As the new year dawned, the Santa Claus rally in the major US indices was confirmed for investors. So far, we have seen, among other things, the preliminary CPI inflation reading from the Eurozone, which came in below expectations at 2.9 percent. We also received the minutes of the FOMC meeting, which show, among other things: "Recent indicators suggest that growth in economic activity has slowed from its strong pace in Q3 last year. Job growth has slowed since the beginning of the year, but has remained strong, and the unemployment rate has remained low. (...) In addition, members agreed to continue reducing the Federal Reserve's holdings of Treasury securities, in line with previously announced plans." In the coming week, investors will be awaiting the latest inflation readings from the United States and GDP data from the United Kingdom.

Table of contents:

- US consumer price index (CPI) annualised (December)

- UK monthly gross domestic product (GDP) (November)

- US producer price index (PPI) on a monthly basis (December)

- Stocks to watch

Thursday, 11.01, 13:30 GMT, US consumer price index (CPI) annualised (December)

The CPI monitors changes in the prices of consumer goods and services. The CPI is an important indicator because it helps us to understand trends in consumers' purchases and the impact of inflation on their purchasing power. It is calculated on the basis of a basket representing typical consumer spending, covering various categories such as food, housing, transport, etc. Regular measurements of the CPI allow us to track how the prices of these products and services change over time. A positive CPI indicates an overall increase in the prices of goods and services.

On the other hand, a negative CPI means that prices are lower than the year before. It is an important tool for economists and policymakers to help them understand the impact of inflation on the economy and take appropriate action. For consumers, it is information about how their money is losing value in the context of rising or falling prices, allowing them to adjust spending, plan savings and make financial decisions.

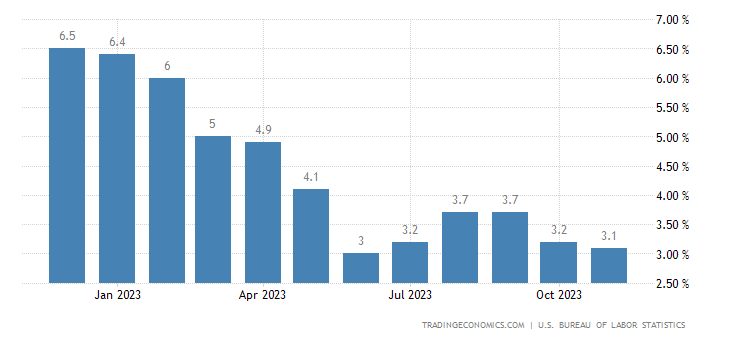

In November 2023, the US annual inflation rate fell to 3.1 percent, reaching its lowest level in five months. This is, however, a small reduction compared to October, when it stood at 3.2 percent. The main factors behind the fall in the inflation rate include energy costs, which fell by 5.4 percent compared to 4.5 percent in October, as well as fuel prices, which recorded a decline of 8.9 percent and heating oil by as much as 24.8 per cent.

On the other hand, prices rose fastest in the health-related goods sector (by 5 versus 4.7 percent) and transport services (10.1 versus 9.2 per cent). Meanwhile, core inflation, which excludes energy and food prices, remained at 4 percent, in line with forecasts. The current forecast for December is for overall inflation to continue to fall to 3 percent and for core inflation to remain at 4 percent.

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the USD, while a lower-than-expected reading could be bearish for the USD.

Impact: USD

Friday, 12.01, 13:30 GMT, UK monthly gross domestic product (GDP) (November)

Gross domestic product (GDP) indicates the total value of goods and services produced in a country for a certain period. GDP is an important indicator of the health of an economy because it gives an overall picture of how well or poorly it is doing. If the GDP growth is higher than expected, the economy is in good shape and growing faster than expected. On the other hand, if the GDP growth is lower than expected, the economy performs weaker than anticipated. Furthermore, if the GDP growth is negative for two consecutive quarters, it may be considered a technical recession due to contracting economic output.

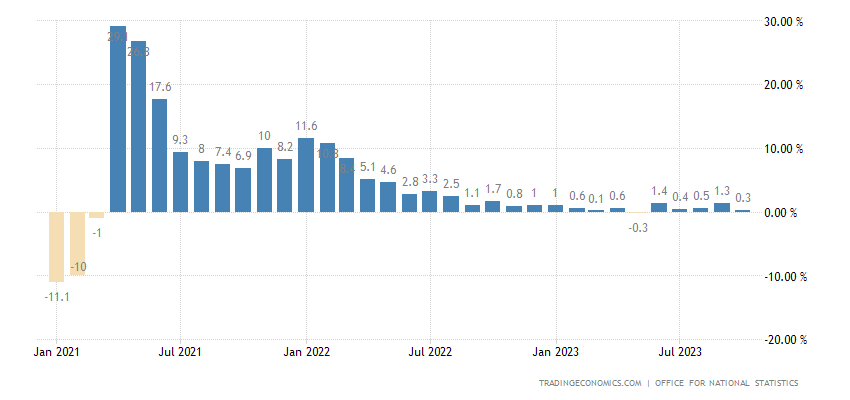

In October 2023, the UK economy contracted by 0.3 percent compared to September, reversing the upward trend of the previous two months and departing from market forecasts of no change. The main contributor to the decline was the services sector, which fell by 0.2 percent, particularly in information and communication ( down 1.7 percent), which includes computer software, as well as film and television production. Output in consumer services declined by 0.1 percent. Overall output fell by 0.8 percent, mainly due to significant declines in the manufacturing sector (down 1.1 percent), which includes the production of computers, electronics, optics, machinery and equipment. At the same time, construction output fell by 0.5 percent, partly due to adverse weather conditions. Analysis of the data for the last three months to October shows that UK Gross Domestic Product is stuck in stagnation. On an annual basis, a particular slowdown is evident, as the UK economy grew by just 0.3 percent on an annual basis. The forecast for November is for this slowdown to continue at 0.4 percent year-on-year (0.1 percent m/m).

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the GBP, while a lower-than-expected reading could be bearish for the GBP.

Impact: GBP

Friday, 12.01, 13:30 GMT, US producer price index (PPI) on a monthly basis (December)

PPI (Producer Price Index) inflation is a statistical measure that tracks changes in the wholesale prices of goods and services over a specified period of time. The PPI measures the percentage change in the average prices that producers receive for their products and services. In short, it refers to inflation from the perspective of producers.

The PPI is an important economic indicator because it can provide information on possible changes in production costs, influencing the decisions of businesses and investors. Also, changes in the PPI can influence the evolution of overall inflation in the economy. Price increases in the production phase can move further up the supply chain, which can ultimately affect retail prices and, as a result, consumer inflation.

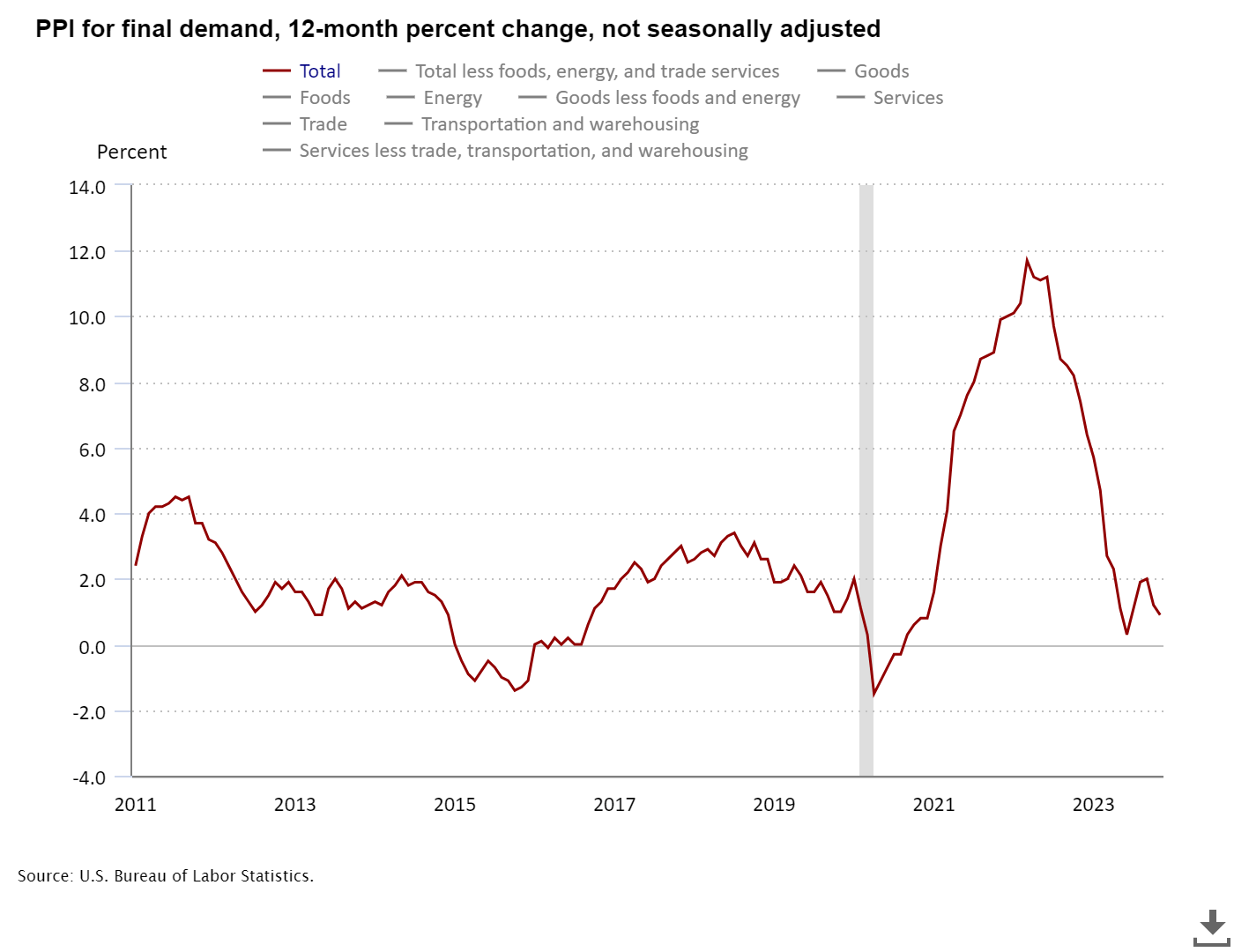

In November 2023, US producer inflation remained unchanged from the previous month, which was lower than the expected increase of 0.1 percent. On an annualised basis, PPI inflation was just 0.9 percent, the lowest in five months. This type of inflation, which historically has greater fluctuations than consumer inflation, has not reached the inflation target set by the Federal Reserve of 2 percent for some time.

The current forecast is for a 0.2 percent increase in PPI inflation compared to the previous month.

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the USD, while a lower-than-expected reading could be bearish for the USD.

Impact: USD

Stocks to watch

UnitedHealth (UNH) announces financial results for the quarter ending December 2023. Forecast EPS: 5.99. Positive earnings surprise in 10 of the last 10 reports. Deadline: Friday, 12 January.

JPMorgan (JPM) announces financial results for the quarter ending December 2023. Forecast EPS: 3.51. Positive earnings surprise in 9 of the last 10 reports. Deadline: Friday, 12 January.

Bank of America (BAC) announces financial results for the quarter ending December 2023. Forecast EPS: 0.6233 Positive earnings surprise in 10 of the last 10 reports. Deadline: Friday, 12 January.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.98% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.