Tonight the markets have received another shock. President Donald Trump opened a new front of the trade war, introducing tariffs on Mexican products. Meanwhile, the Chinese manufacturing PMI fell below 50 points, which is a worse reading than market expectations. Therefore, uncertainty on the markets may increase.

Donald Trump has threatened to impose tariffs on Mexico if the country does not stop immigrants from crossing the US border illegally. Trump did not manage to build a wall, so he adopted a different model of combating the illegal crossing of the border. The new United States tariffs will start at 5 percent on June 10 on all imports from Mexico and increase by 5 percentage points on the first day of every month until they reach 25% on October 1.

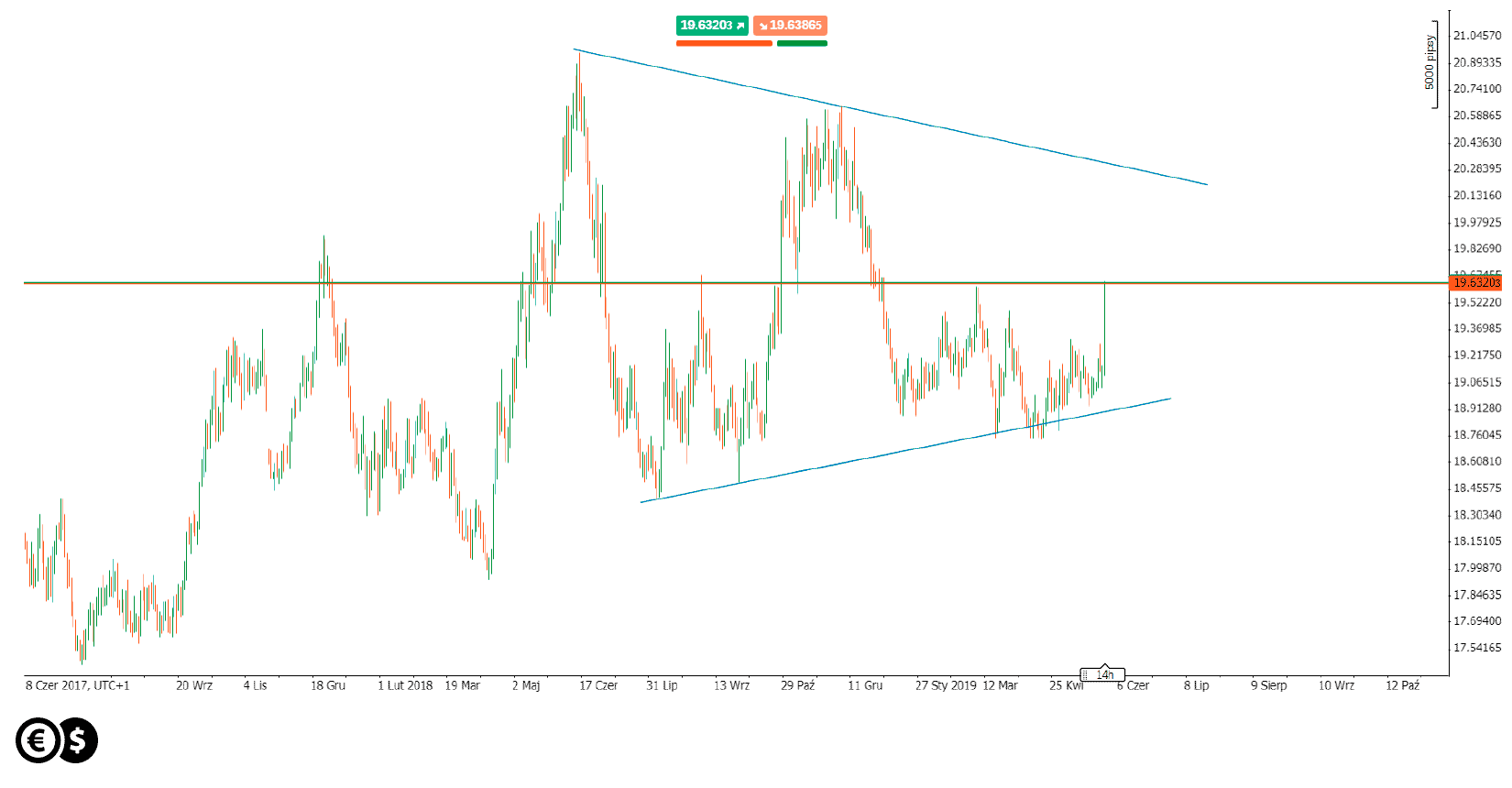

The Mexican peso reacted to the above information, which lost in relation to the US dollar by more than 2 percent. The USD/MXN has spiked, exceeding the level of 19.63.

USD/MXN daily chart. Conotoxia trading platform.

In turn, the combination of the escalation of the trade war with worse data from China could affect both the USD/JPY pair and the stock market indices. The official manufacturing PMI index in China fell in May to 49.4 from 50.1 points in the previous month and was worse than market expectations at 49.9. This meant the first drop in production activity since February as the escalation of the trade conflict with the US increased. New orders fell for the first time in four months.

The USD/JPY was at the lowest level since the beginning of February, beating the level of 109.00. The expected volatility in the options market also increased. The advantage of PUT options over CALL options has also increased. It seems, therefore, that investors may be willing to pay more for hedging against probable further appreciation of the Japanese yen. In turn, futures contracts for US indices losing in the morning almost one-percent. This is probably not the end of emotions for today, because in the afternoon we will get to know a lot of data from the US, including PCE inflation.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.