The price of WTI crude at the beginning of the week exceeded $66, and Brent beat $73. This means that the price of oil has surged to levels unseen since October last year due to the end of Iran`s oil imports announced by US President Donald Trump.

At the end of last year, despite the introduction of sanctions on Iran by the US, eight countries received permission from the US to import oil from Iran, in the meantime to find an alternative source to buy oil. These countries are: China, Japan, South Korea, Taiwan, India, Turkey, Italy and Greece. Only Taiwan, Greece and Italy have ceased to import Iranian oil, while other countries have until May 2 to abandon the purchase of oil from Iran. If they do not stop buying, they will be sanctioned by the United States. The aim of the Trump administration's actions is to cut off Iran from the sources of financing the country.

Meanwhile, Iran in the reaction announces that it can close the Strait of Hormuz. It is located between Iran and the United Arab Emirates and is crucial for the transport of oil. The tankers flowing through the strait are responsible for almost half of all oil transport by sea in the world. Therefore, any transport problems could shake up the supply of oil in the world. This, in turn, may put pressure on price increases.

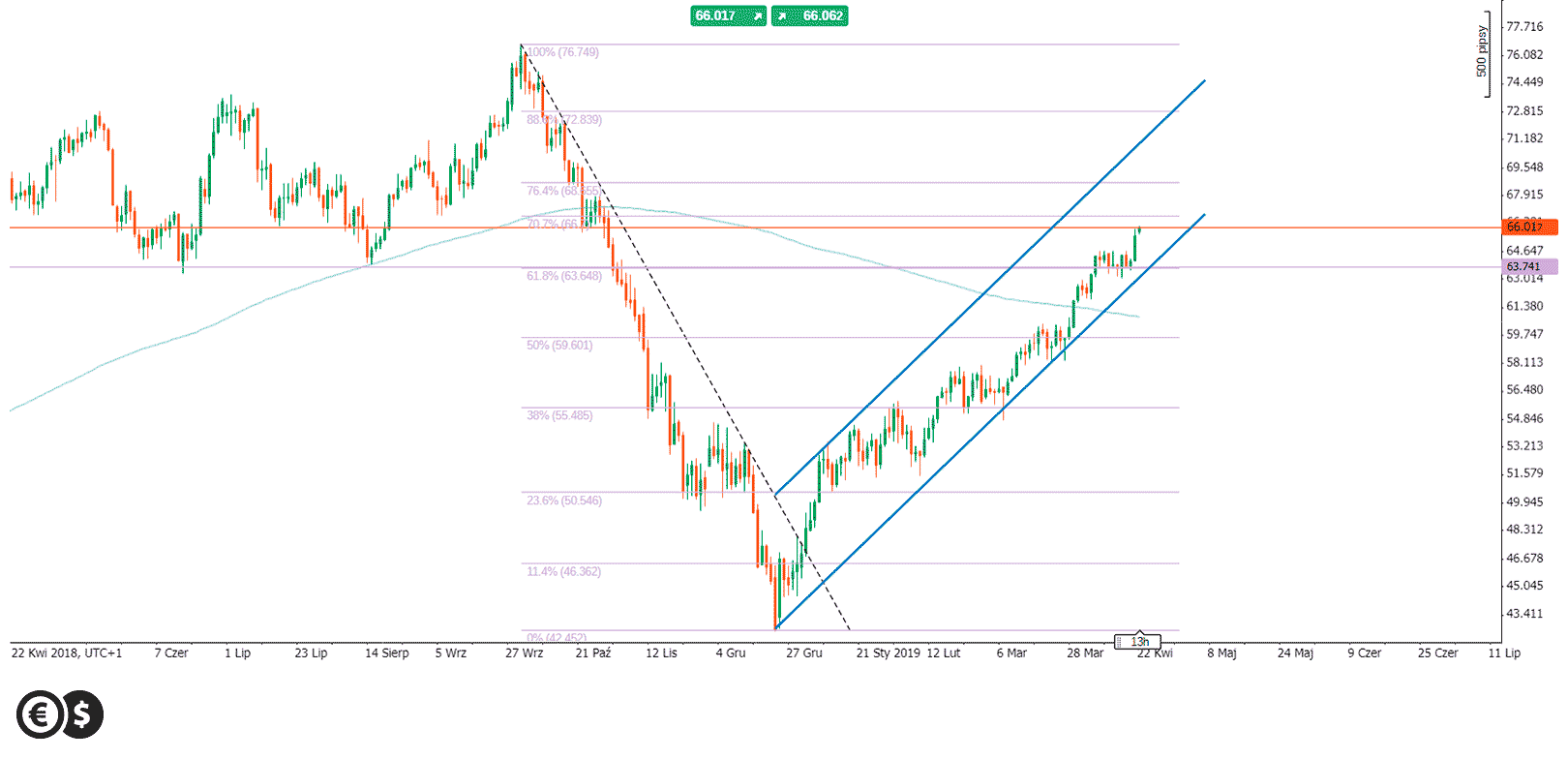

Chart: price of oil WTI. Conotoxia trading platform.

Since the beginning of the year, the price of WTI oil has increased by more than 45 percent, which makes crude oil the best-performing commodity this year. A strong upward trend, occurring after a significant downward correction in the last quarter of the previous year, may indicate high demand. The entire upward movement takes place in the trend channel, the lower and upper limits of which can determine local resistance and support levels. In addition, potential resistances can be drawn Fibonacci levels.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.