The price of WTI oil has increased by 27 percent since the beginning of the year, which seems to make one of the better investments in 2019. The popular Nasdaq 100 index increased by about 25 percent in this period, and the S&P 500 by 20 percent. However, the last two days have brought over a 6-percent fall on the oil market.

The main price drivers in the oil market recently appeared to be the US-China and US-Iran relations. In the first case, it is still about the same, that is, about the progress in talks on the agreement between these countries and the end of the trade war. The closer the agreement is, the lower the chances of a drop in the demand for oil and the global economic slowdown seem. In turn, an increase in tensions may mean fears about reducing the demand for the oil and, consequently, a drop in its prices. Regarding Iran at some point, there was also talk of a possible growing conflict that could even become an armed conflict, because Iran was accused of disrupting oil transport in the Middle East.

According to the latest information, new events have appeared both in one and in the second issue. President Donald Trump reiterated that he could impose additional duties on imports from China if he wished, after promising to maintain a truce at the G20 summit last month. This again seems to increase fears about the drop in demand. In addition, according to Bloomberg, US Secretary of State Mike Pompeo said that Iran, which was affected by US sanctions for its weapons program, signaled that it is ready for talks. This opens the possibility of a diplomatic solution to the current dispute.

What's more, the weather conditions in the Gulf of Mexico improved, where workers at the drilling platforms were evacuated at the end of the week due to Hurricane Barry coming up. Over the weekend, oil production from this region dropped by almost 75 percent. According to the Department of Energy, the area of the Gulf of Mexico is responsible for 16 percent of oil production in the United States.

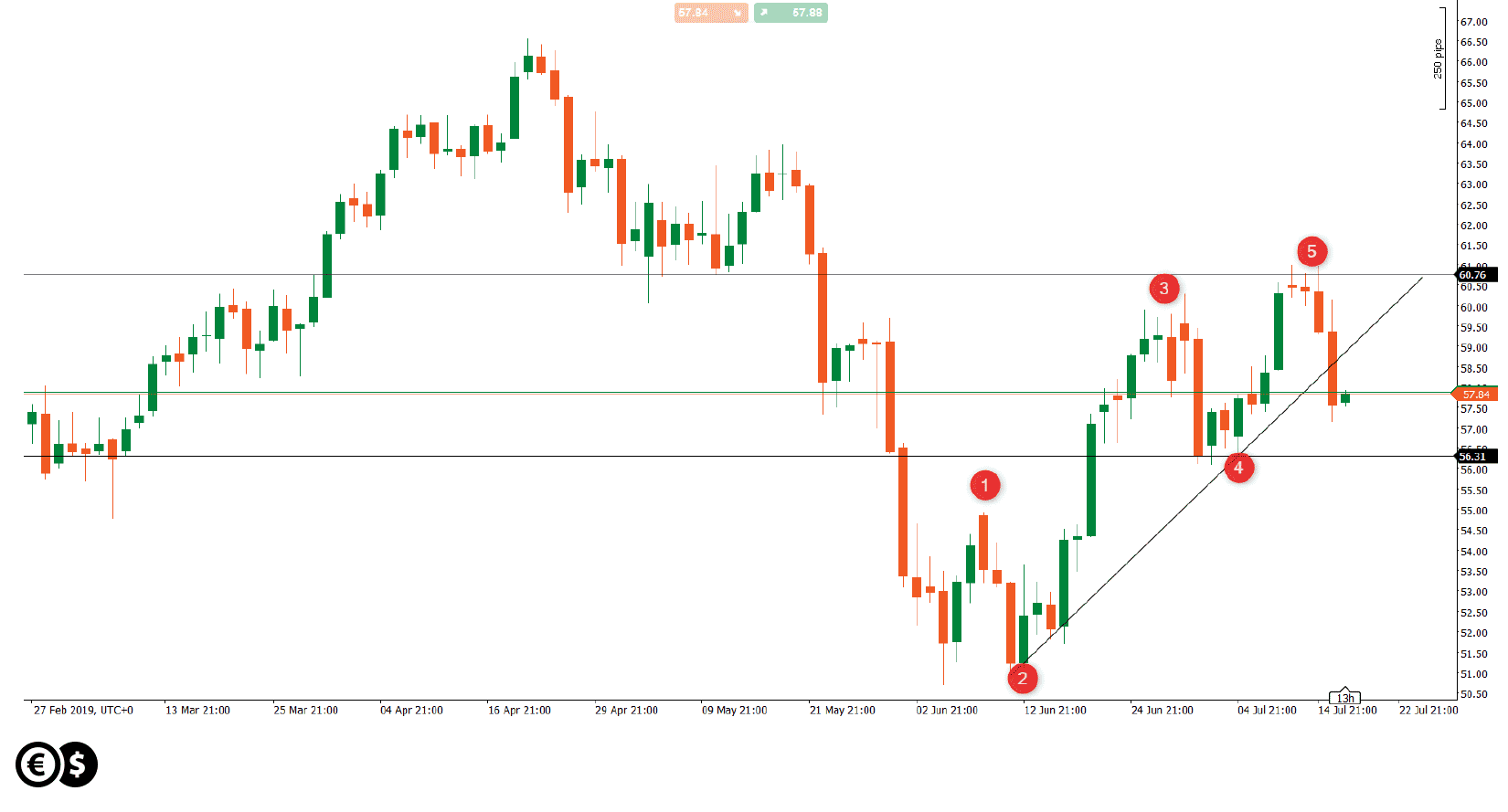

Oil daily chart. Source: Conotoxia trading platform

From the technical point of view, strong resistance seems to be confirmed in the area of previous lows at 60.76 USD per barrel. At this point, an upward impulse wave consisting of five subwaves was completed. Breaking the trend line may suggest that the market may create a larger correction in terms of price and time with the closest possible support at 56.31 USD.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.