Another short week is upon us, with Labour Day being celebrated in many parts of the world. Nevertheless, it will be full of important and potentially market-moving events, such as interest rate decisions in the US and the EU, and PMI reports from all the major economies.

Monday 01.05. 14:00 GMT, U.S. ISM Manufacturing Purchasing Managers Index PMI (April)

The Institute of Supply Management's (ISM) Manufacturing Purchasing Managers Index (PMI) Report on Business is based on data collected from the monthly responses of purchasing and procurement managers at more than 400 industrial companies.

The PMI is a composite index that takes into account five indicators with different weights, including new orders, production, employment, supplier deliveries and inventories. Each indicator is weighted differently, and the overall index is seasonally adjusted. The PMI is a composite index based on seasonally adjusted diffusion indices for five of the indicators with different weights: New orders (30%), production (25%), employment (20%), supplier deliveries (15%) and inventories (10%).

Currently, the forecast for this index is 46.6. The previous forecast was 47.5, while the result was 46.3. Over the past five years, the highest level of this index was reached in April 2021 (presenting the results for March); it was then 64.7. Since then, we have had a slight downward trend, which continues to this day.

Source: Tradingeconomics.com

If the reading is higher than expected, it may be considered favourable for the US dollar. On the other hand, if the reading is lower than expected, it may be considered unfavourable for the US dollar.

Impact: USD

Tuesday 02.05. 07:55 GMT, Germany Manufacturing Purchasing Managers Index PMI (April)

Like its US counterpart, the PMI index for German purchasing managers reflects the extent to which these managers are involved in the manufacturing sector. A reading above 50 indicates growth in the sector, while a reading below 50 indicates contraction. These surveys are of great interest to investors because purchasing managers usually get early access to information about their company's performance, which may be a key indicator of the state of the economic activity.

The previous result was 44.0, which was below the forecast of 45.7. As in the case of the US, the highest results were in April 2021 for March, at precisely 66.6. In Germany, we have also had a downward trend since then, but a bit more dynamic and with more significant deviations.

Source: Tradingeconomics.com

If the reading is higher than expected, it may have a bullish (positive) effect on the euro's value. On the other hand, if the reading is lower than expected, it may have a bearish (negative) effect on the euro.

Impact: EUR

Tuesday 02.05. 08:00 GMT, Eurozone Manufacturing Purchasing Managers Index PMI (April)

For the eurozone, the data collection and calculation of this index is the same as for Germany. The forecast for the upcoming results is 47.1. The previous forecast was 48.0, while the result turned out to be 45.5. As in the previous examples, here, too, we have a situation where the highest readings in the past five years were in the spring/summer of 2021, and since then, there has been a downward trend.

Source: Tradingeconomics.com

If the reading is higher than expected, it may have a bullish effect on the euro. On the other hand, if the reading is lower than expected, it may have a bearish effect on the euro.

Impact: EUR

Tuesday 02.05. 08:30 GMT, U.K. Manufacturing Purchasing Managers Index PMI (April)

In the UK, the way data is collected and calculated for this index is the same as in the eurozone. The latest result for the UK was 46.6, below the 48.5 expected at the time. Here, the trend over the last five years is similar to that of the economies discussed above. Since the summer of 2022, however, we have seen a stabilisation that even includes upward deviations.

Source: Tradingeconomics.com

A higher-than-expected reading may be taken as positive for the GBP, while a lower-than-expected reading may be taken as negative for the GBP.

Impact: GBP

Tuesday 02.05. 01:45 GMT and Thursday 04.05 01:45 GMT, China Caixin Manufacturing Purchasing Managers Index PMI (April)

The topic is more complicated for China than for Western countries. China's HSBC Manufacturing PMI is a sophisticated index measuring manufacturing sector activity. It shows whether the manufacturing economy is growing or declining. When the PMI value is below 50, it means the manufacturing economy is shrinking; when the value is above 50, it means the manufacturing economy is expanding.

Flash data, or preliminary PMI results, are released around six days before the end of the month. They are then replaced by the final PMI results, which are published as soon as they are available. The PMI is based on a survey of around 430 purchasing managers who assess the level of business conditions in their companies. Respondents assess, among other things, employment, production, new orders, prices, deliveries and inventories.

The forecast for April’s result is 51.7. The preliminary data will come out on April 30th, but more precise data will be released on May 2nd and 4th. The last time final result published in April for March was 50.0, with a forecast of 51.7. In the case of China, the downward trend is not as clear-cut as in the case of Western countries. Here it is more lateral, but it also has large deviations.

Source: Tradingeconomics.com

If the PMI result is higher than expected, it may have a positive effect on the Chinese currency (CNY), while if the result is lower than expected, it may have a negative effect on the CNY.

Impact: CNY

Tuesday 02.05. 09:00 GMT, Eurozone Consumer Price Index (CPI) YoY (April)

A CPI is a tool used to measure changes in the prices of the goods and services we spend money on as consumers. It allows us to track how our buying habits are changing and how inflation is rising. In this way, the CPI helps to better understand how the economic situation is developing.

The previous reading was in line with the forecast at 6.9%. A strong upward trend began in early 2021 and peaked in November 2022, after which there has been a strong downward trend.

Source: Ycharts.com

On the one hand, if the reading is higher than expected, it means that inflation is higher, which favours a fall in the value of the euro. Still, it is also a stimulus for the European central bank to raise interest rates and reduce the money supply, and from this side, it may cause an increase in the value of the euro. On the other hand, if the reading is lower than expected, it means lower inflation, but it may give the European Central Bank an argument to stop its policy of raising interest rates.

Impact: EUR

Wednesday 03.05. 18.00 GMT, Fed Interest Rate Decision

At FOMC meetings, members vote on whether to raise, lower or leave interest rates unchanged. These decisions affect the level of interest rates, which in turn affects the value of the currency. Investors closely follow the FOMC's decisions and changes in the level of interest rates, as this information can be crucial to their trading strategies. The value of a currency tends to rise when interest rates are high, as they attract investors seeking higher returns on their deposits. Conversely, when interest rates are low, the value of the currency tends to fall as investors look for other places to put their money. As a result, FOMC decisions and interest rate levels have important implications for global financial markets and national economies.

The previous time interest rates were forecast to be set at 5%, and this scenario came true. For the past year, interest rates in the US have been raised vigorously, although the trend has slowed recently. The current forecast for the May 3 meeting is that the interest rates may be raised by another 25 basis points to reach the 5.25% level.

Source: Tradingeconomics.com

A higher-than-expected rate may be positive for the USD, while a lower-than-expected rate may be negative for the USD.

Impact: USD

Thursday 04.05. 12:15 GMT, Eurozone Interest Rate Decision

The European Central Bank (ECB) has a board of six members who make decisions on interest rate levels with the 16 eurozone central bank governors. These decisions may be crucial for investors who follow interest rate changes because they may affect currency valuations, especially in the short term.

The current forecast is that interest rates in the eurozone would rise to 3.75%. The previous forecast was for an increase to 3.5%, and that scenario came true. The phenomenon of keeping rates at 0% in the eurozone continued for a good few years. It ended in July 2022 when the process of raising interest rates sharply began to handle the rising inflation.

Source: Tradingeconomics.com

If the reading is higher than expected, it may have a positive effect on the euro. On the other hand, if the reading is lower than expected, it may have a negative effect on the euro.

Impact: EUR

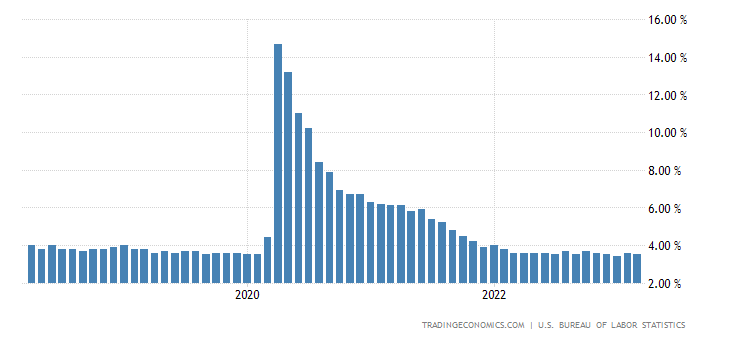

Friday 05.05. 12:30 GMT, U.S. Unemployment Rate (April)

The unemployment rate is a measure of the percentage of people who are unemployed while actively seeking employment during the previous month in relation to the total number of people of working age, i.e., potentially able to work. This means that the unemployment rate measures the level of unemployment in the working population. One of the main reasons why the unemployment rate is considered an important indicator is that it affects the country's economic activity. A high unemployment rate means that many people are unemployed and unable to earn money, which can lead to poverty and pressure on the government budget, as the government must provide support for the unemployed. On the other hand, a low unemployment rate means that most people are working and earning money, which can lead to economic growth and increased production. However, the unemployment rate is not a perfect measure of the labour market situation. It does not consider people who are not actively looking for work, such as students, people who are unable to work, or so-called "professional unemployed" who have given up looking for a job. In addition, the unemployment rate does not consider the quality of work, such as wages, working hours and other conditions of employment. It is therefore important to analyse the unemployment rate in the context of other labour market indicators, such as wages, working hours, education and training levels, etc.

The forecast for the upcoming reading is 3.6%. The forecast was also 3.6% last time, while the reading turned out to be slightly lower at 3.5%. The unemployment rate has been stable for over a year, hovering between 3.5% and 3.8%.

Source: Tradingeconomics.com

If the reading is higher than expected, it may be considered negative for the US dollar, and if the reading is lower than expected, it may be considered positive for the US dollar.

Impact: USD

Stocks to watch

Pfizer (PFE) announcing its earnings results for the quarter ending on 03/2023. Forecast: 0.9733. Positive earnings surprise in 9 out of the last 10 reports. Time: Tuesday, May 2, before the market opens.

Ford Motor (F) announcing its earnings results for the quarter ending on 03/2023. Forecast: 0.4021. Positive earnings surprise in 8 out of the last 10 reports. Time: Tuesday, May 2, after the market closes.

Apple (AAPL) announcing its earnings results for the quarter ending on 03/2023. Forecast: 1.43. Positive earnings surprise in 8 out of the last 10 reports. Time: Thursday, May 4, after the market closes.

Warner Bros Discovery (WBD) announcing its earnings results for the quarter ending on 03/2023. Forecast: -0.1194. Positive earnings surprise in 5 out of the last 10 reports. Time: Friday, May 5, before the market opens.

Santa Zvaigzne-Sproge, CFA, Head of Investment Advice Department at Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis, and opinions contained, referenced, or provided herein are intended solely for informational and educational purposes. The personal opinion of the author does not represent and should not be constructed as a statement, or investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73,18% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.