Tomorrow at 4:00 will be published the decision of the central bank of New Zealand (RBNZ – Reserve Bank of New Zealand) on interest rates together with a statement for this decision.

In May, the Reserve Bank of New Zealand decided to cut the cash rate from the record low 1.75 percent to 1.5 percent, which was in line with the market expectations. This was the first interest rate cut since November 2016. At that time, the RBNZ also stated that it was necessary to support employment prospects and inflation in line with the goal in conditions of slower global economic growth. Policy makers added that the lower interest rate path in the forecasted period is appropriate.

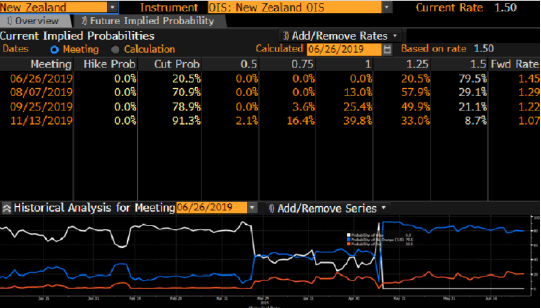

Interest rate market indicates the possibility of cutting by the RBNZ tomorrow morning at 20.5 percent. This is a relatively small probability. It is only in August that the probability of a cut is over 70 percent.

Chart: implied probability of interest rate cuts in New Zealand. Source: Bloomberg

It seems, therefore, that the statement will be the most important thing in tomorrow's decision. The market will try to find out if there are chances of cutting rates at the next meeting. If so, then it is already largely discounted. In this case, it can also be included in the New Zealand dollar exchange rate, which remains very stable despite cut in May. Meanwhile, the delay of another cut after the summer this year may be good news for NZD.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.