In the world of cryptocurrencies, where bitcoin (BTC) and ethereum (ETH) have long been seen as the gold and silver of this digital domain, news stories such as 'these three cryptocurrencies will soon surpass bitcoin' are increasingly common. This provokes questions about the wisdom of investing in alternative tokens, known as altcoins. We will therefore take a closer look at the top 100 altcoins, their advantages and disadvantages, to better understand which might be a better choice for us.

Table of contents:

- Cryptocurrency bull market

- Possibility to diversify against BTC and ETH

- The strongest gaining altcoins

- Is it worth investing in altcoins?

Cryptocurrency bull market

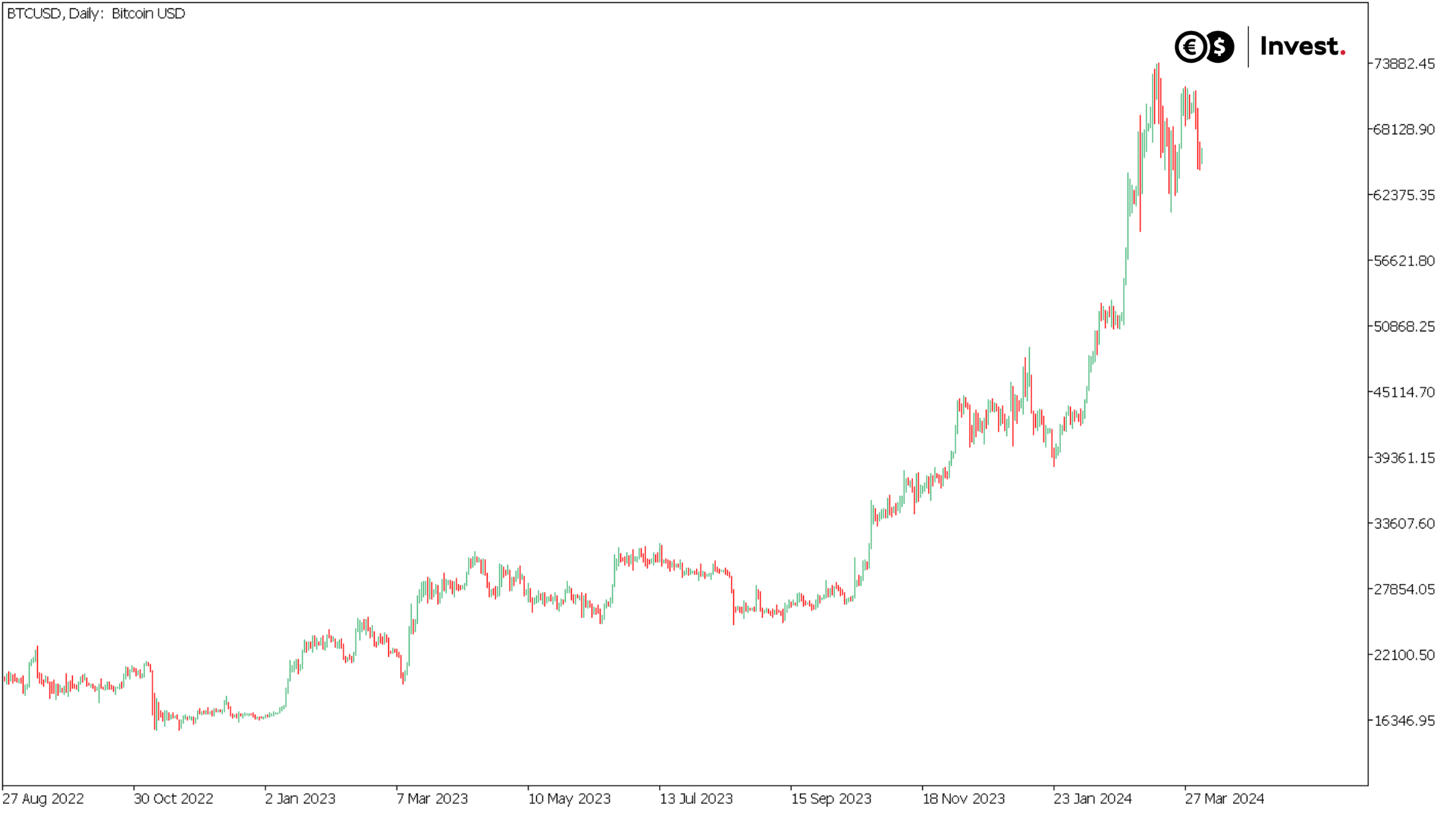

Since bitcoin hit its historic peaks, many altcoins have followed suit. Are we already dealing with a bubble similar to those seen in 2019 and 2021?

Source: Conotoxia MT5, BTCUSD, Daily

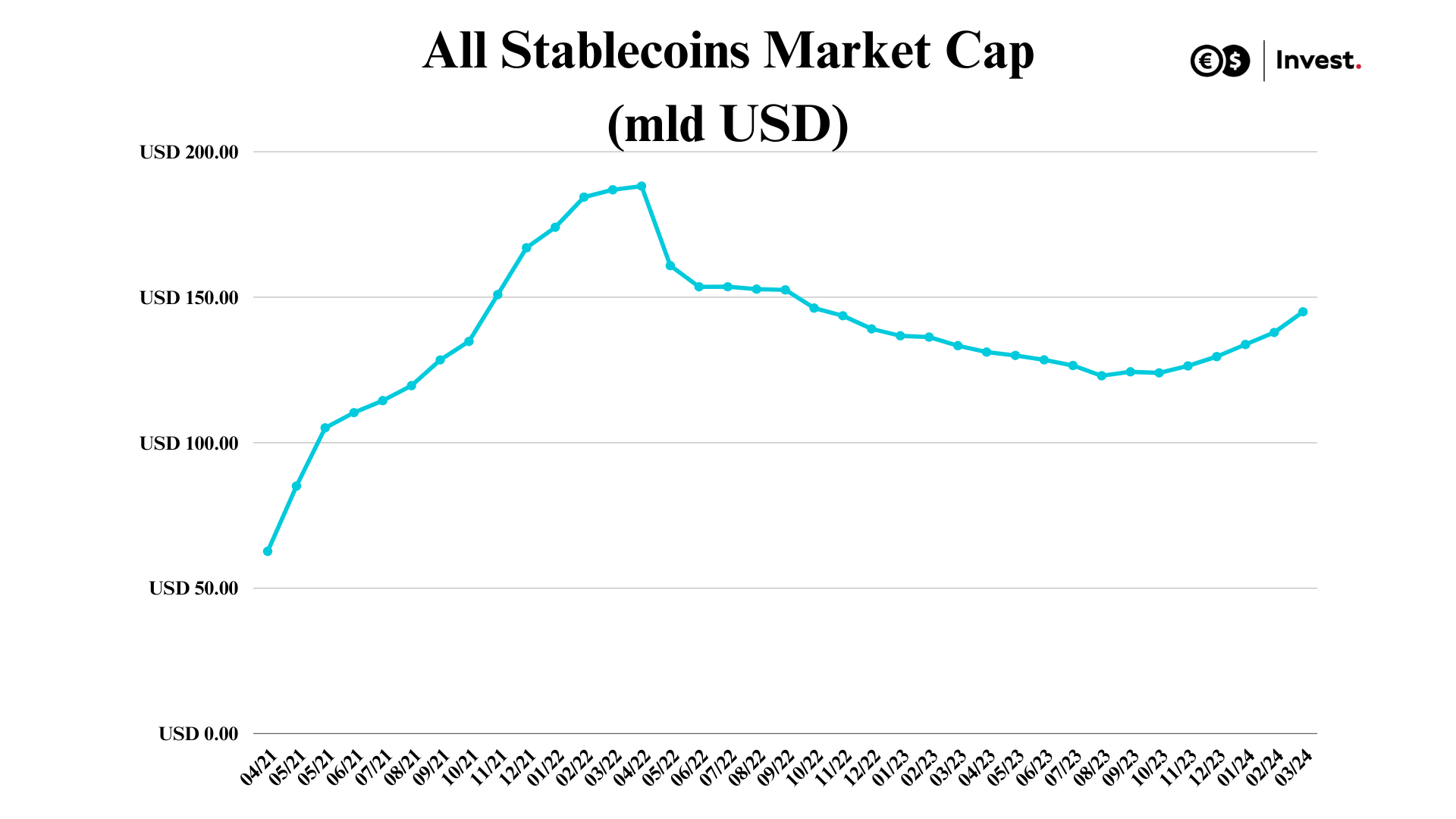

If we look at the amount of money in the cryptocurrency market as measured by stablecoin capitalisation, we are still some way away from the levels of the last speculative bubble - currently around 19% relative to the peaks.

Source: Conotoxia's own analysis, Defilam data

Possibility to diversify against BTC and ETH

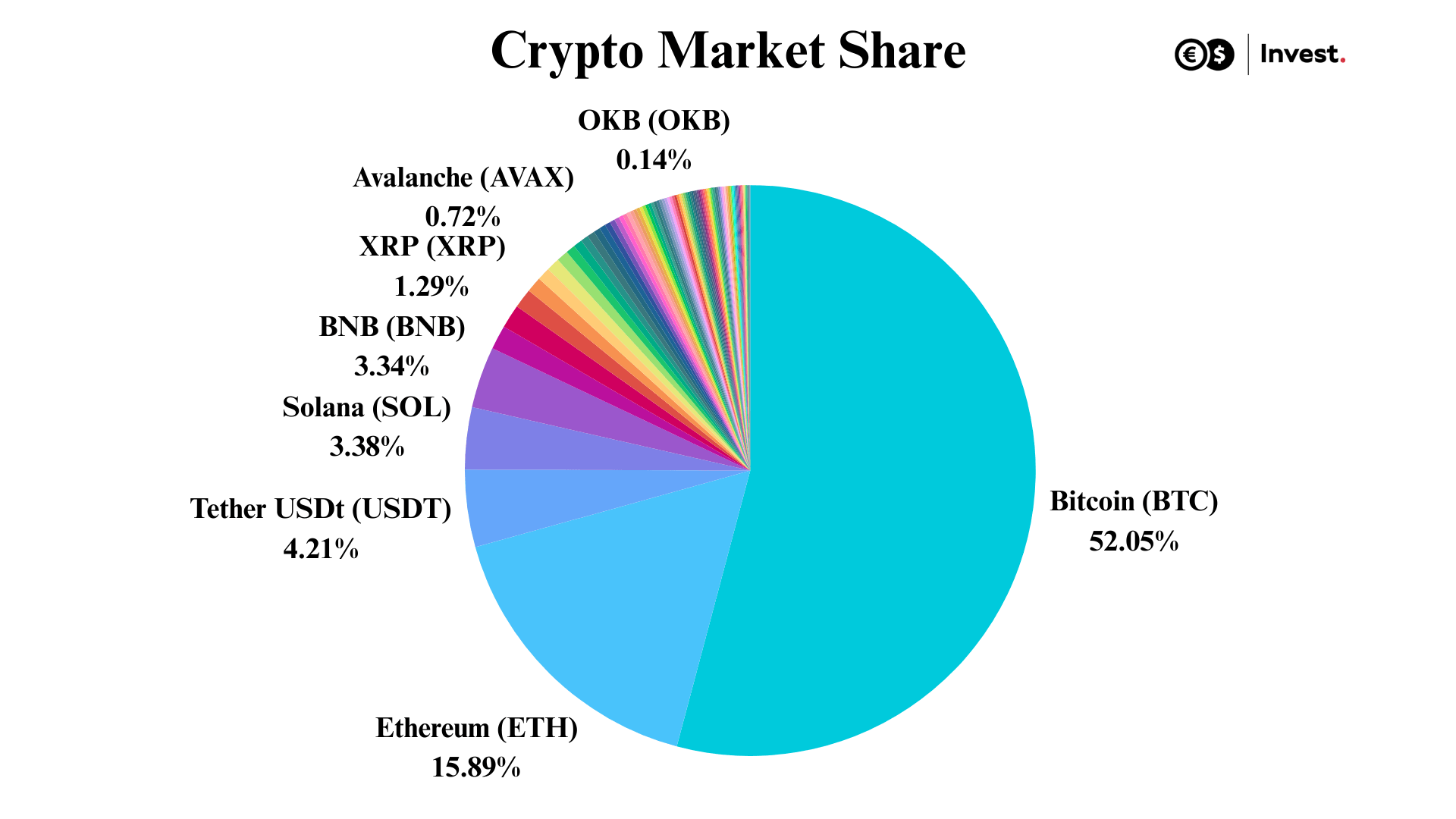

Technically speaking, any cryptocurrency that is not bitcoin or ethereum is called an altcoin. They account for about one-third of the total cryptocurrency market capitalisation.

Source: Conotoxia own analysis

For an investment to benefit from diversifying our cryptocurrency portfolio, it should have a low correlation with bitcoin. However, the average correlation of the top 100 altcoins with bitcoin as of early 2023 is 0.5, indicating a significant dependence on this largest cryptocurrency. In comparison, the average correlation in the stock market is around 0.25, which may suggest that declines in the value of bitcoin are very likely to cause altcoin sell-offs.

The strongest gaining altcoins

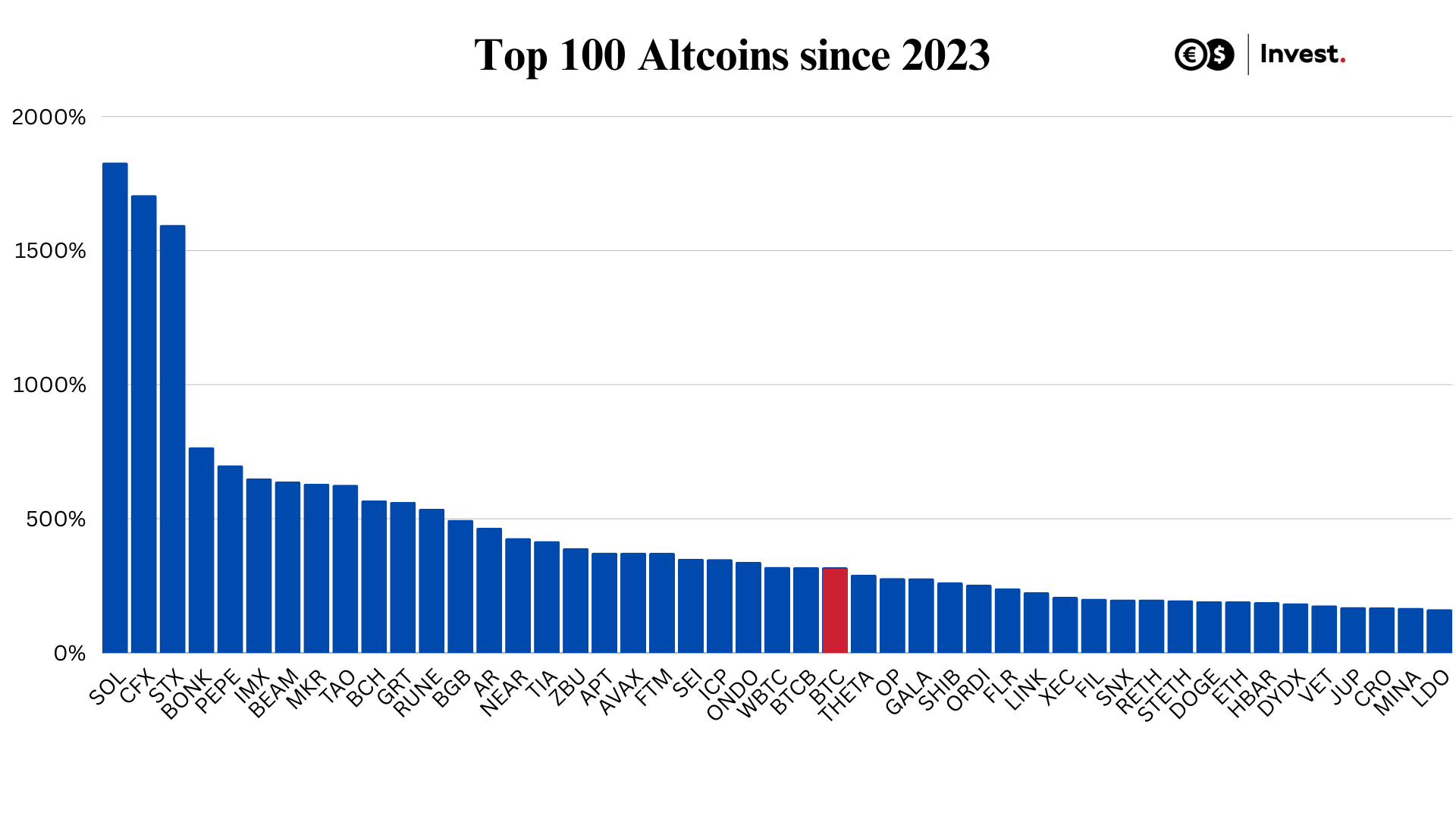

Among the top 100 altcoins that have performed best during the current bitcoin bull market (BTC gains since the start of 2023 are 319%) are:

- Solana (SOLUSD) +1829%

- CFX (CFXUSD) +1707%

- Stacks (STXUSD) +1596%

Despite the impressive performance, only 38 of the top 100 altcoins managed to surpass bitcoin's return. The median return of altcoins over the period was 199%, meaning that half of the altcoins recorded a return higher than 199%. For this reason, a high diversification between different altcoins, even over 30 different tokens, was recommended.

Source: Conotoxia own analysis

Is it worth investing in altcoins?

An investment in altcoins often carries the potential for higher returns, but also more than twice the risk of bitcoin and ethereum on average. Hence, it seems reasonable to analyse the decision carefully and to be cautious. If one nevertheless decides to invest, a high degree of diversification and spreading one's capital over as many positions as possible can be an effective strategy when choosing altcoins. However, it is important to remember that cryptocurrency markets are characterised by high systematic risk, meaning that the performance of most altcoins is dependent on the success of bitcoin, not vice versa. Another problem with most cryptocurrencies is that they lack the fundamental intrinsic value that other assets such as equities or commodities have. The positive reception of ETFs on bitcoin by investors seems to confirm the usefulness of cryptocurrencies as an investment vehicle and not just as a payment method.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,48% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.