Theoretically, the increase in stock prices is due to the belief that companies listed on the stock exchange will bring investors better and better results, i.e. they may, gain an advantage over competitors, increase market share, etc. The faster the growth of company profits, the higher the price appreciation may be.

The increase in the company's results seemed to be one of the main factors causing an increase in the prices of shares on Wall Street, despite the fact that investors often talked about a "speculative bubble" or expensive shares. In relation to the financial results presented by the US companies, the bubble was unlikely to be spoken. Top US corporations such as Facebook or Google were able to present revenue increases of 20-30 percent on an annual basis. Since the financial crisis, the combined growth of corporate profits in the United States has doubled. In times of crisis, they amounted to about 1 trillion dollars, and in 2018 exceeded 2 trillion dollars.

Nevertheless, the last quarters have stopped pointing not only to such a rapid improvement in results, but also to their decline. This can be very disturbing information for investors, which may affect the S&P 500, Nasdaq 100 or Dow Jones indexes. According to the latest data, which are based on preliminary estimates, corporate profits in the United States dropped by 3.5 percent in the first quarter of 2019 to USD 2,003 trillion, while in the previous quarter it amounted to USD 2.076 trillion. This is the largest decrease in corporate profits since the fourth quarter of 2015, when it amounted to 5.2 percent. Market expectations were at the level of profit growth by 2 percent.

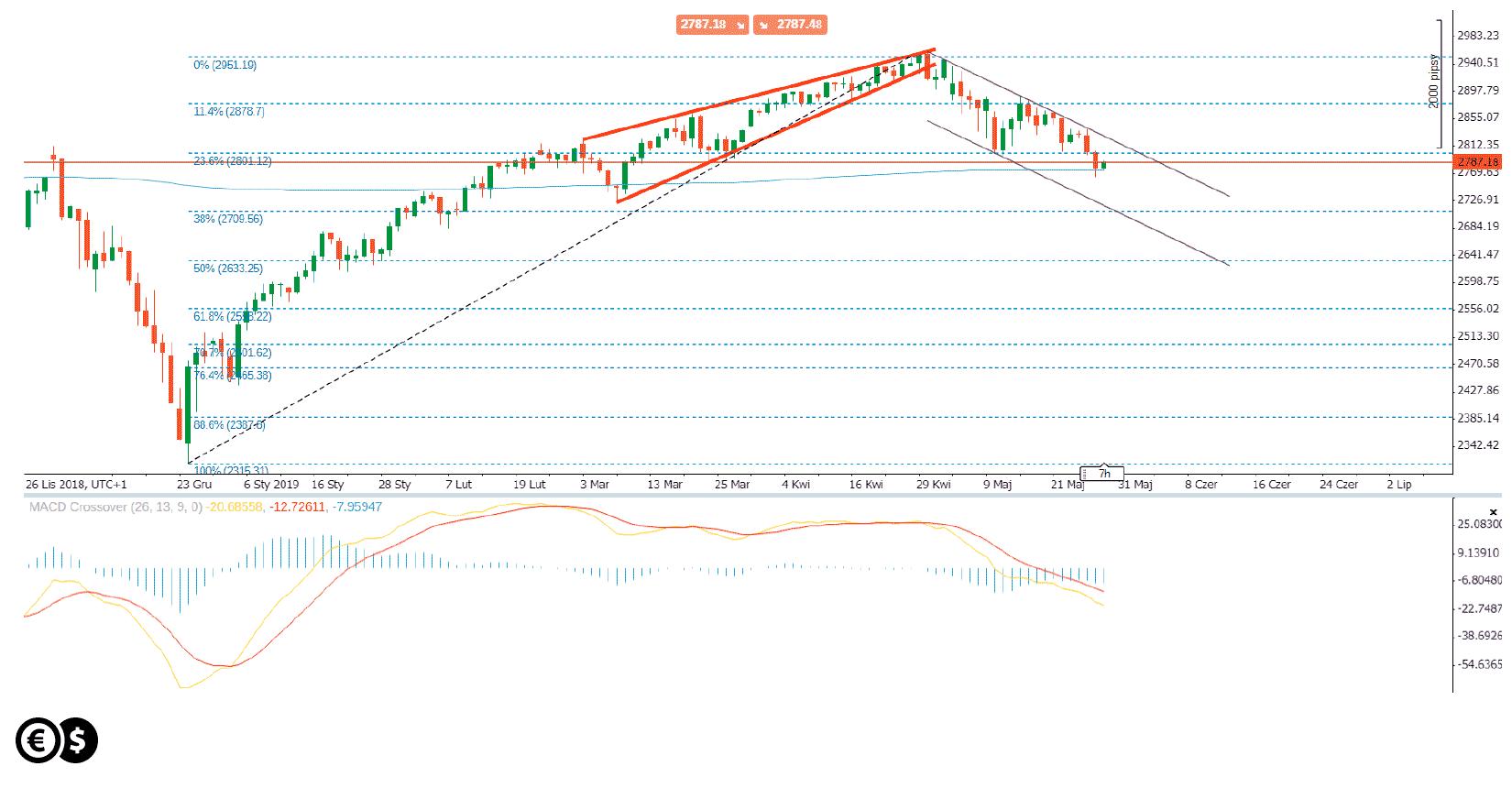

S&P 500, daily chart. Conotoxia trading platform

So if the profits of the companies do not improve, and even they continue to deteriorate, it may have a negative impact on the US stock indices. Looking at the S&P 500, we note that the index has already reached a significant 200-session average, which for many may be a determinant of the market trend. The S&P 500 seems to remain in the trend channel, the upper and lower limit of which can determine resistance and support areas. At the beginning of May, the S&P 500 broke the lower limit in the rising wedge pattern.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.