The US dollar index sets new high for 2019 and as a result the dollar index reached the highest level since mid-2017. Such a significant strengthening of the US currency may not be a consequence of dollar strength, more a consequence of the weakness of other currencies included in the USD Index basket.

The largest share in the USD index has the euro, which weakened due to poor macroeconomic data from the eurozone, especially from Germany, which is the largest economy in Europe. The larger than expected economic slowdown and the cutting of forecasts for such indicators as GDP or inflation, also causes market participants to postpone expectations regarding the next interest rate hike by the European Central Bank. What is more, the expectations of the dovish central bank's policy may increase, and this may exert pressure on the single currency.

Besides euro, the British pound remains weak due to the lack of clear actions leading to orderly brexit. In addition, a greater slowdown in the euro area is also not good for the United Kingdom, regardless of brexit solutions.

It is worth paying attention to the next central banks, which do not see the need to raise interest rates in the near future. This led to the weakening of the Canadian dollar or the Swedish krona. Both the Bank of Canada and Riksbank postponed expectations of interest rate hikes mainly due to economic growth and lack of significant inflationary pressure.

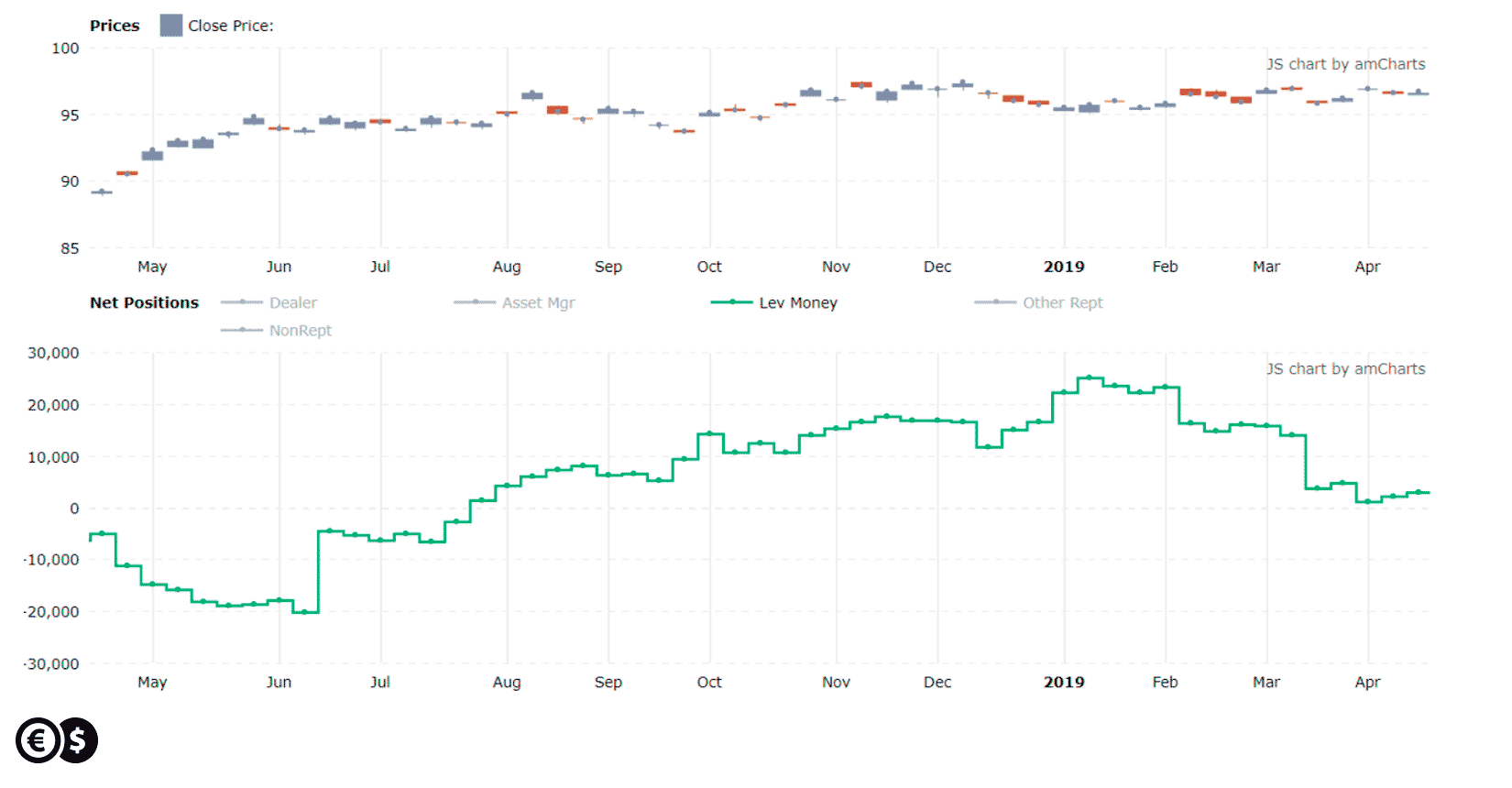

All this can cause the US dollar to be strong due to the weakness of other currencies. If we look at the positioning of leveraged funds on USD Index futures, we will notice that here from the beginning of the year the net long positions of leveraged funds (speculators) have basically decreased not increased.

Pozycje długie netto funduszy lewarowanych i indeks USD. Źródło: tradingster.

Może to oznaczać, że chętnych do kupna samego dolara nie jest tak wielu, jak chętnych do sprzedaży pozostałych walut, a tego typu dywergencje są warte dalszego obserwowania.

Daniel Kostecki, Główny Analityk Conotoxia Ltd.

Powyższy komentarz nie jest rekomendacją w rozumieniu Rozporządzenia Ministra Finansów z 19 października 2005 roku. Został on sporządzony w celach informacyjnych i nie powinien stanowić podstawy do podejmowania decyzji inwestycyjnych. Ani autor opracowania, ani Conotoxia Ltd. nie ponoszą odpowiedzialności za decyzje inwestycyjne podjęte na podstawie informacji zawartych w niniejszym komentarzu. Kopiowanie bądź powielanie niniejszego opracowania bez pisemnej zgody Conotoxia Ltd. jest zabronione.

59 proc. rachunków inwestorów detalicznych odnotowuje straty pieniężne w wyniku handlu kontraktami CFD u niniejszego dostawcy. Zastanów się, czy rozumiesz, jak działają kontrakty CFD i czy możesz pozwolić sobie na wysokie ryzyko utraty pieniędzy.