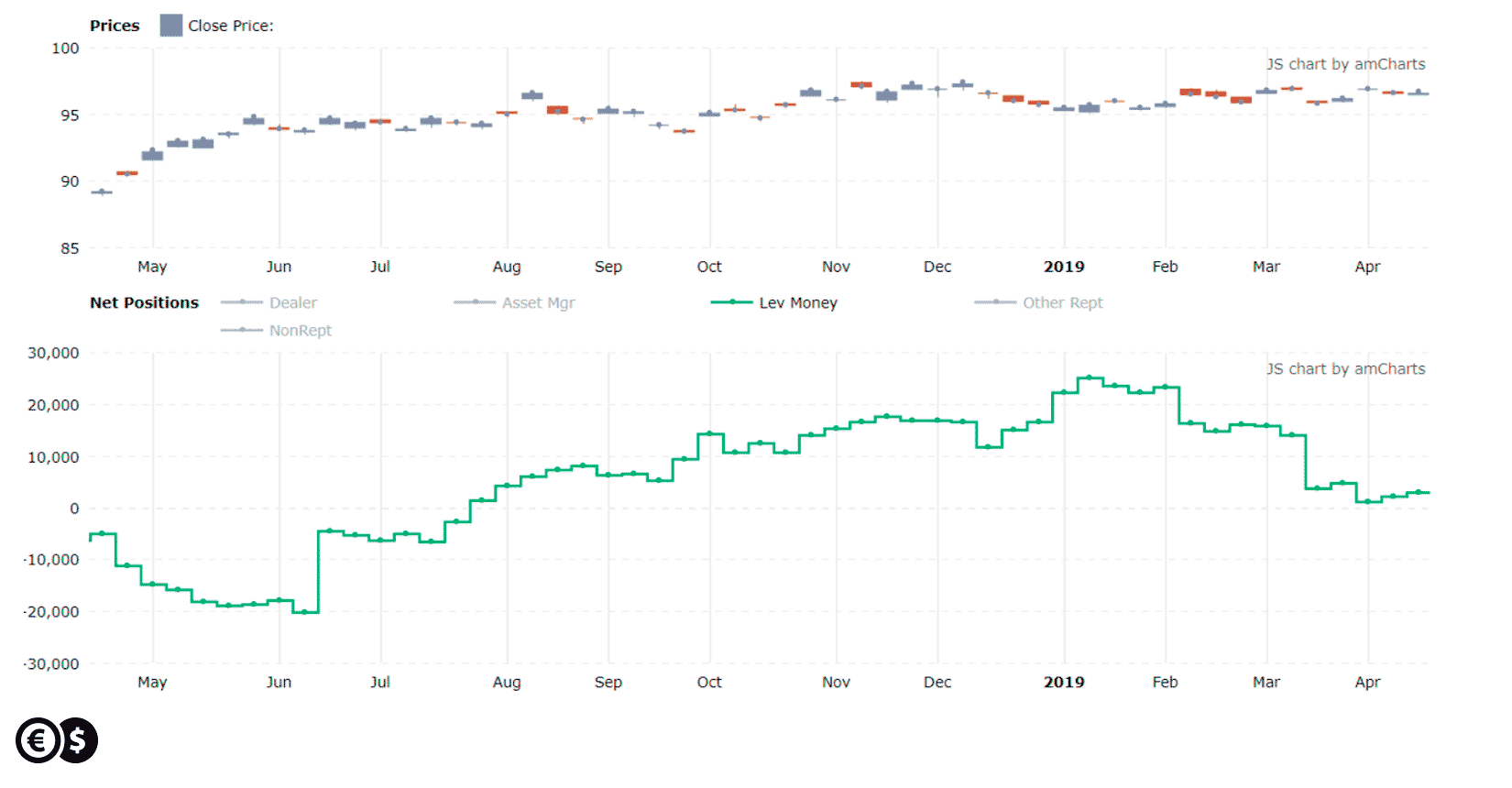

There are still a lot of scenarios and options, as well as unknowns, but the belief that the pound will eventually strengthen will increase to the highest level since June last year. - results from CFTC data as part of the COT report.

The net long positions in the week ended on April 16th, increased to 18.411 contracts. This means that there are more long positions than short ones in the group of leveraged funds (speculators). The last time such an advantage of long positions over short ones was observed in summer last year. GBP short trimmed to 6.516, smallest bearish position since June 2018.

Leverage funds net long positions. Source: tradingster.com

From the above chart it is quite clear that the funds reduced short positions, and in turn, sentiment may be directed towards the appreciation of the pound. From the perspective of Brexit, the rise of the GBP/USD quotes could be supported by a bipartisan agreement, the approval of Prime Minister Theresa May's plan or, for example, another referendum. It can, therefore, be presumed that a hard Brexit scenario is relatively unlikely - this is indicated by the positioning on futures contracts.

Chart: GBP/USD, D1. Conotoxia trading platform.

The key support level which was defended a few times at 1.2980 has been broken. Therefore, in order to achieve the pound appreciation scenario assumed by the leveraged funds described above, the GBP/USD currency pair would have to go back over 1.2980 and break the upper limit in the downward channel.

Daniel Kostecki, Conotoxia Ltd. Chief Analyst

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.