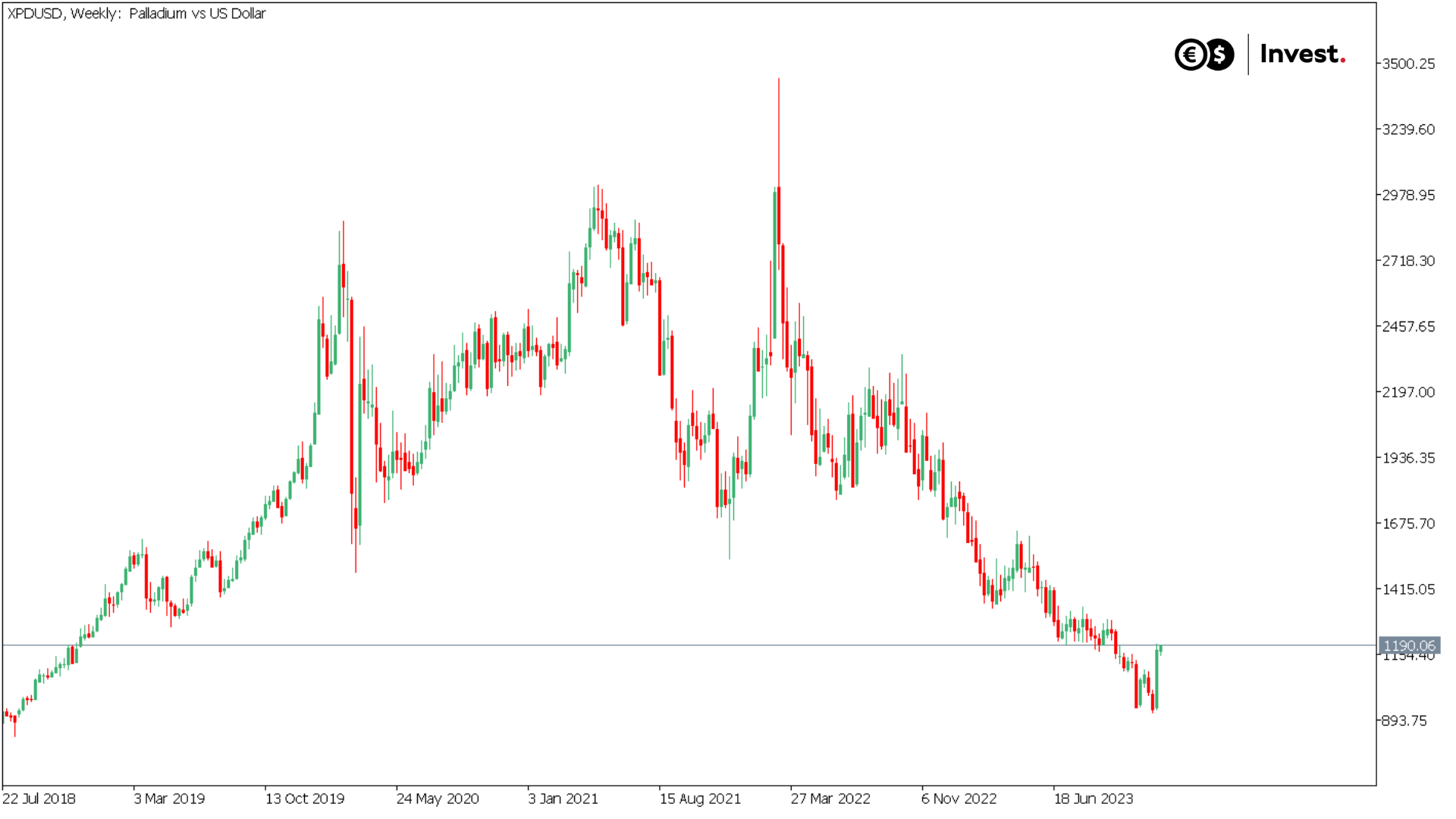

Last week, palladium was the undisputed leader among the major commodities, gaining 23% after previously falling 65% from its peaks. We are currently seeing a rebound from areas previously seen in late 2018. Let's consider whether this is already the beginning of a reversal in the price trend of this commodity or just a temporary correction?

Table of contents:

Why has the price of palladium risen?

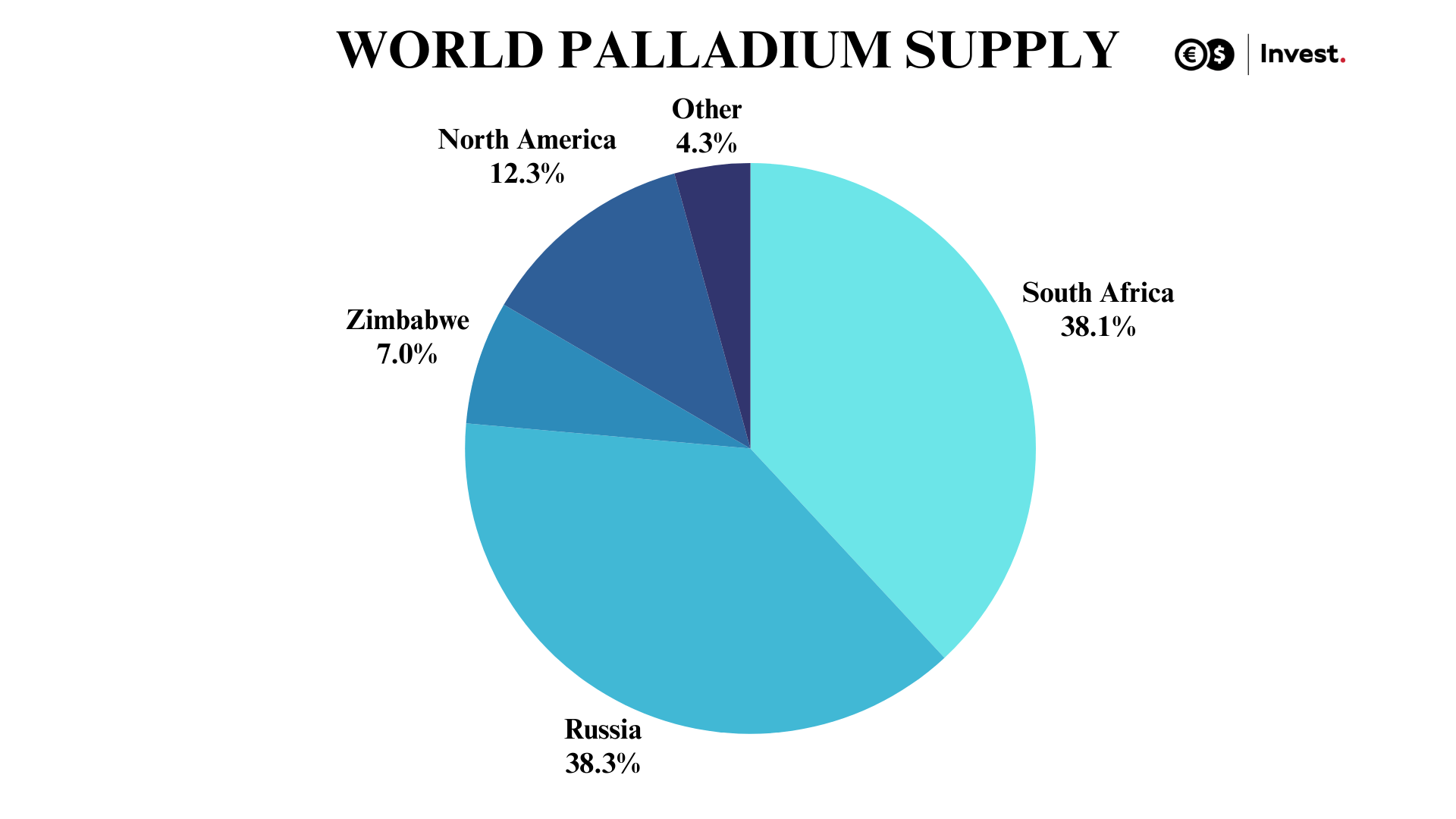

Following the UK's announcement of new sanctions targeting Russia, UK citizens and companies were banned from 15 December from trading in a wide range of Russian metals, including copper, nickel, aluminium, lead and zinc. However, the sanctions did not extend to palladium, although this was expected. This is particularly important news as Russia accounted for as much as 38.3% of global palladium production in 2023, according to SFA Oxford.

Source: Conotoxia MT5, XPDUSD, Weekly

To understand how the price of palladium might evolve in the future, let us first look at what the current situation in this market is. The second largest miner of this raw material, practically on a par with Russia, is South Africa, which accounts for 38%, followed by the entire region of North American countries in third place (12.3% of global output). A significant proportion, as much as 41.8% of the volume of world palladium extraction, is recycled, which can have a significant negative impact on the price in the long term.

Source: Conotoxia, SFA Oxford data

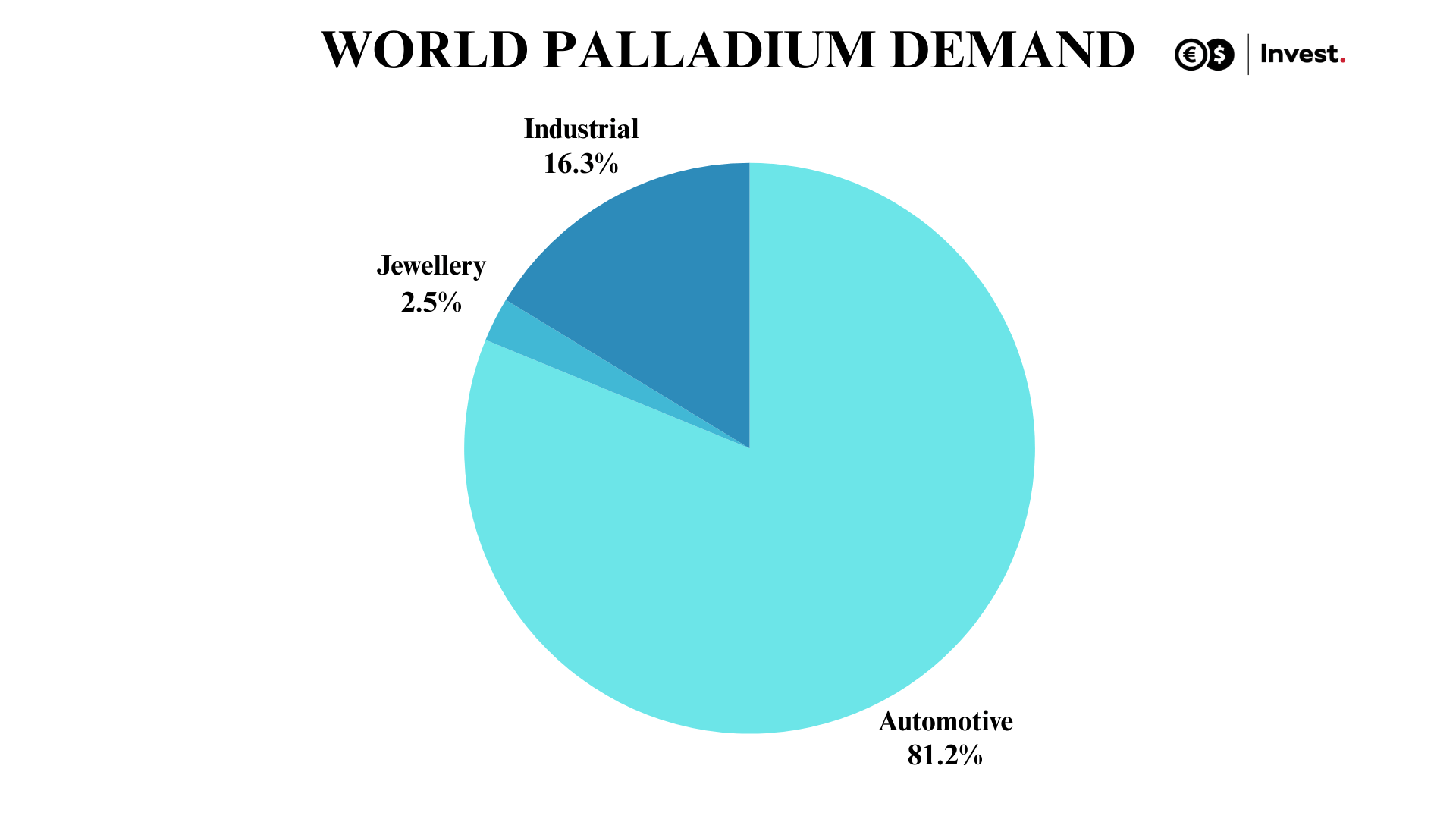

As much as 81.2% of global demand for palladium comes from the automotive industry, where it is used primarily in the manufacture of catalytic converters. Another important application area is the electronics industry, where palladium is an important component of capacitors, relays, electrical contacts and other electronic components, generating 16.3% of global demand. The jewellery industry, although accounting for only 2.5% of palladium demand, also plays a key role.

Source: Conotoxia, SFA Oxford data

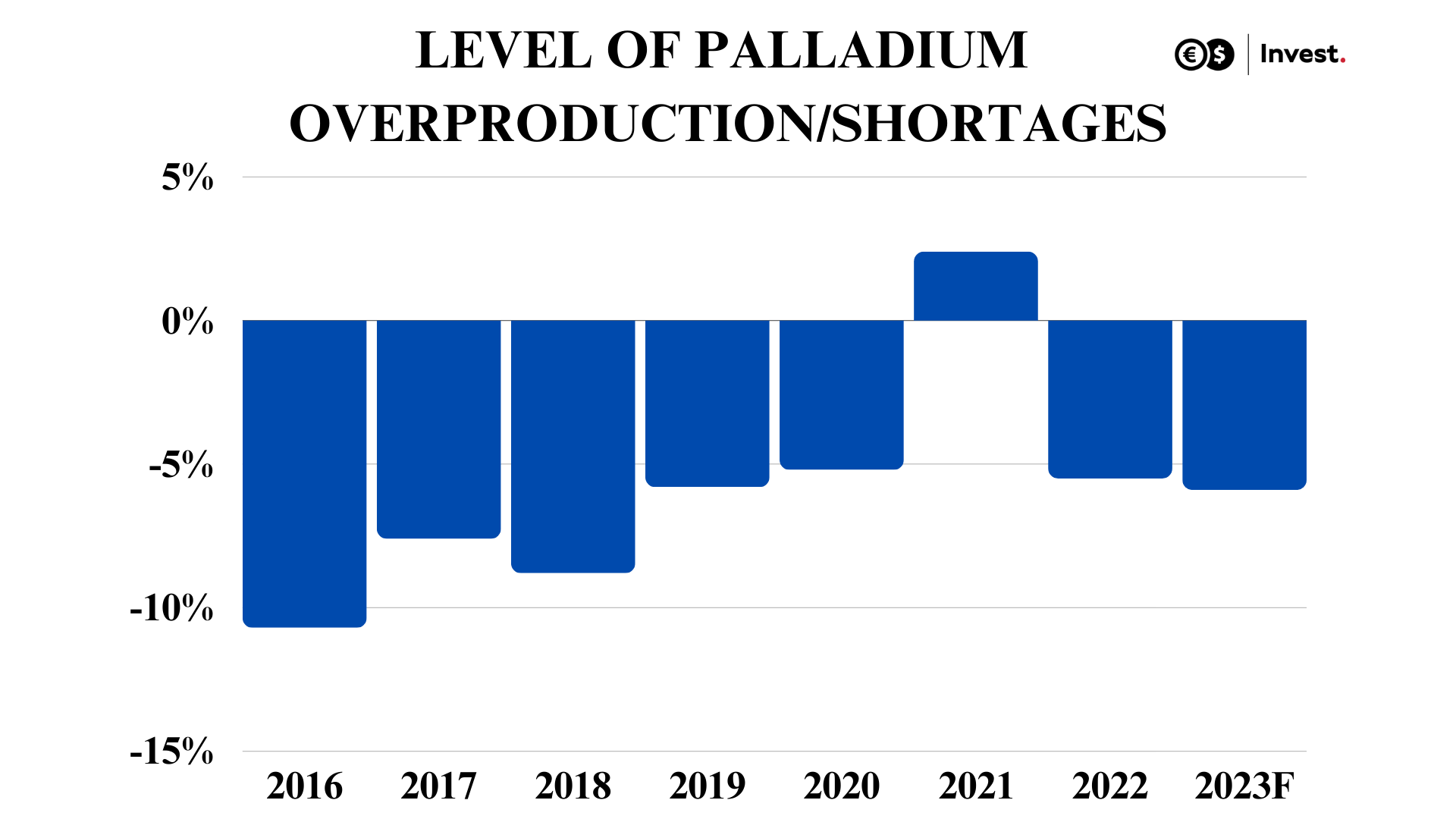

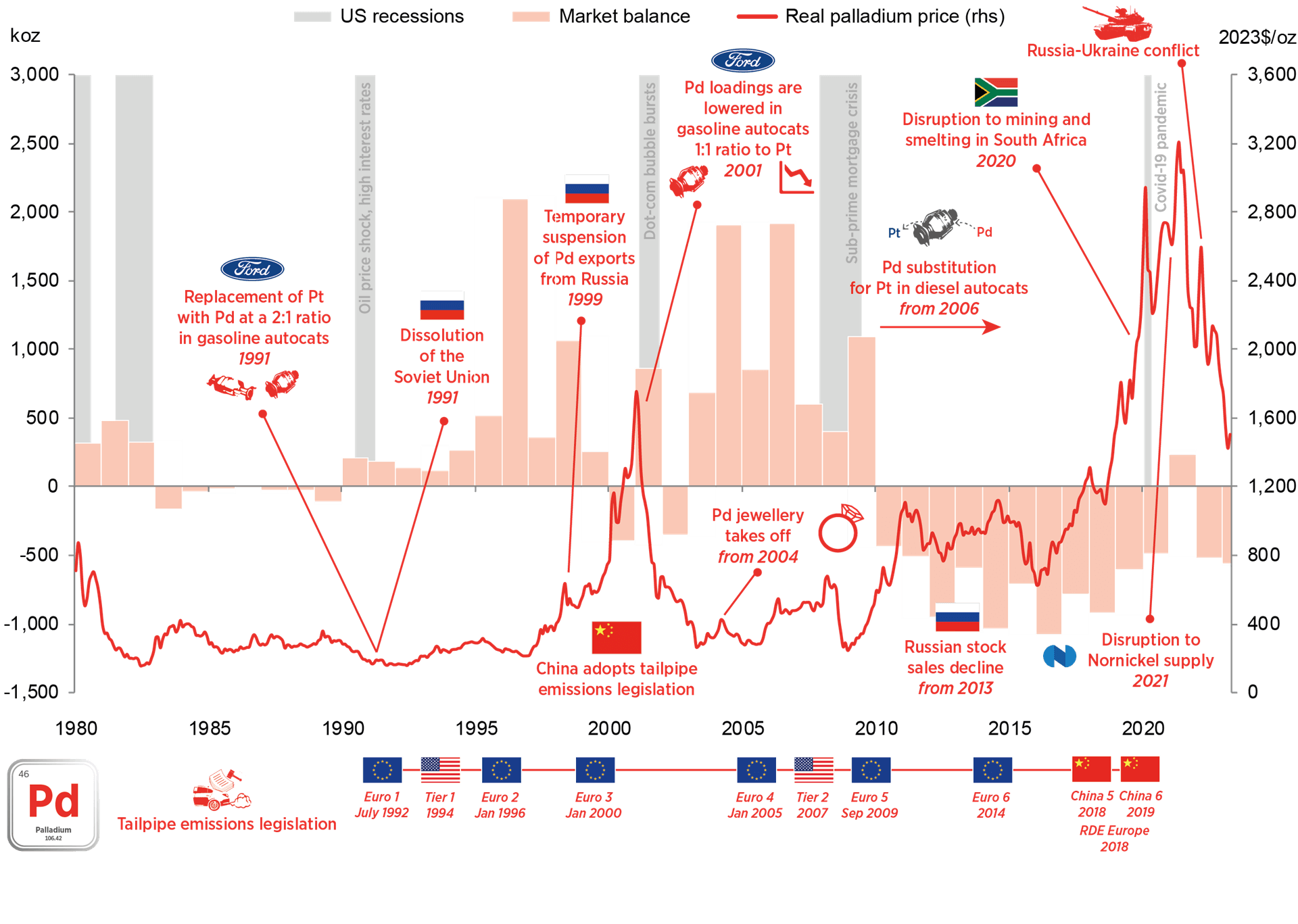

The price of palladium appears strongly dependent on the situation in the global automotive industry. An 11% decline in its revenues from 2019 onwards has translated into a reduction in global demand of 8.8% over this period. Despite this, there has been an almost constant shortage in this market since 2016. Forecasts point to a level of 5.9% of global demand in 2023. This means that manufacturers in the current environment are forced to use stockpiles, relying mainly on the recycling of used parts.

Source: Conotoxia, SFA Oxford data

Palladium forecast for 2024

Despite a significant slowdown in automotive sales in Europe, we are experiencing long-term shortages of this raw material. These are partly mitigated by recycling, with the scale of this increasing by 20% since 2016. Previously, between 2010 and 2020, this kind of situation triggered a sharp increase in the price, reaching levels of over US$3 000 per ounce. It seems, therefore, that in 2024, we can expect mainly an increase in the stability of this market and possibly a sustained price above USD 1 000 per ounce.

Source: SFA Oxford

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.95% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.