The trade war between the United States and China seems to be the main reason for the very poor reading of China`s GDP for the second quarter. However, the remaining publications were better than the market expectations, thanks to which the market sentiment remains neutral.

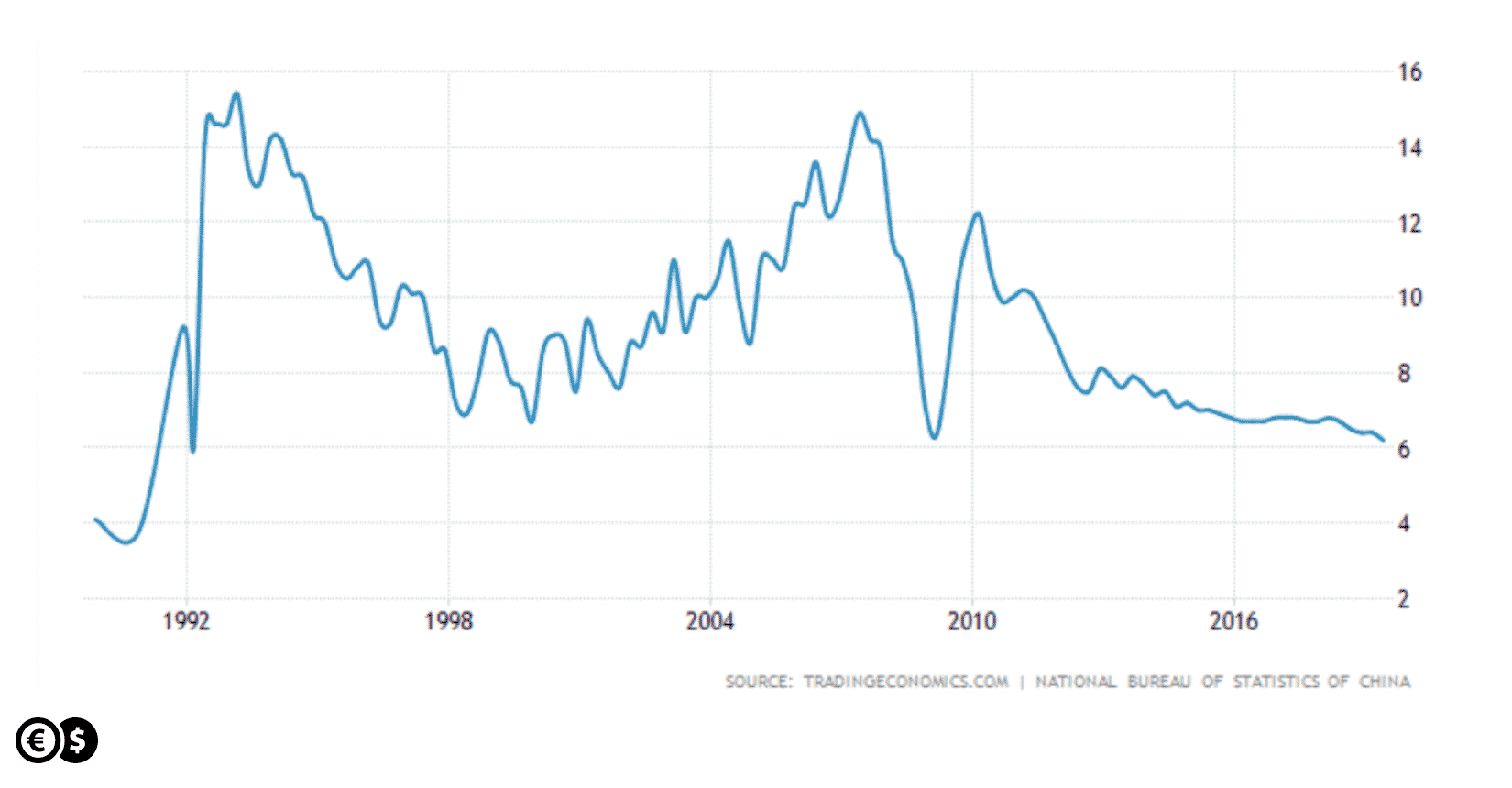

6.2 percent – that's what China's GDP for the second quarter was, compared to market expectations at 6.3 percent and a previous reading of 6.4 percent. As a result, it was the lowest GDP reading since the first quarter of 1992, or 27 years. After the stabilization of GDP growth in the years 2016-2017 at the level of 6.7-6.8 percent since the beginning of 2018, the growth have been systematically falling, which is an alarming signal also for other world economies.

China GDP annual growth rate. Source: tradingeconomics

Nevertheless, industrial production and retail sales rose in June above market expectations and above previous readings. Production growth to 6.3 percent and retail sales to 9.8 percent on an annual basis. Market consensus was 5.2 and 8.3 percent, respectively. Thanks to that, the sentiment in the markets has not deteriorated in a decisive way. It seems that thanks to such data, the New Zealand and Australian dollar strengthened.

This is the fourth day in a row when the NZD/USD and AUD/USD rise. Due to the strong economic connection between New Zealand, Australia and China, these publications seem to support currencies from the antipodes. However, this is not the end of interesting events for NZD and AUD, because inflation from New Zealand for the second quarter will be published tonight. The market expects 1.7 percent y/y. Publication at 0:45. Meanwhile, at 3:30 a minute from the last RBA meeting will be released. The above events may lead to a further increase in volatility for NZD/USD and AUD/USD.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.