At the heart of the financial markets, the semiconductor sector has seen a staggering 83% growth in the last 12 months.This could be largely due to the rapid development of artificial intelligence (AI). This technology, which is revolutionising almost every aspect of our lives, is increasing the demand for advanced microprocessors and integrated circuits, putting semiconductor manufacturers at the heart of the technological transformation. In the face of this phenomenal growth, many investors are wondering whether the semiconductor sector still harbours profit potential or whether the best opportunities have passed. In this article, we take a look at the current state of the industry, its key players and the challenges and opportunities to assess whether investing in semiconductor stocks could pay off in the coming years?

Table of contents:

- Semiconductor sector: Nvidia, Intel, TSMC or AMD?

- Is it still worth investing in the semiconductor sector?

Semiconductor sector: Nvidia, Intel, TSMC or AMD?

A cornerstone of modern technology, the semiconductor sector has long been seen as an indicator of future technological trends. Present from smartphones to cars, microprocessors and integrated circuits, data centres and advanced computer systems are essential to our daily lives. With the increasing use of artificial intelligence in various fields, the importance of semiconductors continues to grow, opening up new opportunities for innovation and profit.

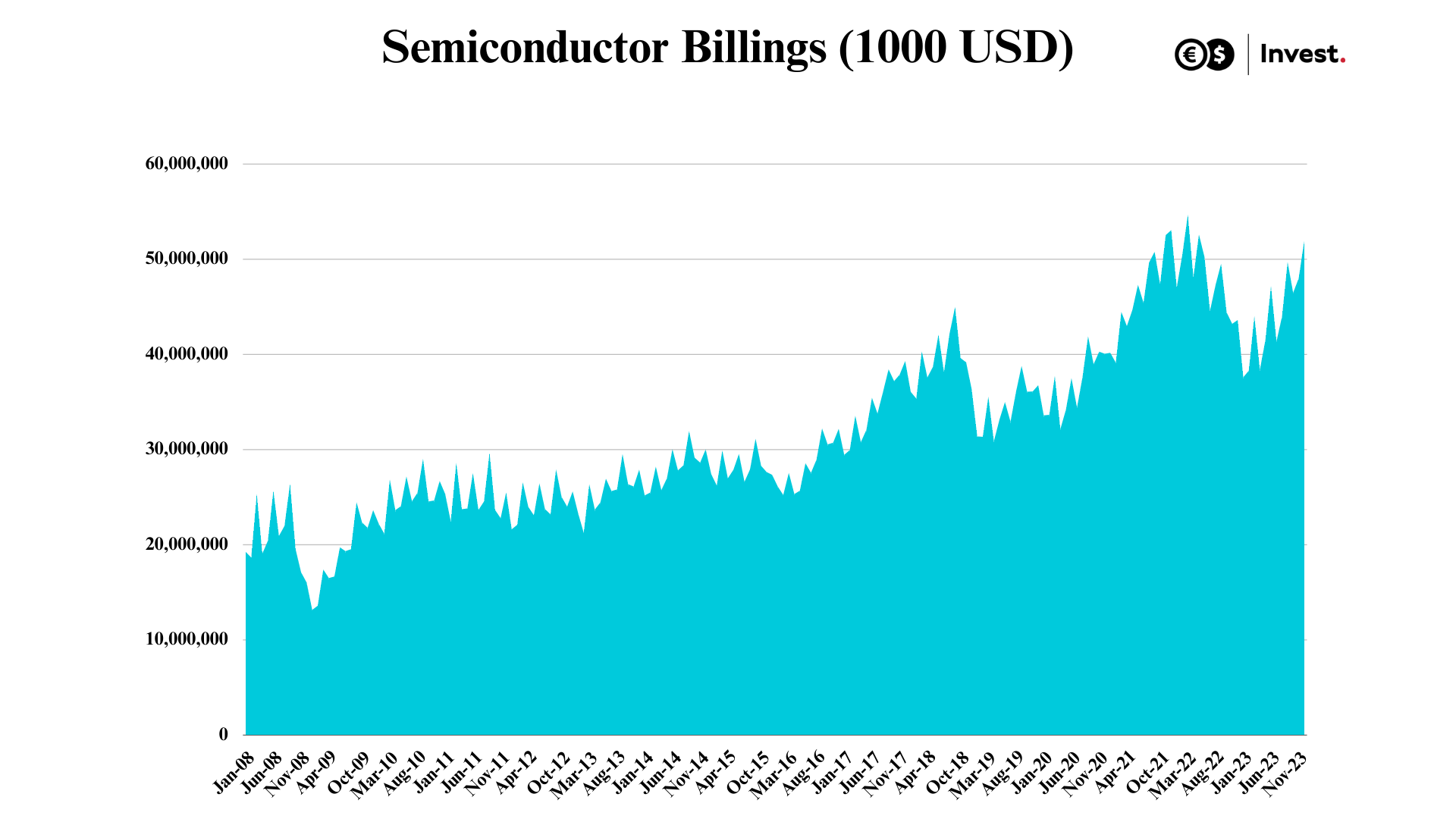

According to World Semiconductor Trade Statistics, in December 2023, global semiconductor orders increased by 19.1% compared to the previous year, ending a slowdown in the industry. Since 2008, the sector has shown an average annual growth rate of 6.9%.

Source: Conotoxia own analysis, WSTS data

Source: Conotoxia own analysis, WSTS data

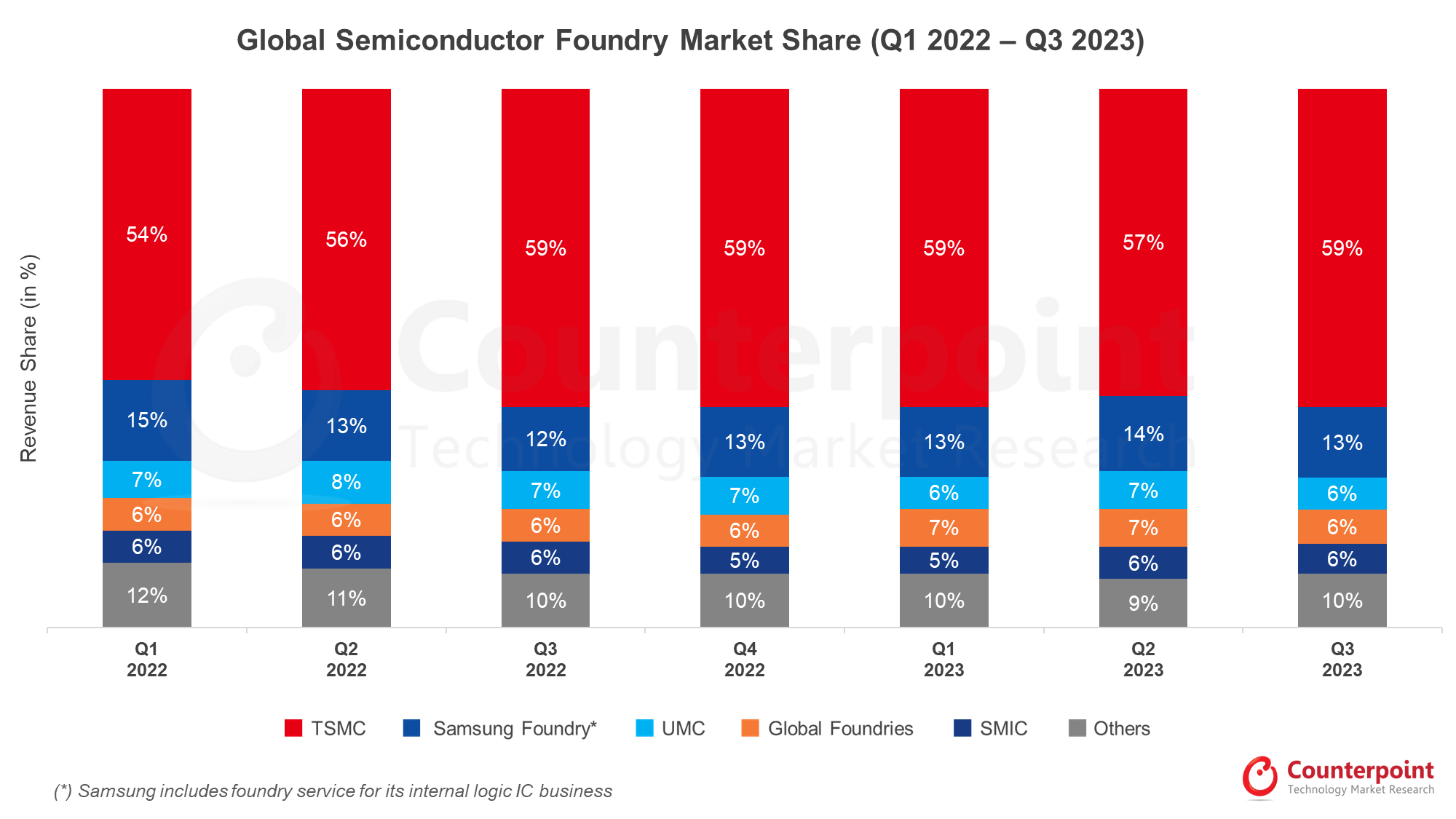

Among semiconductor manufacturers, Taiwan's TSMC dominates the market with 59% share, followed by South Korea's Samsung, with 13% share, and third place goes to UMC, also a Taiwanese company, with 6% market share.

Source: CounterPoint Research

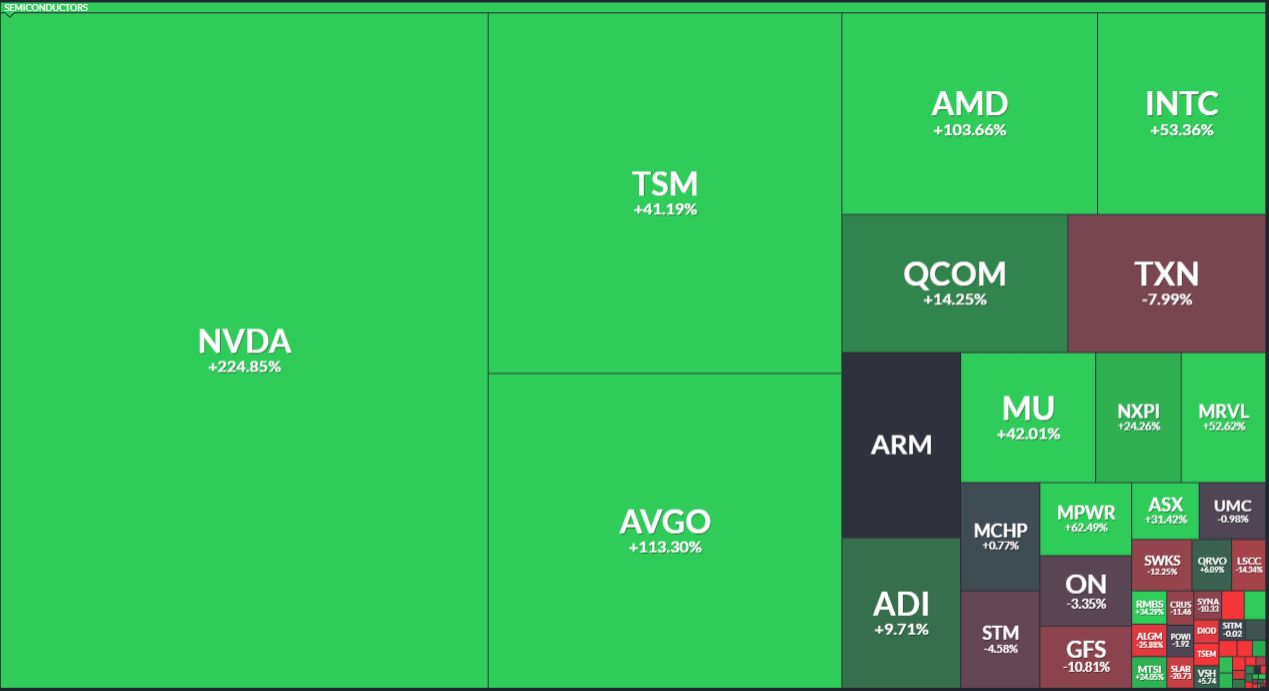

There are also companies that adopt a 'fabless' business model, focusing on semiconductor design without being involved in manufacturing. An example of this is Nvidia, which accounts for 38.6% of the sector's capitalisation. Broadcom and AMD play similar roles, with shares of 13% and 6% respectively.

Source: Finviz

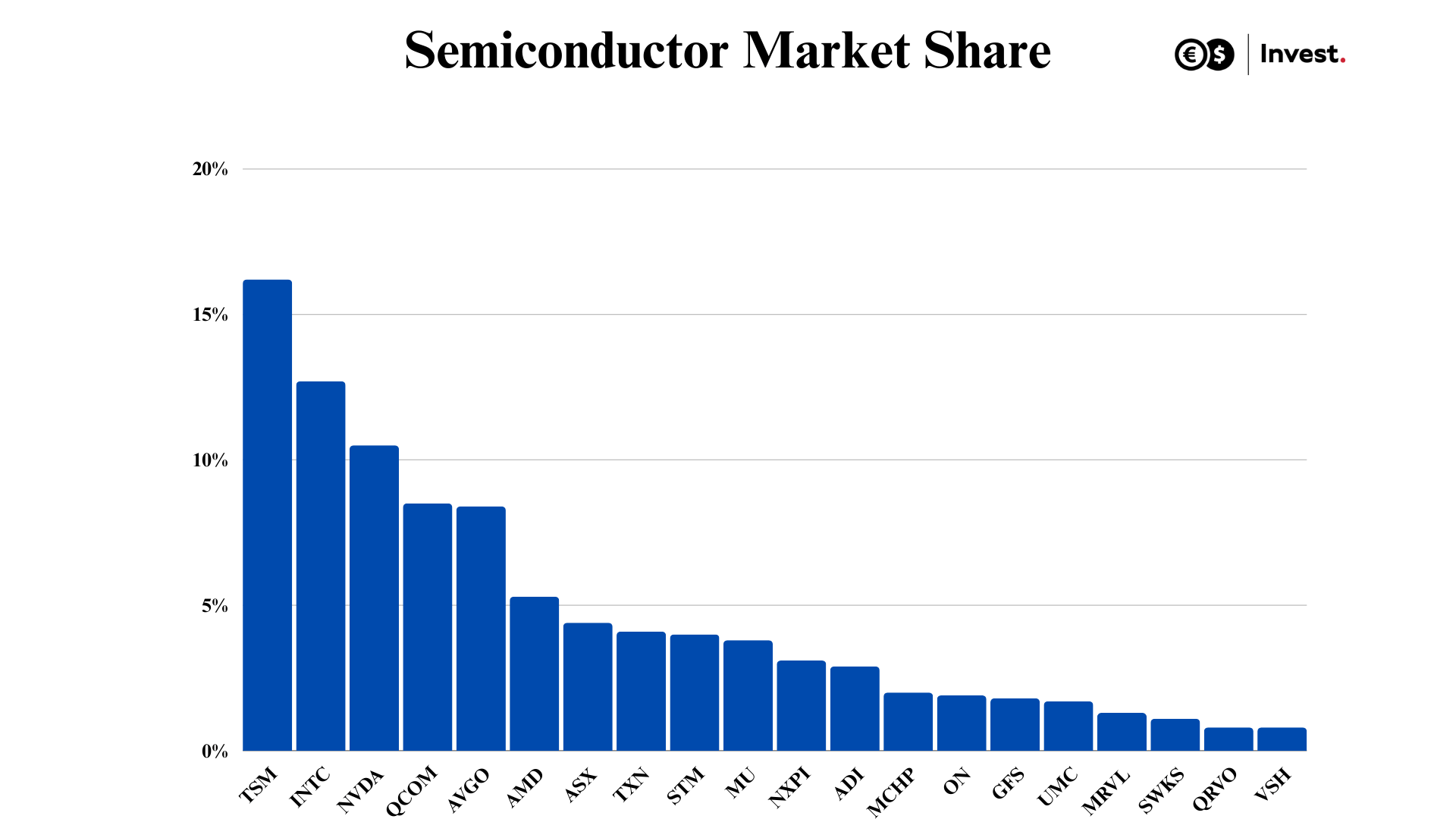

Although Nvidia is the most expensive company in the semiconductor sector in terms of capitalisation, it only ranks third in terms of sales volume, with 10.5% market share. TSMC, which is a manufacturer for companies such as Nvidia, AMD and Apple, is 60% ahead of Nvidia in terms of sales value, despite its much lower capitalisation.

Source: Conotoxia own analysis

Is it still worth investing in the semiconductor sector?

In addition to selecting individual semiconductor companies for our investment portfolio, it is possible to invest in the entire sector. An example of a fund that allows such an investment is the iShares Semiconductor ETF (SOXX).

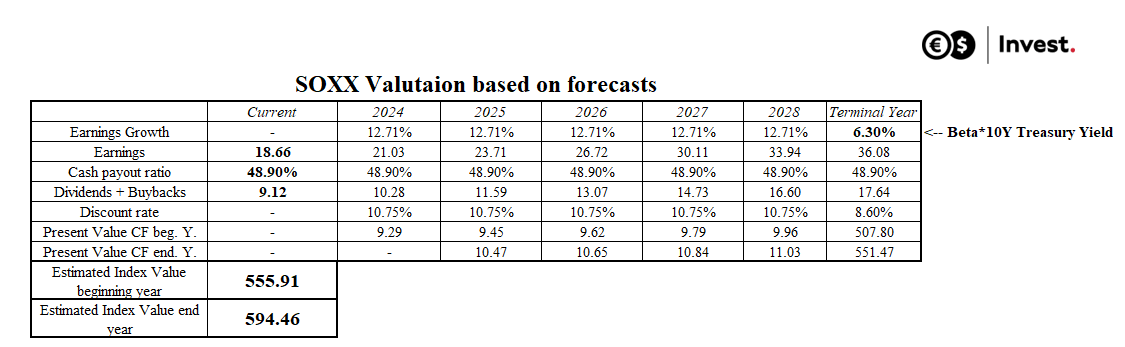

Following New York University's Professor Aswath Damodaran's principle of 'always pay attention to the price' (keep your eyes on the price), analysing future earnings forecasts for semiconductor companies can provide valuable insights. Data from Professor Damodaran shows that the average projected earnings growth rate for these companies over the next five years is 12.71%, with these companies reinvesting an average of 51.1% of their profits into the sector. This suggests that the current intrinsic value of the fund could be around US$555, which is around 12% lower than the current price of the SOXX fund. This is one potential signal of an overvaluation of the sector. However, if we expect the sector to develop faster than forecast, there is still potential for further value appreciation in the sector.

Source: Conotoxia own analysis

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.98% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.