It took just 10 days to get the WTI up more than 14 percent. In mid-June, the WTI futures contract was traded at 51-52 USD, currently it is above 59 USD. This means the highest level in four weeks.

Such a rapid increase in oil prices may stem primarily from the growing tension between Washington and Tehran, which overshadowed the US trade war with China. It might be also suggested by the price action, because the trade war seems to be a supply factor for the oil market, and the conflict between the US and Iran may be a demand factor. Current data on changes in crude oil stocks also support the price. Moreover, if the talks between the US and Chinese presidents at the G20 summit were successful, this could further support the demand for oil. In principle, the entire correction from April to June seemed to be the result of increased market concerns about the global economic slowdown and increased chances of recession in the US, which in turn could reduce demand.

Yesterday's API data showed a decline in crude oil inventories by more than 7.5 million barrels. This was the largest weekly drop in crude oil inventories since mid-December 2018. It is also worth noting the increase in gasoline demand due to the beginning of the summer driving season. The market also draws attention to the next-week OPEC meeting in Vienna and to the G20 summit this weekend in Japan. According to Bloomberg, Russian President Vladimir Putin will probably discuss the reduction of oil production with the Saudi prince Mohammed Bin Salman during the summit, potentially a breakthrough in OPEC + policy, before the delegates meet in the Austrian capital.

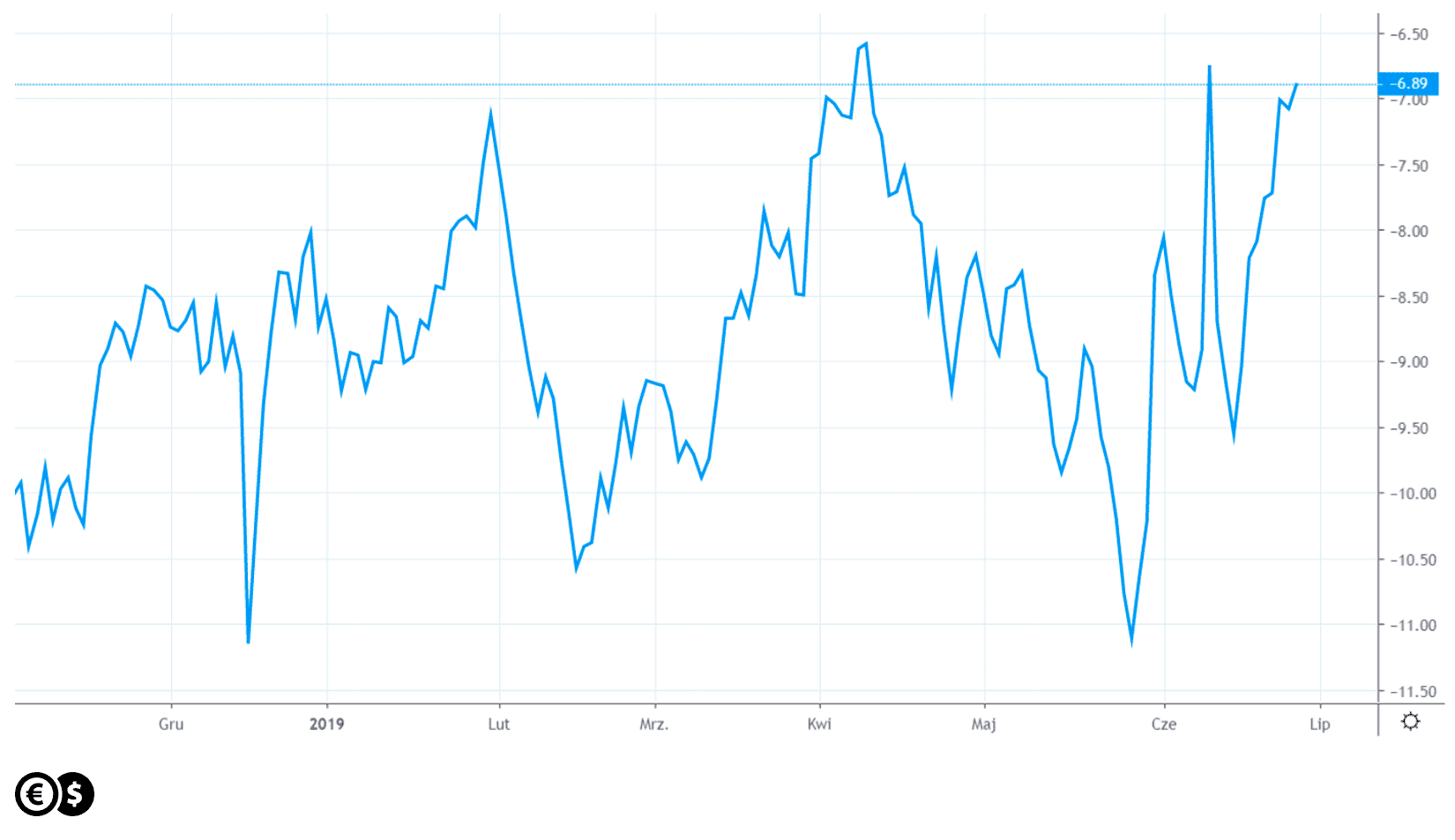

It might be also worth paying an attention to the reduction of the difference in the price of the WTI and Brent oil. The spread - the difference between the price of one and the other type of oil - decreased to about $ 7 from 11.

Chart: WTI - Brent spread. Source: tradingview

This information is important for those investors who use the pair trading strategy, which consists in finding two correlated markets (like two types of oil), and then buying a contract for one of them, while selling the second contract. The goal is a possible profit when, after a period of smaller correlation, these markets will return to it again.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.