The zloty seems to be steadily strengthening for six weeks in relation to the euro. This is the biggest rally of zloty appreciation to the single European currency for more than a decade, and precisely since 2008. Then was the last time we observed a six-week decline in the EUR/PLN rate.

As a result, this is the best month since November and the best quarter since the third quarter of last year for the zloty. The recent rise in the PLN and emerging markets has been positively influenced by optimism ahead of the US and Chinese presidents meeting in Osaka at the G20 summit, as well as a rally on the government bond market. In the last two months, the demand for Polish bonds was strong, because they have such an attractive yield. Thus, 10-year bond yield dropped from 3 percent to 2.34 percent. This level was unobserved since April 2015. The zloty may also be favoured by the emerging split in the Monetary Policy Council regarding the possibility of submitting a rate hike motion this fall.

The underlying scenario, which was assumed by the chairman of the Monetary Policy Council, indicated that interest rates would not change until the end of the current MPC's term of office. However, subsequent data from the Polish economy may change this view, as published preliminary data on inflation in Poland in June indicated its growth by 2.6 percent. This is a reading above the NBP (National Bank of Poland) inflation target of 2.5 percent and the highest value since November 2012. During the analyzed period, prices of food and non-alcoholic beverages increased by 5.7 percent, and fuel prices by 3.1 percent on an annual basis.

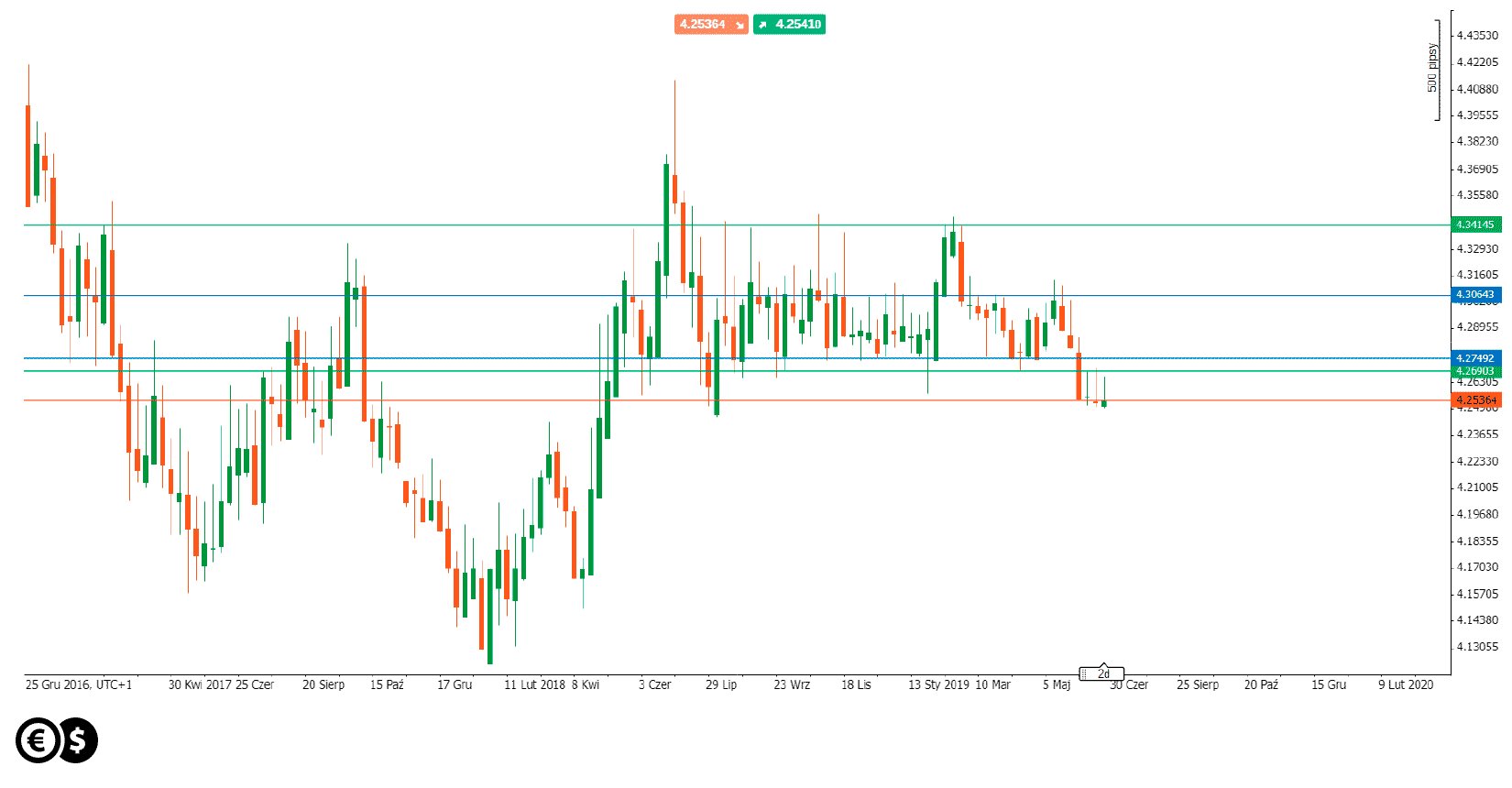

If, therefore, the opportunity to cut interest rates by the European Central Bank is added to the rising chances of a change in the number of votes in the Monetary Policy Council, we may see a possible divergence in the bias of both central banks. Consideration of interest rate hikes in Poland and the possibility of cutting them in the eurozone may lead to a further decline in EUR/PLN. The rate is now at an important barrier 4.25-4.24. Its defeat could mean a drop to the levels most recently observed in the spring of 2018 and thus a break from the long-term consolidation.

EUR/PLN weekly chart. Conotoxia trading platform.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.