The biggest surprise of the week appears to be Brazil joining the ranks of OPEC+ countries and the planned cuts in global oil production, which are expected to be as high as 2%. In the week ahead, we will see whether the current oil price cuts will translate into a continuation of the fall in German inflation and Wednesday's Bank of Canada interest rate decision. Particularly important for investors may be Friday's readings on the situation in the US labour market, where the first signs of deterioration may be emerging.

Table of contents:

- Canada interest rate decision

- Japan's quarterly gross domestic product (GDP) (Q3).

- German Consumer Price Index (CPI) YoY (November)

- US unemployment rate (November)

- Stocks to watch

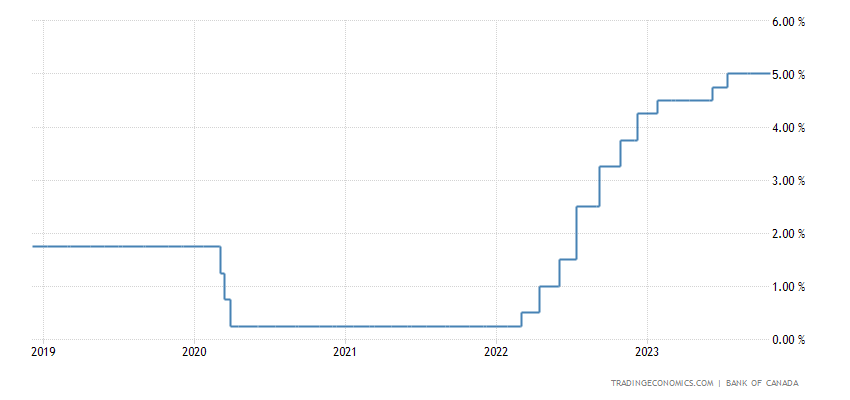

Wednesday, 6.12, 15:00 GMT, Canada interest rate decision

The three main factors on the basis of which central banks make monetary policy decisions are usually:

- the unemployment rate,

- the rate of price increases (inflation rate),

- the growth rate of the economy (GDP).

Canada's unemployment rate rose to 5.7 per cent in October 2023, up from 5.5 per cent the previous month. This is the highest level since January 2022, and a reading above market expectations of 5.6%. This result confirms earlier warnings from the Bank of Canada that the aggressive cycle of interest rate hikes has had a material impact on the slowing Canadian economy, which has translated into a cooling labour market. However, it is worth noting that the unemployment rate is still below pre-pandemic levels.

Another factor that may prompt the central bank to end the interest rate hike cycle is a faster decline in inflation than previously expected. Canada's annual inflation rate fell to 3.1 per cent in October 2023, down from 3.8 per cent the previous month and slightly below market expectations of 3.2 per cent. This result is lower than the Bank of Canada's forecast. It assumed that inflation would remain close to 3.5% until the middle of next year.

Canadian GDP contracted by 0.3% in Q3 2023, the first contraction since Q2 2021, compared with a revised 0.3% increase in the previous period. This result highlights that higher interest rates from the Bank of Canada are having a greater impact on the Canadian economy, retreating from the previously strong growth at the start of the year. Canadian GDP was pressured by a 1.3 per cent decline in exports of goods and services, mainly due to a 25.4 per cent reduction in foreign sales of refined petroleum, while imports of goods and services declined by 0.2 per cent.

Source: Tradingeconomics.com

The Bank's interest rate decision could have an impact on CAD quotes.

Impact: CAD

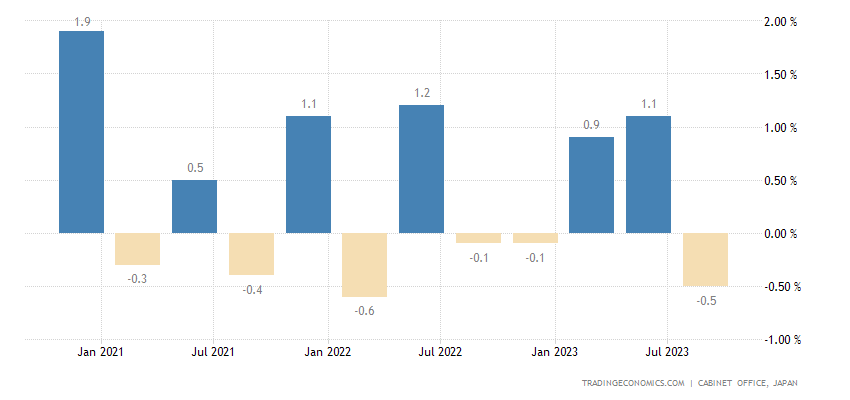

Thursday, 7.12, 23:50 GMT, Japan's quarterly gross domestic product (GDP) (Q3).

Gross domestic product (GDP) indicates the total value of goods and services produced in a country for a certain period. GDP is an important indicator of the health of an economy because it gives an overall picture of how well or poorly it is doing. If the GDP growth is higher than expected, the economy is in good shape and growing faster than expected. On the other hand, if the GDP growth is lower than expected, the economy performs weaker than anticipated. Furthermore, if the GDP growth is negative for two consecutive quarters, it may be considered a technical recession due to contracting economic output.

From the preliminary readings, we know that the Japanese economy contracted by 0.5% quarter-on-quarter in Q3 2023, which was worse than market forecasts of a 0.1% contraction, following a 1.1% increase in Q2. This is the first decline in GDP since Q4 2022, and it happened amid increased cost pressures and mounting global adversity. Private consumption, which accounts for more than half of the economy, unexpectedly slowed, deviating from the 0.2% growth forecast and following a 0.9% decline in Q2. Meanwhile, capital expenditures surprisingly fell for the second consecutive quarter, compared to the consensus forecast of 0.3% growth and at a much faster pace (-0.6% vs. -0.1% in Q2), while public investment fell for the first time in three quarters (-0.5% vs. 0.3%). As forecast, net trade also had a negative impact on GDP, as exports (0.5% vs. 3.9% in Q2) grew less than imports (1.0% vs. -3.8%). Meanwhile, government spending increased by 0.3% after previously showing no growth.

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the JPY, while a lower-than-expected reading could be bearish for the JPY.

Impact: JPY

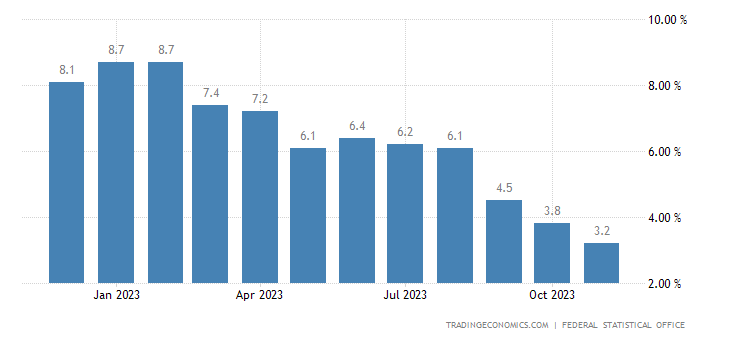

Friday, 8.12, 7:00 GMT, German Consumer Price Index (CPI) YoY (November)

The CPI monitors changes in the prices of consumer goods and services. The CPI is an important indicator because it helps us to understand trends in consumers' purchases and the impact of inflation on their purchasing power. It is calculated on the basis of a basket representing typical consumer spending, covering various categories such as food, housing, transport, etc. Regular measurements of the CPI allow us to track how the prices of these products and services change over time. A positive CPI indicates an overall increase in the prices of goods and services.

On the other hand, a negative CPI means that prices are lower than the year before. It is an important tool for economists and policymakers to help them understand the impact of inflation on the economy and take appropriate action. For consumers, it is information about how their money is losing value in the context of rising or falling prices, allowing them to adjust spending, plan savings and make financial decisions.

For the next month in a row we see, a decline in consumer inflation in Germany. In November, it decreased to 3.2% year-on-year, compared to 3.8% in the previous month. This was also a reading below the market consensus of 3.5%. This is the lowest level of inflation since June 2021, mainly due to a sharp decline in the rate of increase in food prices (5.5% vs. 6.1% in October) and a faster pace of reduction in energy prices (-4.5% vs. -3.2%), resulting from the so-called base effect, i.e. a comparison with the historically high levels of 2022. Inflation in services decreased from 3.9 to 3.4% in October. Core inflation, excluding volatile items such as food and energy, fell to 3.8% in November, reaching its lowest level since August 2022. On a monthly basis, consumer prices fell by 0.4%, beating market expectations of 0.2%. The current forecast is for a month-on-month decline in inflation of 0.4%, which would be the first decline in six months.

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the EUR, while a lower-than-expected reading could be bearish for the EUR.

Impact: EUR

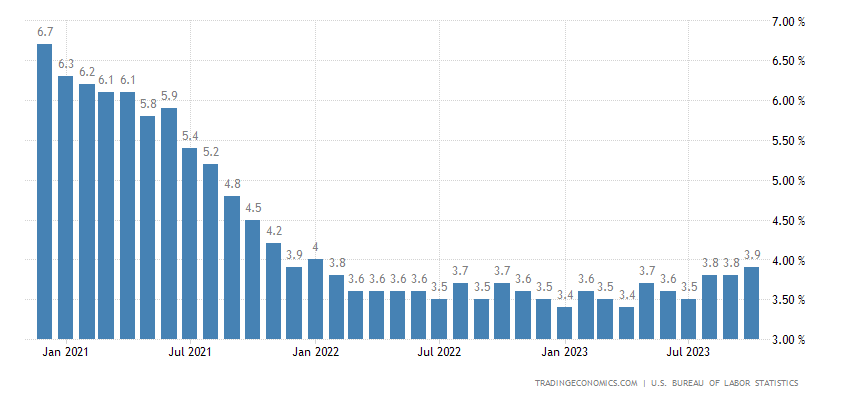

Friday, 8.12, 13:30 GMT, US unemployment rate (November)

The unemployment rate is the percentage of people without a job actively seeking employment in the previous month relative to the total number of people of working age or in the labour market. A high unemployment rate means that a large number of people are out of work despite actively seeking employment. A low unemployment rate indicates a stable labour market and greater availability of jobs.

Unemployment rates are important for economic analysis and can affect social and economic aspects. A high unemployment rate is associated with lower incomes and increased poverty, while a low unemployment rate promotes increased wages and social welfare. Governments and policymakers monitor the unemployment rate to assess the effectiveness of employment policies and take action to create jobs and support the unemployed. However, it should be remembered that the unemployment rate is one of many tools for assessing the labour market. Analysing other indicators, such as the labour force participation rate or wages, is also essential.

The US unemployment rate rose to 3.9% in October 2023, slightly exceeding market expectations and the previous month's figure of 3.8%. This is the highest unemployment rate since January 2022, with the number of unemployed increasing by 146,000 to reach 6.51 million, while the number of employed fell by 348,000 to 161.2 million. The employment rate declined to 60.2%, down from 60.4% in September, and the labour force participation rate fell to 62.7% from 62.8%. Since the recent lows in April, both the unemployment rate and the jobless rate have increased by 0.5 percentage points and 849,000 respectively. The current forecast is for the unemployment rate to remain at 3.9%.

Source: Tradingeconomics.com

A higher-than-expected reading could have a bearish impact on the USD, while a lower-than-expected reading could be bullish for the USD.

Impact: USD, US500

Stocks to watch

AutoZone (AZO) announces financial results for the quarter ending November 2023. Forecast EPS: 31.2. Positive earnings surprise in 10 of last 10 reports. Deadline: Tuesday, 5 December, before the market opens.

Brown Forman (BFb) announces financial results for the quarter ending November 2023. Forecast EPS: 0.51. Positive earnings surprise in 5 of last 10 reports. Deadline: Wednesday, 6 December.

Broadcom (ABGO) announces financial results for the quarter ending November 2023. Forecast EPS: 10.96. Positive earnings surprise in 10 of last 10 reports. Deadline: Friday, 7 December.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.95% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.