Long-term inflation expectations in the United States dropped, and inflationary pressure further decreased after yesterday`s publication, which appeared along with the revision of US GDP for the first quarter. Today we will see more inflation data, which if disappointed, may put even more pressure on the US Federal Reserve.

Inflation and the labor market are the two main areas for the US Central Bank to look after. When the labor market is in good shape and the unemployment rate is below 4 percent, the FED may focus on inflation to be close to the 2 percent target. Despite the improving condition of the economy in recent years, however, it has not been possible to significantly affect the increase in prices and inflation. Meanwhile, there are more and more signals that may indicate the impending economic slowdown, and the probability of recession in the US determined Cleveland FED increased to approx. 40 percent. As a consequence, inflation expectations may also fall, which were at the lowest level since July 2017.

Yesterday's publication pointed to easing inflationary pressure in the United States, increasing expectations for potential interest rate cuts by the Federal Reserve. The inflation rate followed by the Fed increased by 1.0 percent in the last quarter. FED representatives may probably focus on weak domestic demand and inflation at the next meeting, and GDP data will be secondary.

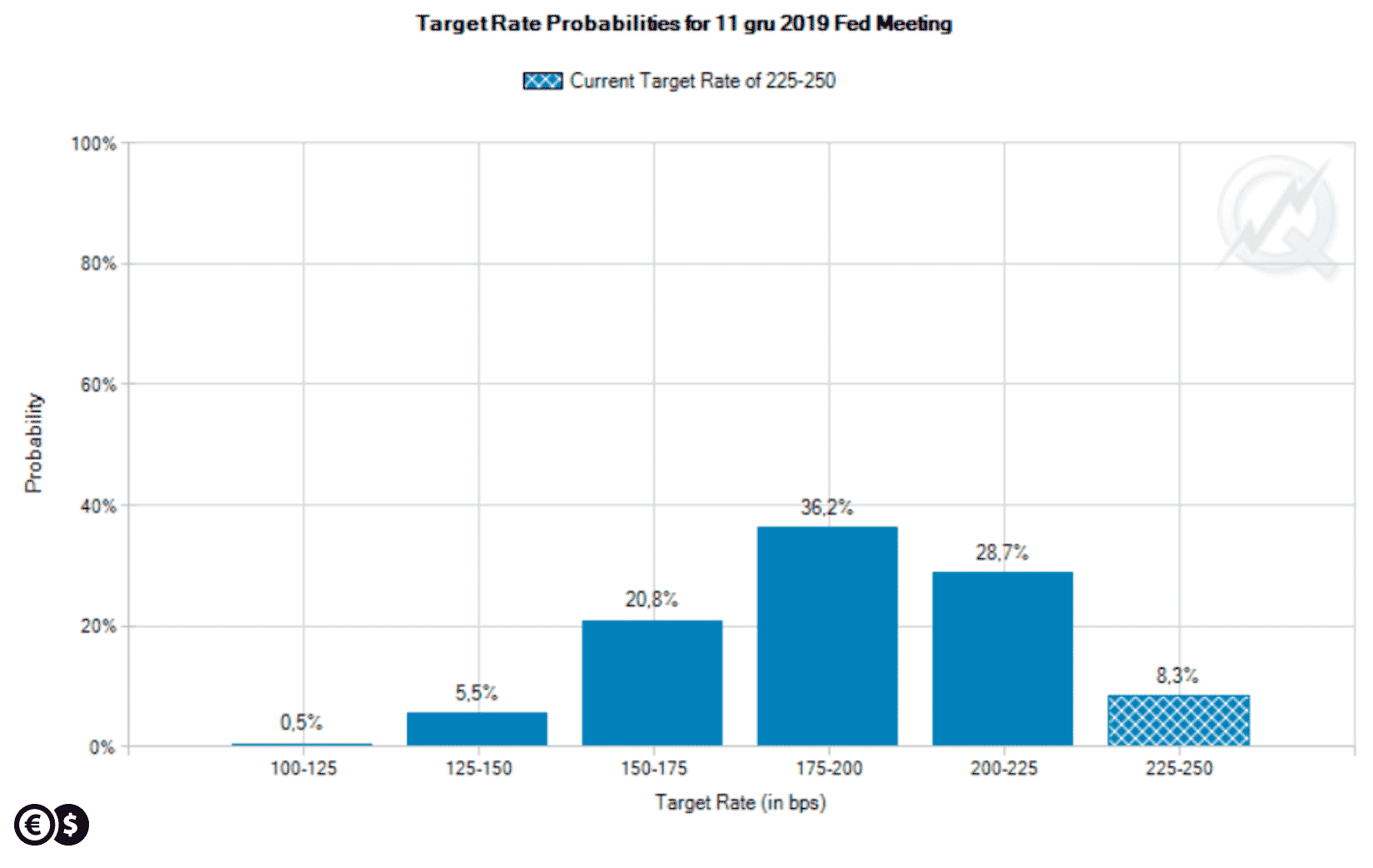

Fed Funds Futures target rate probabilities. Source: CME

The market probability of interest rate cuts in the US increased to over 90 percent by the end of the year. On the other hand, the odds of two cuts in the second half of 2019 seem to be also growing.

The next meeting of the Open Market Committee (FOMC) will be held on 18-19 June. During the publication of the decision on interest rates, the latest macroeconomic projections of the FED will be presented, on which market attention will be focused.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.