It is well known that precious metals are one of the more popular financial instruments or ways to store the value of money in time. It is also often said that they are safe havens to which capital returns when the risk aversion increases in the world.

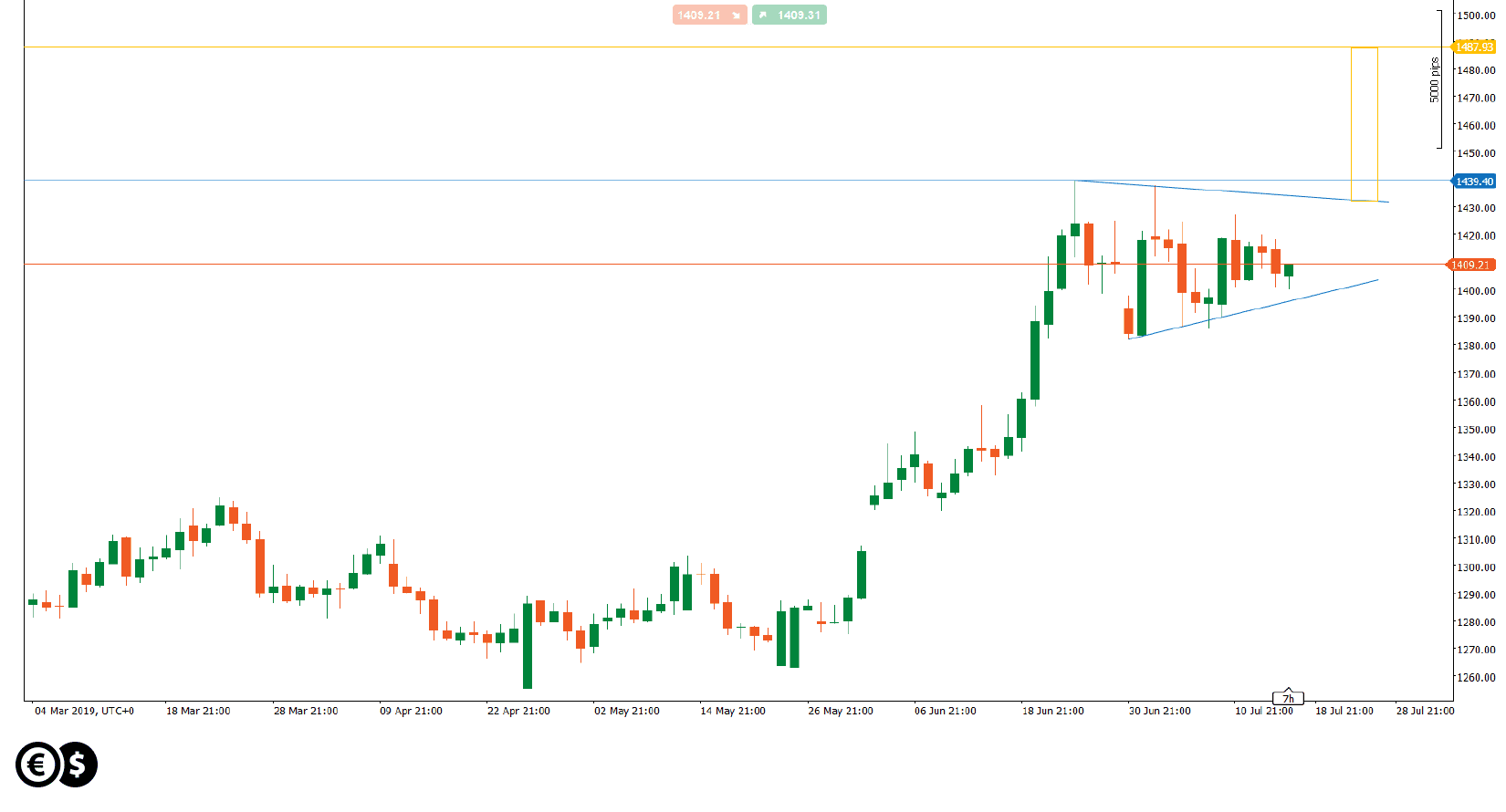

A good example of this was the situation on the gold market, which from the beginning of May this year went up by over 13 percent. As a result, the price has reached its highest level in nearly six years, exceeding USD 1,400 per ounce. The rally on the gold market could have been supported by several factors. Increased uncertainty and fear at that time in the markets, fears of recession, weakness of the dollar, decline in bond yields, return to safety. Currently, the price of gold is in consolidation. However, its shape begins to resemble the characteristic pattern of a symmetrical triangle.

Daily chart of gold. Conotoxia trading platform

The symmetrical triangle pattern is usually a trend continuation pattern and consists of two descending lines within which the price moves. If the upward limit is broken, then according to the principles of technical analysis, the target for the upward trend should be around 1487 USD.

An interesting situation is also on the silver market. The price of this metal hits the four-month high. From the end of May to today, the price of silver has already increased by about 10 percent. Silver is more industrial metal than gold and, in turn, the economic situation and its perspectives are more important here. Silver can also be supported by the deficit on this market.

Gold and silver in the second half of the year may attract investors' attention and it seems that next interesting months for these metals are still ahead of us. It is therefore worth following these two markets and checking how the situation develops.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.