Investors were impatiently awaiting this weekend because of the G20 summit that took place in Japan. Big uncertainty concerned the effect of the talks between the US and China presidents on the trade agreement. However, already in the middle of last week there were expectations of a positive solution to this issue.

On Saturday after the meeting of Donald Trump, the US and China announced a truce in their trade war, and President Trump said he would refrain from imposing additional tariffs on Chinese products worth 300 billion USD. What is more, President Donald Trump said that the US is winning the trade war the day after reaching a temporary truce with the Chinese president.

However, this is not the end of positive information for the markets, because also during the weekend the US president and the leader of North Korea met, resuming discussions on the nuclear agreement. All that was enough for the markets to be optimistic, which exceeded the poor data from the Chinese economy, where the manufacturing PMI fell below 50 points. The stock market, however, discounts the future, and this is the opinion of investors to be much better.

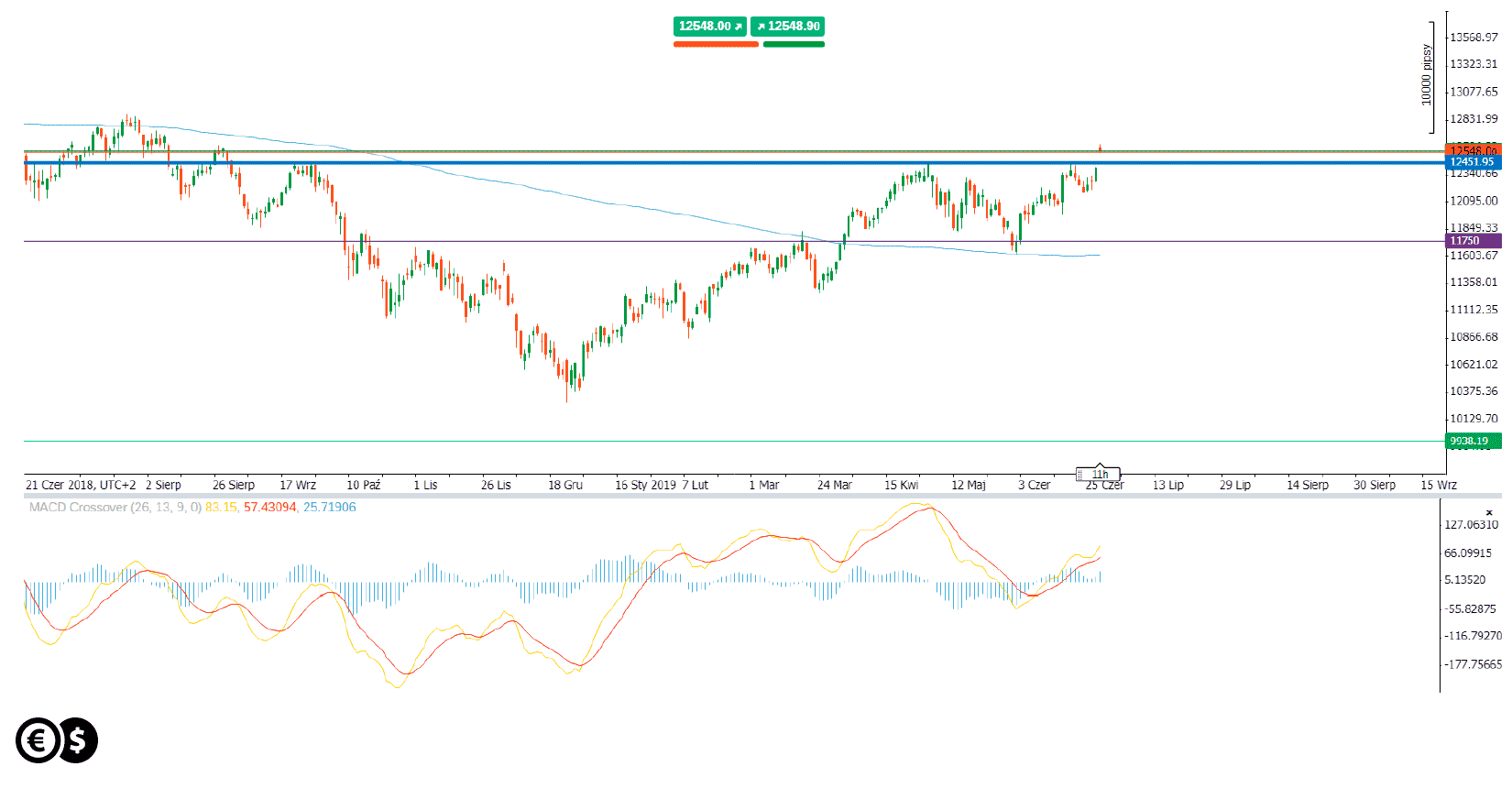

US stocks futures hit new record highs. Dow Jones and S&P 500 increase by more than 1 percent, and the futures contract on the Nasdaq 100 jumped by over 1.6 percent. The risk appetite seems to increase in Europe, where the German DAX gains over 1 percent, breaking a significant resistance at 12,450 points.

Chart: Dax, D1. Conotoxia trading platform

The lack of escalation of the trade conflict and the resulting hopes for improvement in the global economy cause that investors are currently forgetting poor data from the Chinese or European economy, where manufacturing PMI indices are still trading below 50 points. However, the basic question remains: will the agreement be successfully implemented and end the trade conflict once and for all?

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.