The price of an ounce of gold was at the beginning of this week at the lowest level since December 2018. One of the factors that may have recently influenced the price drop is the strength of the US dollar, in which gold is settled on global markets. The price of gold at the beginning of the week was at USD 1266.

Nevertheless, there may be several reasons that may support the price of gold. One of them is the very low level of real bond yields, ie nominal values adjusted for the inflation level. Historically, such low values have been an important support for gold. What's more, the lack of rapid and subsequent interest rate hikes by the major central banks of the world may hinder the growth of bonds yield, which in turn could further improve the attractiveness of gold in the eyes of investors. Gold in itself has no yield, and the lower the yield bonds, due to the dovishness of central banks, the theoretically greater attractiveness of gold.

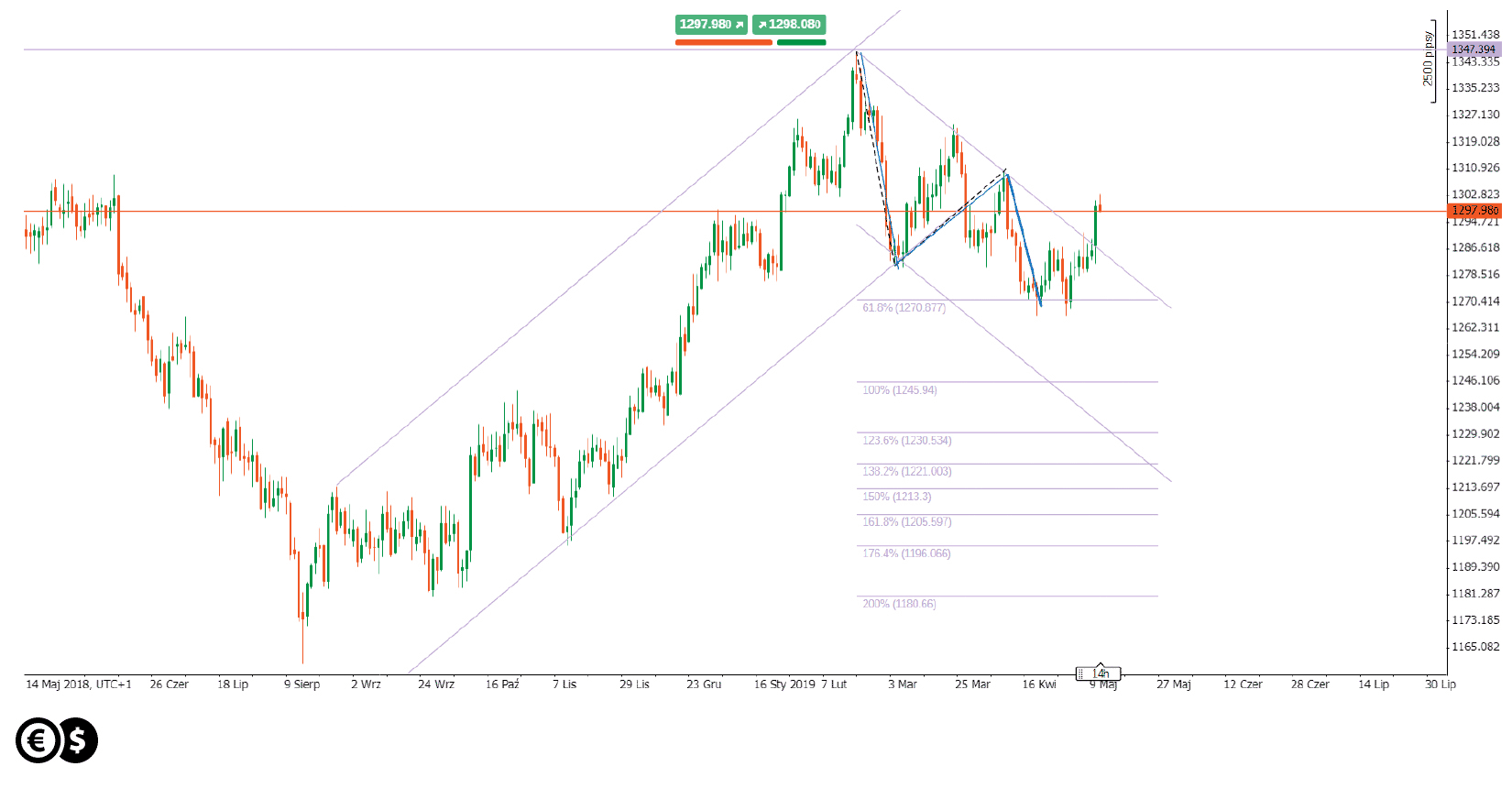

Chart: price of gold on the daily chart. Conotoxia trading platform.

The price of gold has created a potential corrective movement after a strong rally. The price in the recent correction has been moving within a downward trend channel. The whole decline in price may be considered as a simple correction where the recent price drop has stopped at the key 61,8 Fibo expansion. However, return to the upward trend would be possible only after a breakout of the upper limit in the described channel.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.