Almost all asset managers with more than $100 million in assets have now filed their 13F reports for Q4 2023. We can learn from them what the best of the best bought and sold in the last quarter. So let's analyse what stocks and sectors were in the spotlight for investors such as Warren Buffett or Michael Burry.

Table of contents:

- What were the superinvestors buying and selling?

- How did Warren Buffett invest in Q4 2023?

- Michael Burry completely changes his strategy in Q4 2023!

- Conclusions

What were the superinvestors buying and selling?

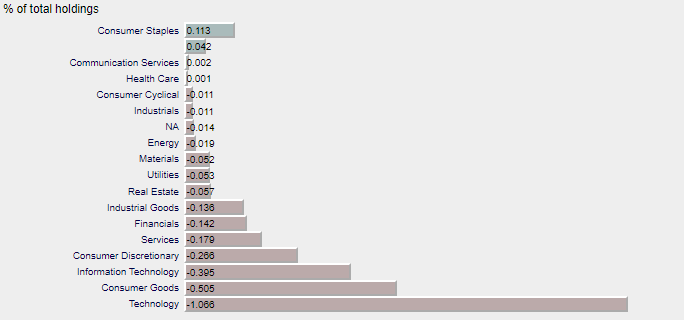

At a time when the theme of artificial intelligence development is growing in popularity and with the Nasdaq 100 technology index up 10.8% over the past three months, top investors sold off stocks en masse, primarily from the technology sector, which accounted for 1.066% of their total portfolio. An analysis of net stock purchases (total purchases minus sales) by sector shows that in the last quarter of 2023, super investors sold off stocks from almost all sectors, which together accounted for 2.9% of the value of all assets held. The sell-off in technology stocks appears to continue the trend already noted in Q3 2023.

Source: Dataroma, net purchases in Q4 2023.

Despite the general trend of a sell-off in technology company shares, the most frequently bought company was Alphabet (Google), whose shares were acquired by as many as eight super-investors. Microsoft came second, followed by Amazon and Visa.

How did Warren Buffett invest in Q4 2023?

Warren Buffett, known for his conservative approach to long-term investing, made significant changes to his portfolio.

- The most striking was the sale of a 77% stake in computer and printer maker HP Inc. which accounted for 0.7% of the total portfolio value.

- The second-largest deal was the purchase of shares in Chevron Corp. the oil giant, which increased the portfolio by 0.68%.

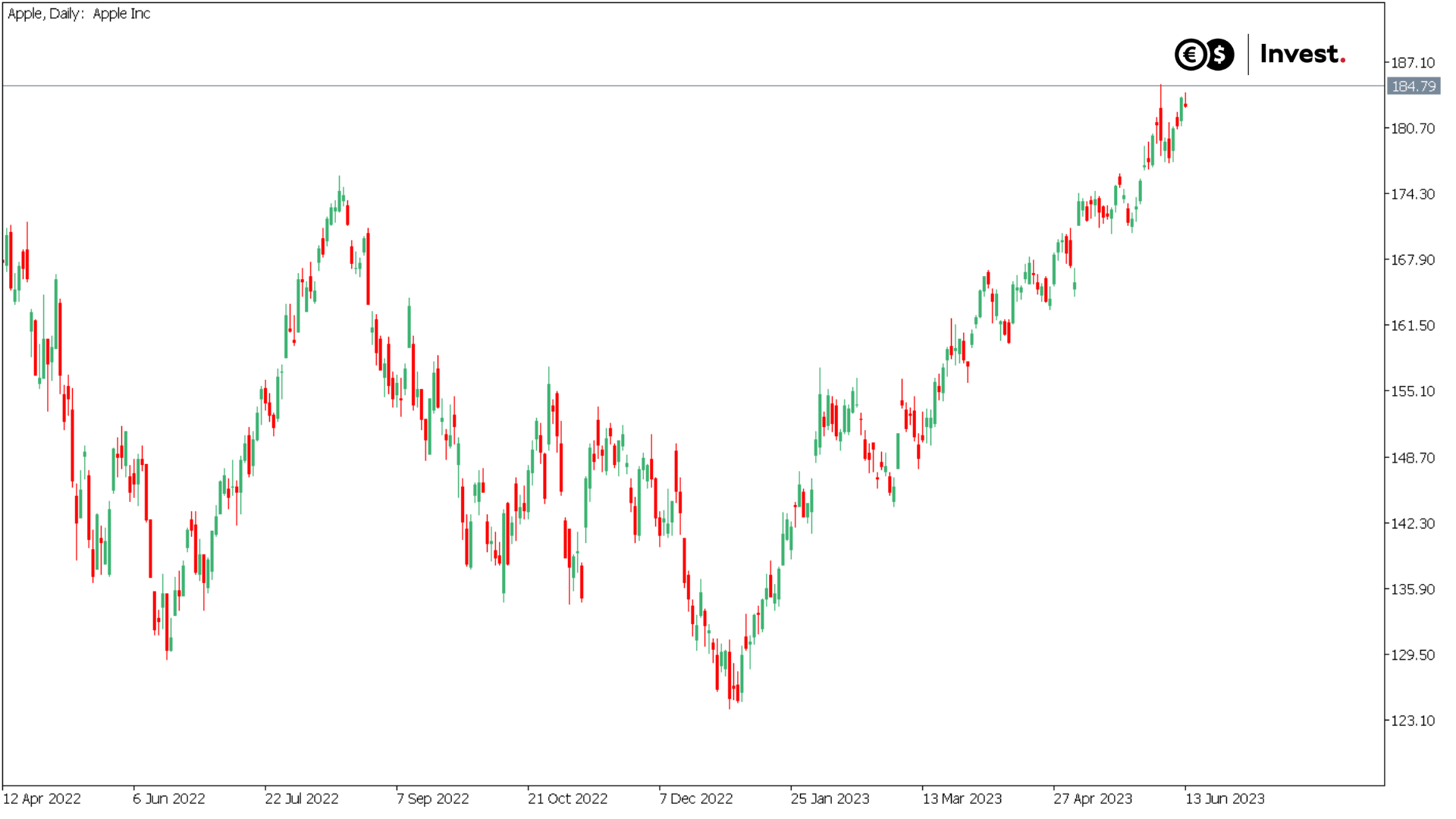

- In third place was an adjustment to shares in Apple, the largest position in Buffett's portfolio, which impacted the fund's portfolio by 0.55%.

Source: Dataroma

Source: Conotoxia MT5, Apple, Daily

Michael Burry completely changes his strategy in Q4 2023!

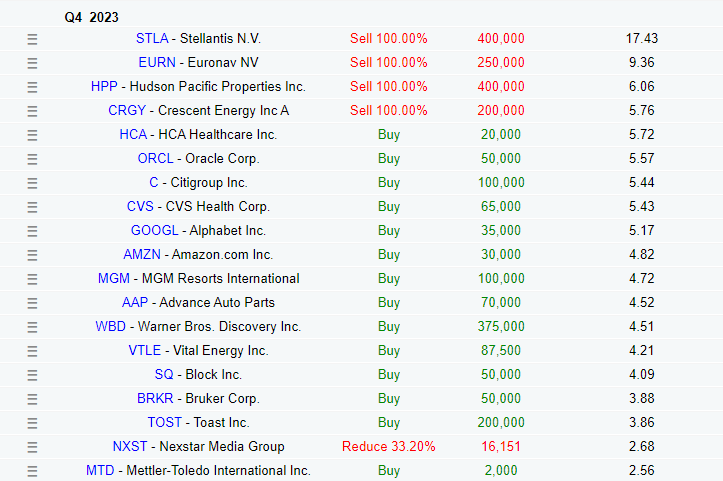

Michael Burry, known for predicting the 2008 financial crisis and renowned for frequent changes to his investment portfolio, has made some significant moves. At the end of Q3 Ub.r. Burry opened positions on the decline of the semiconductor sector. He used options to bet on declines in the iShares Semiconductor ETF (SOXX), which at that point accounted for 47.86% of his portfolio value, and bought options on declines in Booking Holdings Inc. shares, accounting for 7.79% of his portfolio value. However, in the last quarter of 2023, he closed these positions at a loss. With this, he seems to have changed his approach sharply, making numerous new purchases to his portfolio and completely selling as many as 4 of his largest existing positions. Burry has completely sold shares in:

- the global car manufacturer Stellantis N.V., which owns brands such as Peugeot, Citroën, Fiat, Jeep and Dodge, these shares accounted for as much as 17.43% of the value of the total equity portfolio;

- one of the largest tanker operators in the world, transporting crude oil and petroleum products Euronav NV, with a total value of 9.36% of the total portfolio;

- Hudson Pacific Properties, a real estate investment trust (REIT) that specialises in owning, managing, developing and acquiring office and media properties primarily on the west coast of the United States;

- a US energy company, primarily active in the upstream oil and gas sector, Crescent Energy, with a total portfolio size of 5.76%.

Michael Burry's portfolio has changed dramatically from what we have seen for most of 2023, when he repeatedly tried to catch a reversal in the broad equity market's uptrend. However, it seems that after months of battling the bull market, he has decided to go along with the prevailing market trend, betting on companies mainly in the consumer goods sector (accounting for a total of 29.4% of the portfolio) such as China's Alibaba and JD.com and US Amazon.

Source: Dataroma

Conclusions

When analysing the transactions made by super investors in the last quarter, it should be taken into account that many of these investments were made more than two months ago. This may affect the timeliness of the investment picture in the market. Interestingly, at a time when discussions about successes and breakthroughs in artificial intelligence dominated, leading investors were focused on finding investment opportunities in other areas.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.98% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.