The price of gold has reached the highest level in 6 years, beating the round 1,400 USD per ounce. Only in two months, the price of gold rose by over 12 percent, becoming one of the better investments in recent months.

Many factors contributed to the rise in gold prices. It seems that everything started with investors' fears for a deeper slowdown in the global economy, and thus also the risk of a recession in the United States. It was to be a consequence of the ongoing and escalating trade war between the US and China. The imposition of tariffs hinders the functioning of the world, which is based on globalization and the free trade of goods and services. This aroused the investors' fears, who started to look for the so-called safe havens, which also include gold.

Another factor that seems to have a positive impact on the bullion market is the increasingly dovish bias of the US Federal Reserve and market expectations regarding the easing of monetary policy. This, in turn, translates into two important issues. One of them is the American dollar, which may not be supported by the increased chances of interest rate cuts. Thus, investors began selling American currency. The second factor is the decline in yields on US debt, probably due to the increase in expectations regarding interest rate cuts. This, in turn, causes that real interest rates approach zero, which may also lead to more interest in gold.

The most recent factor for gold prices may be the imposition of further sanctions by the United States on Iran. This increases the uncertainty in global markets again, which seems to again drive investors to safe assets, including gold.

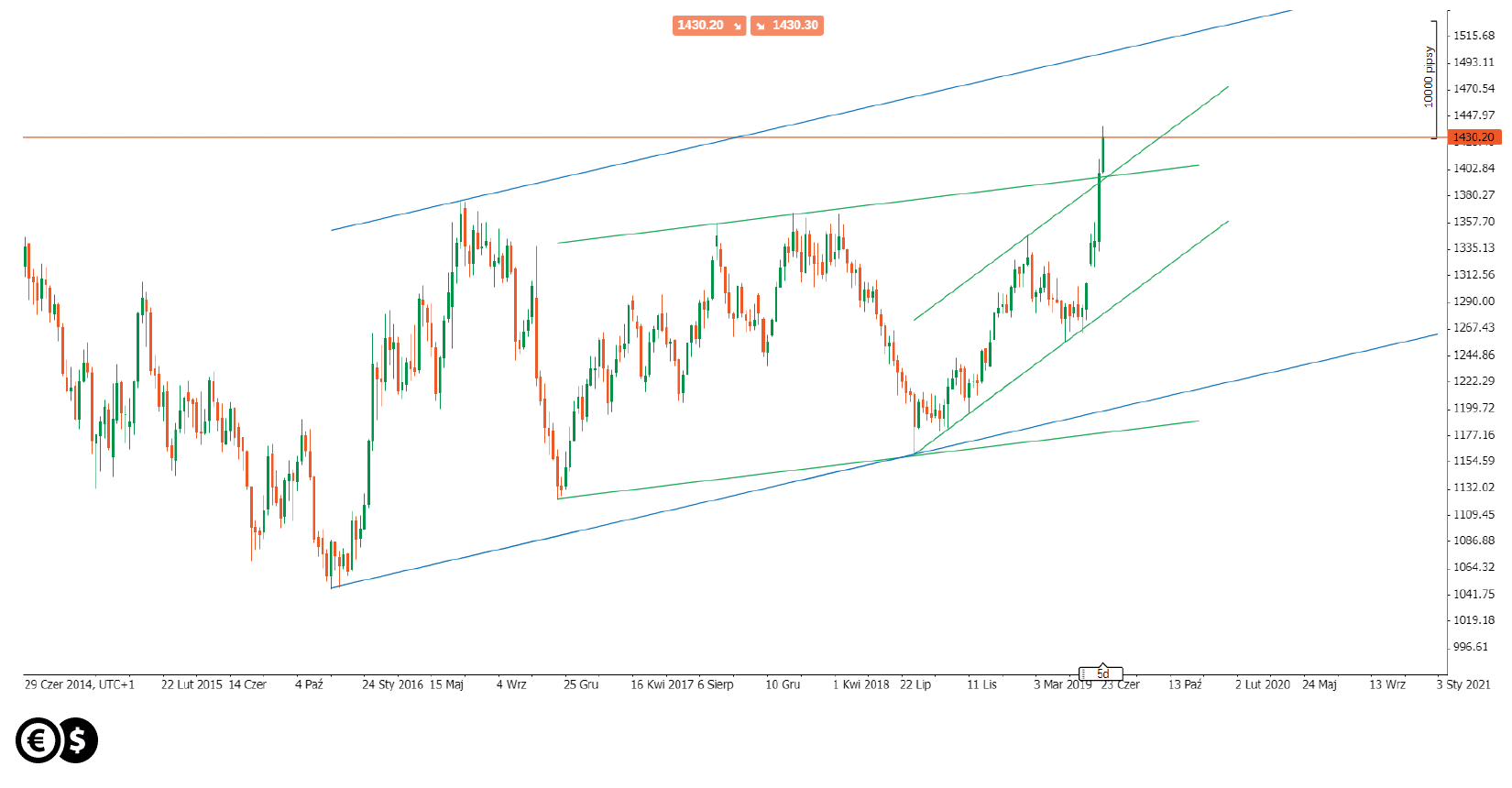

Chart: the price of gold. Weekly chart. Conotoxia trading platform.

The price increase is so dynamic that from the technical point of view the market managed to break the upper limits in the trend channels. These lines may currently be the closest technical support areas, and the resistance may be set by USD 1500, where there is an upper limit in the main, broad trend channel.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.