A Swiss franc next to the Japanese yen is considered a so-called safe haven on the currency market. This is also due to the fact that the Japanese or Swiss and their institutions have invested more money abroad than foreign institutions have located in Japan or Switzerland.

When the money returns to their country of origin through a global increase in risk aversion, this can generate positive cash flows towards the Japanese yen and the Swiss franc. The euro exchange rate in francs became such a barometer for CHF. EUR/CHF is again paying attention, because the franc is the strongest since mid-2017. Such significant appreciation may not please SNB – the Swiss central bank. We remember that one of the more radical steps limiting the CHF's appreciation against the EUR was the introduction in September 2011 of a minimum exchange rate of 1.20. The central bank argued that the excessive appreciation of the currency may threaten the economy and will hinder the growth of inflation.

Today's appreciation of the franc seems to justify a strong rise in risk aversion, which can be seen as a sell-off on the stock market and a very strong rise in bond prices. As a result, the decline of EUR/CHF could attract the attention of the monetary authorities.

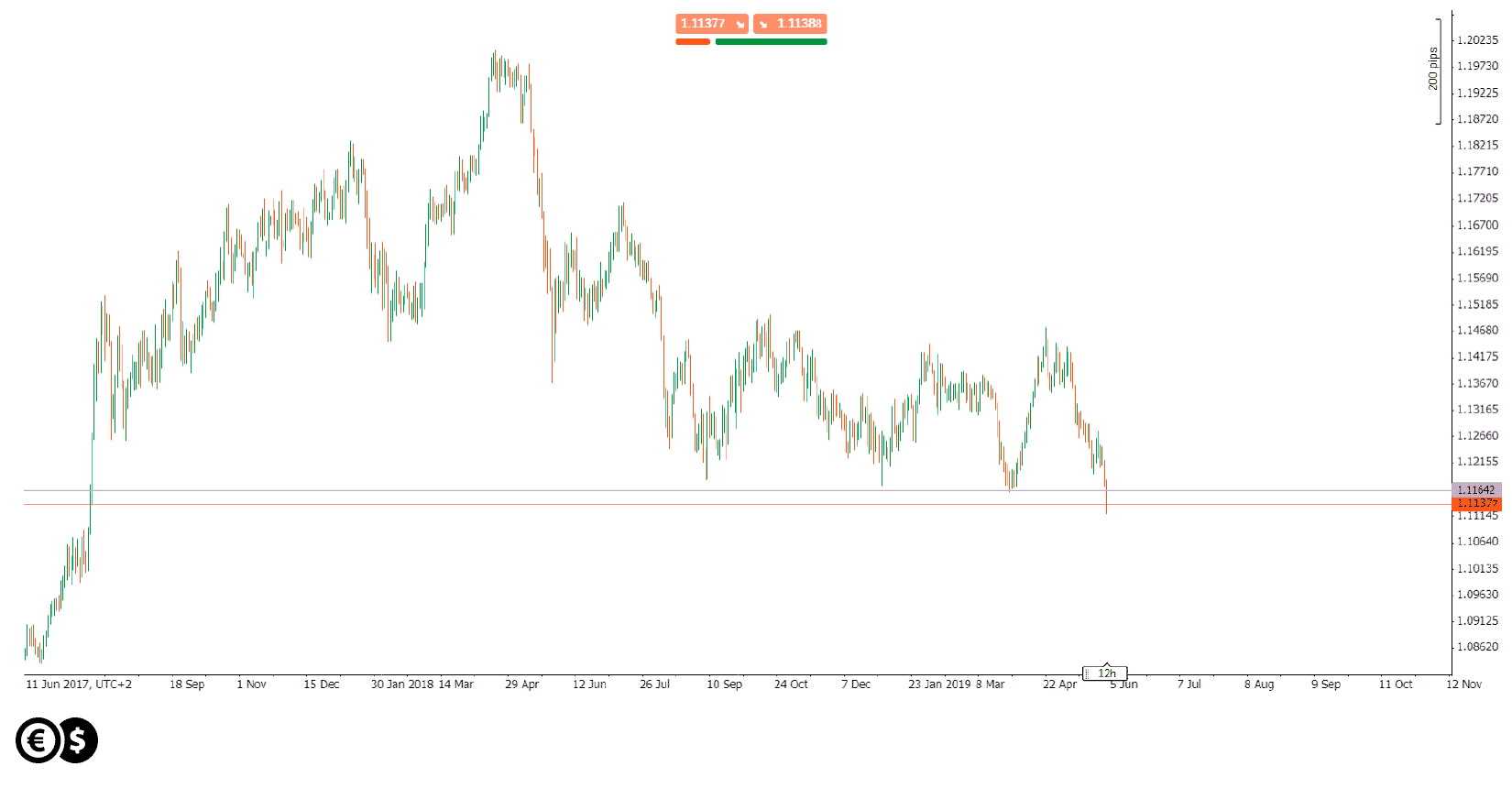

EUR/CHF daily chart. Source: Conotoxia trading platform

In consequence, the franc also gained to the zloty to the highest level since the end of March, approaching the level of 3.86 PLN. If the exchange rate would exceed 3.86, the franc would be the most expensive to Polish zloty from July 2017. In the absence of intervention by the SNB and the lack of easing tension in the trade war, it seems that it can be hard to count on the weakness of the franc.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.