Today, the 176th meeting of the Organization of Petroleum Exporting Countries (OPEC) began in Vienna. Tomorrow, on the other hand, the 6th OPEC meeting will take place with countries outside the cartel, including Russia. The main topic of the meetings will be the continuation of cutting production for the following months.

Even before the meeting in the Austrian capital during the weekend G20 summit there were declarations that seem to favor the rise in oil prices. At the beginning of the week, price of WTI oil increased by almost 3 percent to the highest level in five weeks. The price increase was also supported by a positive message after the meeting of US and Chinese presidents. It was agreed that the two countries are returning to talks on the trade agreement, and the United States will not impose further tariffs on Chinese products worth USD 300 billion. As a result, sentiment in the markets improved and concerns about a greater slowdown in the global economy that could reduce the demand for oil decreased.

Russia and Saudi Arabia want to extend production cuts by OPEC+ countries. Moreover, other OPEC members expressed their support for the agreement between Russian President Vladimir Putin and the Saudi prince Mohammed Bin Salman to extend the production cut period by 6-9 months.

The latest information from the Austrian capital shows that all the ministers who participated in the talks in Vienna on Monday morning approved the 9-month extension of the OPEC + agreement according to what was agreed earlier in December. The current reduction in production is 1.2 million barrels a day, where OPEC is responsible for around 800,000, and countries outside of OPEC for cutting about 400,000. barrels a day.

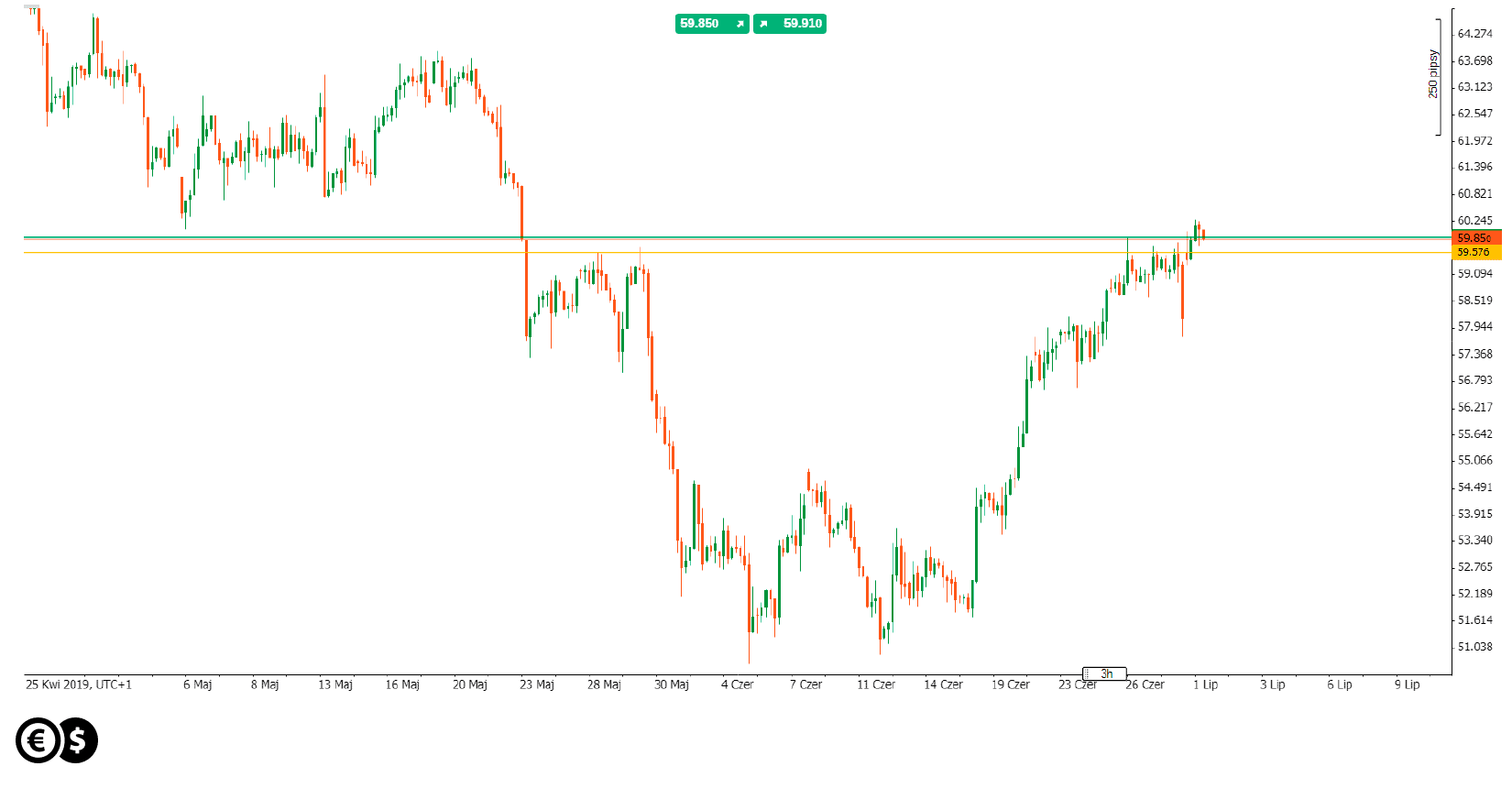

Chart: oil WTI, H4. Conotoxia trading platform

Today, the price of the WTI has exceeded USD 60, which is the highest level for five weeks. Only in the last month the price of oil increased by over 12 percent, which made it an even better investment than the rapidly rising price gold in recent times.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.