As the stock market saying goes, "the trend is your friend". It indicates that market trends tend to persist according to the so-called momentum strategy. Therefore, let us take a look at the three strongest trends of the past week in the financial markets. We will try to understand the reasons behind these stock market movements in order to explore the possibility of their continuation.

Table of contents:

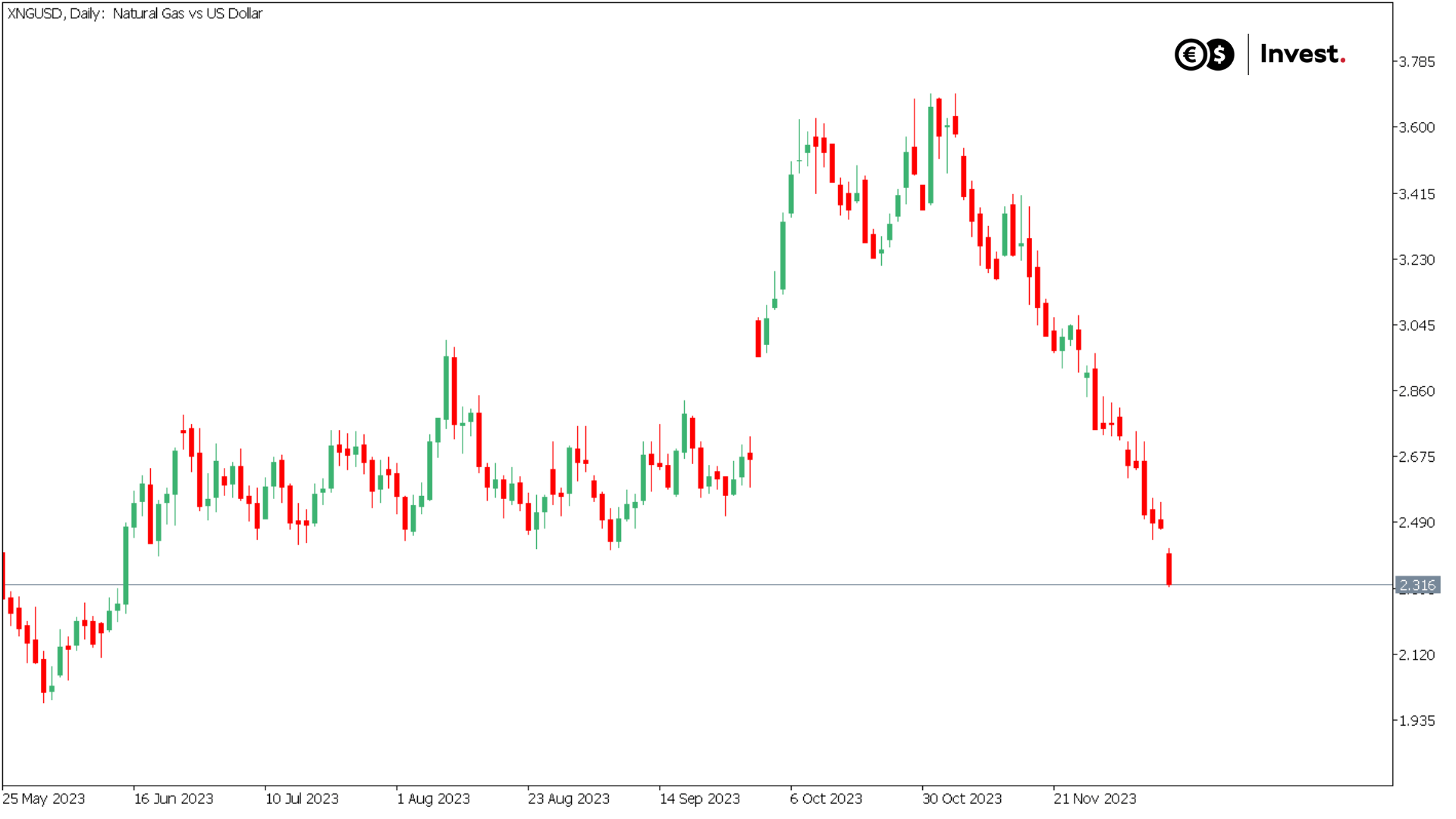

Natural Gas (XNGUSD)

For another week in a row, the price of natural gas on the markets continued its drastic decline, having already reached a reduction of 46.5% since the beginning of the year. In October, the significant level of stored gas in Western European storage facilities was as high as 95.99% of available capacity. According to S&P Global Commodity Insights, we are seeing a balance between demand and supply at the end of 2023. Such a situation significantly hinders possible increases in the price of gas, which recorded an 11.6% decline last week.

Source: Conotoxia MT5, XNGUSD, Daily

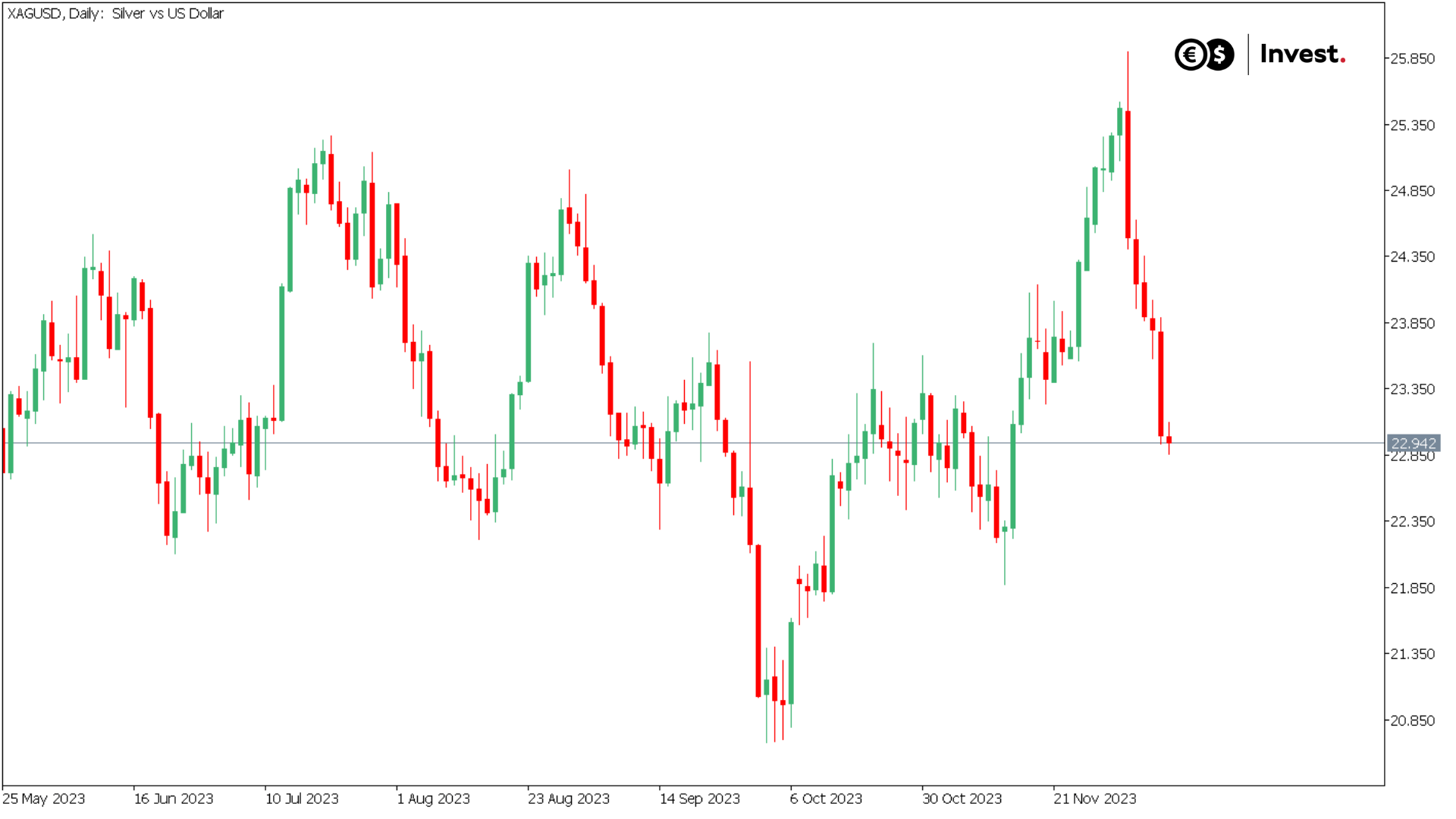

Silver (XAGUSD)

Gold's drastic price declines last Monday exceeded a US$100 move in a single session, which has only happened 12 times in history. It also resulted in a decline in silver prices. This is due to the strong interdependence of the two precious metals' prices, with a long-term correlation between the two as high as 0.8. Declining levels of uncertainty and rising expectations of falling inflation have not helped to improve the prices of the two bullions.

Source: Conotoxia MT5, XAGUSD, Daily

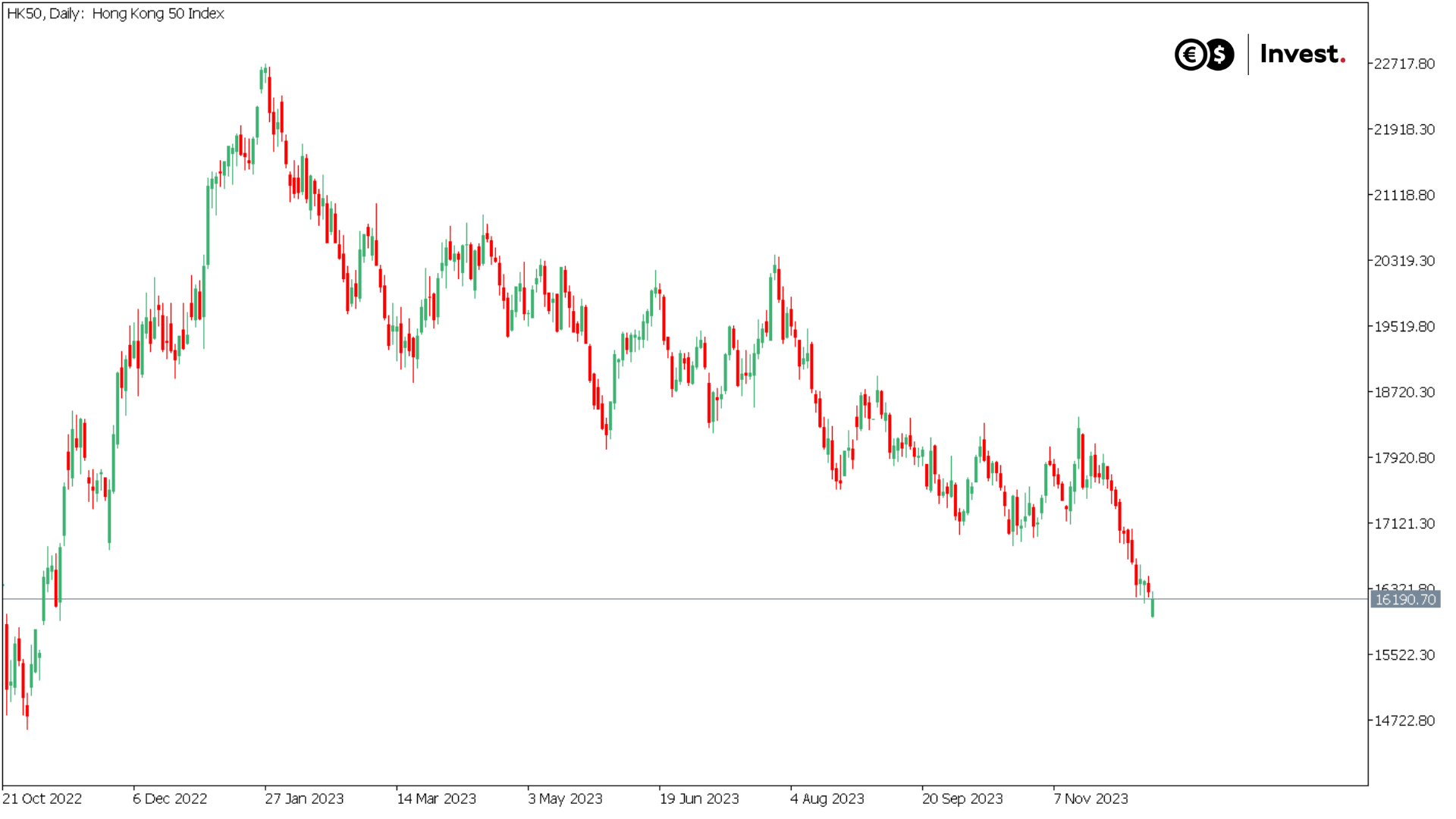

Hang Seng (HK50)

Among developed markets, the biggest fall was recorded on the Hong Kong stock exchange, where the main Hang Seng index fell by 2.5% over the past week. Once one of the most attractive stock exchanges in the world for investors, it is now at one-year lows. This state of affairs may be the result of another negative CPI price index reading, which showed deflation of -0.5% year-on-year. Such data suggests that the Chinese economy is already in recession, as manifested by a decline in export growth, reaching just 0.5% year-on-year.

Source: Conotoxia MT5, HK50, Daily

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.95% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.