Next Thursday, the ECB Executive Board members and the governors of the Eurozone central banks will decide whether to raise interest rates or leave them unchanged in the penultimate meeting of this year. On the other side of the Atlantic Ocean, the first estimates of the US Q3 GDP growth numbers will be released the same day. Meanwhile, a number of high-profile companies will continue to release their Q3 earnings reports throughout the week.

Table of contents:

- US New Home Sales (September)

- Eurozone Interest Rate Decision

- US Gross Domestic Product (GDP) QoQ (Q3)

- Stocks to watch

Wednesday 25.10. 14:00 GMT, US New Home Sales (September)

New Home Sales is an economic indicator published by the US Census Bureau that measures the number of new home sales, taking into account any deposits paid or contracts signed on single-family homes built in the current or previous year. A high number would indicate that the housing activity may be high, leading to strong economic growth. Although a lagging indicator, new home sales are closely watched by investors as they represent consumer demand driven by factors like interest rates, unemployment, and household income. New Home Sales are reported in absolute terms and as a percentage change from the previous month. In addition, new home sales are usually released before Existing Home Sales, as the two data are closely correlated.

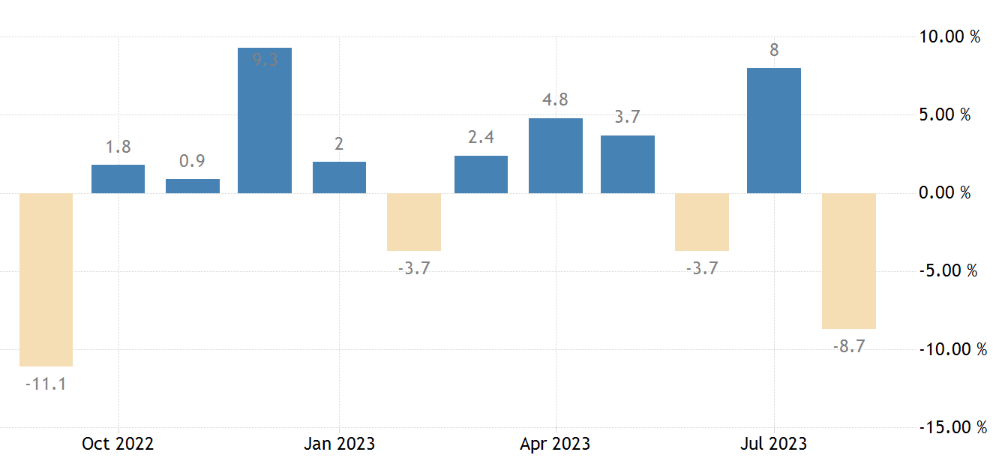

In the US, sales of new single-family homes fell sharply in August 2023, dropping 8.7% to a seasonally adjusted annual rate of 675,000 units. This result fell short of market expectations, missing the 700,000 sales expected and marking the sharpest decline in 11 months. It effectively wiped out the previously reported 8% rise in the previous month. This sharp decline could be attributed to the notable rise in mortgage rates, suggesting that the Federal Reserve's aggressive tightening measures are having a more pronounced impact in the third quarter of the year.

The median price of newly sold homes was 430,300 USD, while the average sales price was 514,000 USD. These figures were lower than the prices recorded a year ago, which were 440,300 USD and 530,800 USD, respectively. At the end of August, there were 436,000 houses still available for sale, equivalent to a supply of 7.8 months at the current sales rate.

Source: Tradingeconomics.com

A higher-than-expected reading may have a bullish effect on the USD, while a lower-than-expected reading could be bearish for the USD.

Impact: USD

Thursday, 26.10. 12:15 GMT, Eurozone Interest Rate Decision

The members of the ECB Executive Board, together with the governors of the Eurozone central banks, vote on whether to raise, decrease, or leave interest rates unchanged. These decisions affect the currency's value, and interest rate policy is among the key instruments to regulate inflation. Investors closely follow central banks' decisions and changes in the level of interest rates, as this information can be crucial to their trading strategies. The currency's value tends to rise when interest rates are high, as they attract investors seeking higher returns on their deposits. Conversely, when interest rates are low, the currency's value tends to fall as investors look for other places to invest their money.

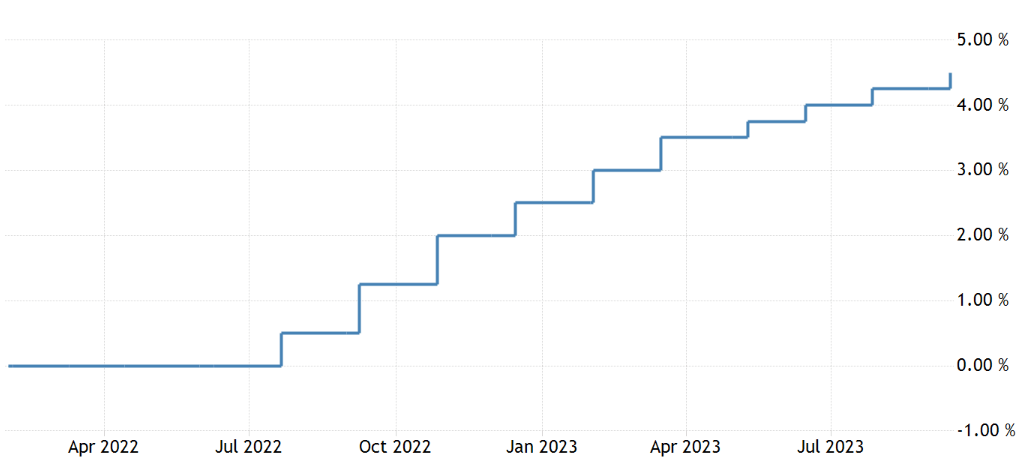

At their latest meeting on 14 September, the voting members of the ECB's Executive Board and the Governors were divided over whether to raise interest rates or maintain the status quo in their ongoing tightening cycle. The decision was described as a finely balanced one, influenced by tactical considerations. Officials were concerned about the potential consequences of pausing for the first time in more than a year, such as the perception of a weakening commitment on the part of the ECB. This, in turn, could lead to speculation that the tightening cycle was coming to an end, thereby increasing the risk of a resurgence in inflation.

Nevertheless, some members advocated for keeping interest rates unchanged. Their perspective was rooted in the belief that the economy had experienced a significant downturn, and they anticipated that inflation would eventually return to around 2% by the end of the projection period. The minutes also underscored the upward adjustments made to the headline inflation forecasts for 2023 and 2024. Notably, these projections were contingent on market interest rates, implying the potential for another interest rate hike by year-end – in this or the last meeting of the year in December.

Source: Tradingeconomics.com

A higher-than-expected rate may be positive for the EUR and negative for the stock market, while a lower-than-expected rate may be negative for the EUR and positive for the stock market.

Impact: EUR, STOXX, DAX

Thursday, 26.10. 12:30 GMT, US Gross Domestic Product (GDP) QoQ (Q3)

Gross domestic product (GDP) indicates the total value of goods and services produced in a country for a certain period. GDP is an important indicator of the health of an economy because it gives an overall picture of how well or poorly it is doing. If the GDP growth is higher than expected, the economy is in good shape and growing faster than expected. On the other hand, if the GDP growth is lower than expected, the economy performs weaker than anticipated.

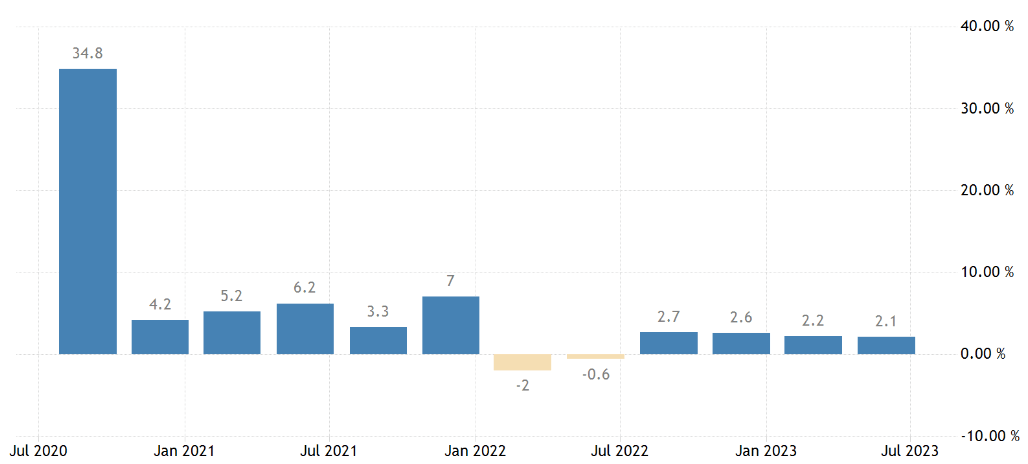

In the second quarter of 2023, the US economy displayed annualized growth of 2.1%, which remained consistent with the earlier estimate. This performance was compared to the revised upward growth of 2.2% observed in the first quarter. Notably, consumer spending showed a less substantial increase than initially anticipated, with a growth of 0.8% compared to the previous estimate of 1.7%. However, there were positive revisions in other areas, including non-residential fixed investment (7.4% vs 6.1%), exports (-9.3% vs -10.6%), and residential investment (-2.2% vs -3.6%). Government spending increased by 3.3%, aligning with the previous estimate.

Furthermore, the Bureau of Economic Analysis conducted annual revisions aimed at eliminating fluctuations stemming from factors such as seasonal weather patterns and holidays. Regarding the overall economic performance for 2022, growth was adjusted downward by 0.2 percentage points to 1.9%. This revision was driven by reductions in consumer spending, inventory investment, state and local government spending, and exports, along with an increase in imports. Looking ahead to 2023, the Federal Reserve anticipates the economy to grow by 2.1%. Meanwhile, there are some surprising forecasts available for the US third-quarter economic growth, including a 4.7% growth by the Trading Economics Forecast and a 5.8% growth forecasted by the Atlanta Fed economists.

Source: Tradingeconomics.com

A higher-than-expected reading may have a bullish effect on the USD, while a lower-than-expected reading could be bearish for the USD.

Impact: USD

Stocks to watch

Microsoft (MSFT) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 2.65. Positive earnings surprise in 9 out of the last 10 reports. Time: Tuesday, October 24, after the market closes.

Alphabet C (GOOG) & Alphabet A (GOOGL) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 1.44. Positive earnings surprise in 6 out of the last 10 reports. Time: Tuesday, October 24.

Visa A (V) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 2.25. Positive earnings surprise in 10 out of the last 10 reports. Time: Tuesday, October 24, after the market closes.

Coca-Cola (KO) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 0.6948. Positive earnings surprise in 9 out of the last 10 reports. Time: Tuesday, October 24, before the market opens.

General Electric (GE) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 0.5594. Positive earnings surprise in 9 out of the last 10 reports. Time: Tuesday, October 24, before the market opens.

Meta Platforms (META) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 3.59. Positive earnings surprise in 5 out of the last 10 reports. Time: Wednesday, October 25, after the market closes.

IBM (IBM) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 2.14. Positive earnings surprise in 9 out of the last 10 reports. Time: Wednesday, October 25, after the market closes.

Amazon.com (AMZN) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 0.5757. Positive earnings surprise in 6 out of the last 10 reports. Time: Thursday, October 26, after the market closes.

Intel (INTC) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 0.2151. Positive earnings surprise in 8 out of the last 10 reports. Time: Thursday, October 26, after the market closes.

Exxon Mobil (XOM) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 2.35. Positive earnings surprise in 8 out of the last 10 reports. Time: Friday, October 27, before the market opens.

Chevron (CVX) announcing its earnings results for the quarter ending on 09/2023. Forecast EPS: 3.42. Positive earnings surprise in 7 out of the last 10 reports. Time: Friday, October 27.

Santa Zvaigzne-Sproge, CFA, Head of Investment Advice Department at Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis, and opinions contained, referenced, or provided herein are intended solely for informational and educational purposes. The personal opinion of the author does not represent and should not be constructed as a statement, or investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.95% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.