After the so-called Nixon shock in October 1971, when we left the gold parity system in favour of a free exchange rate, it is worth noting that the gold exchange rate has since risen by 4461%. Let us consider what factors influence the long-term gold exchange rate. Does an investment in this bullion actually generate additional value or merely maintain it over time?

Table of contents:

- How does money printing affect the price of gold?

- Does gold only protect against inflation?

- Gold price forecasts for 2024

How does money printing affect the price of gold?

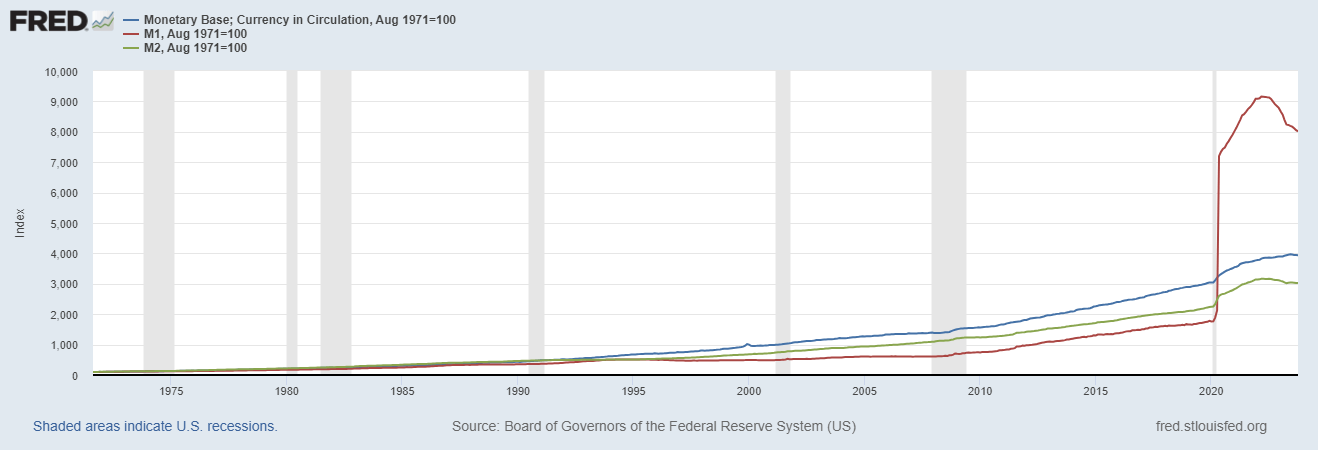

The amount of money in the economy is measured in various ways. The most basic and intuitive measure is the amount of cash in circulation. However, it does not include entries in bank accounts. When this element is taken into account, the so-called monetary aggregate M1 is formed. However, funds deposited in bank deposits and short-term investments can also be considered as 'dormant money'. As a result, when these values are taken into account, we obtain the M2 aggregate. A huge amount of money has been printed since 1971. The amount of dollars in circulation has increased by 3840%, the M1 aggregate by 7914% and M2 by 2923%.

Source: Fred

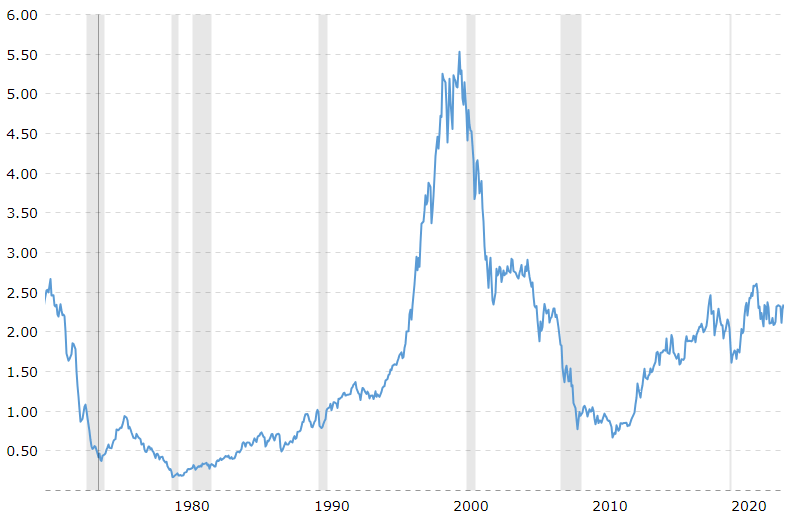

While the long-term trend in the quantity of money correlates with the price of gold, an analysis of the relationship of the change in the price of bullion to the value of these measures using the correlation coefficient shows values between 0.03 and 0.05. This means that in the short term, the change in the value of gold is not significantly related to the amount of money added. This may be due to the simple assumption that the quantity of money increases as economies grow. According to the classical school of economics, it is assumed that the addition should be proportional to the amount of goods produced in the economy. Hence, not all new money will be available to purchase gold.

Does gold only protect against inflation?

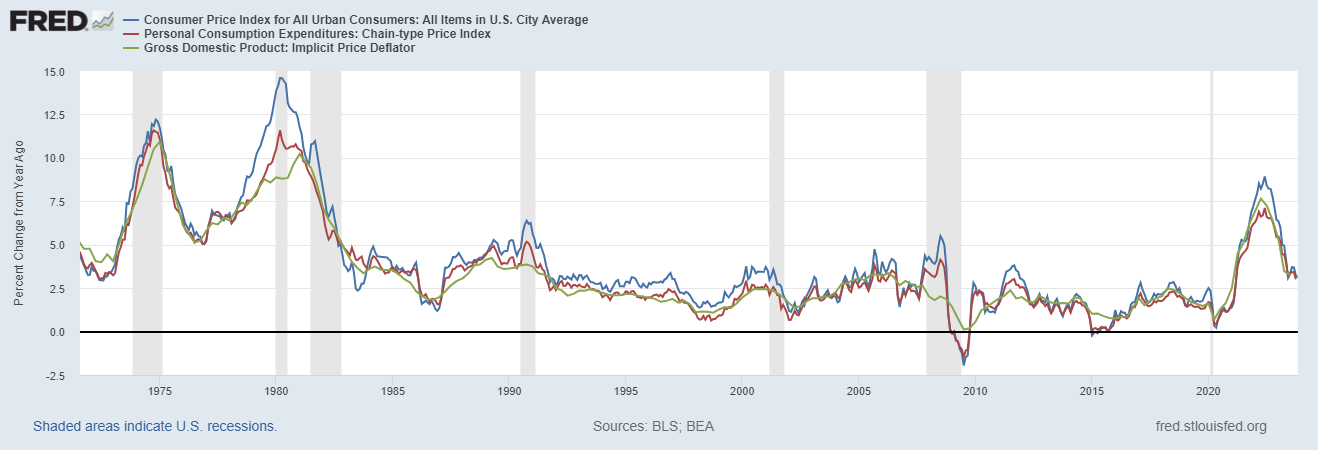

A better measure than the amount of addition, which takes into account relative values, is the overall increase in prices, i.e. inflation. The two most popular measures of inflation are the CPI and the PCE, which differ in the composition of the basket of consumer goods. Since 1971, cumulative CPI inflation in the United States has been 655% and PCE inflation 485%. If we wanted to measure inflation as the aggregate increase in all prices in the economy, a less popular indicator, the so-called GDP deflator, is used for this purpose, which increased by 475% over this period. This means that gold during this period not only effectively protected our wealth from the declining purchasing power of our currency, but also generated a gain of between 504 and 693% in real terms over inflation. What may seem interesting is that the main US S&P 500 index (excluding dividends) performed very similarly during this period.

Source: Macrotrends, S&P 500 to gold ratio

It turns out that short-term changes in inflation describe changes in the gold price somewhat better relative to the level of addition. Nevertheless, the correlation measured ranges from 0.16 to 0.19, which further would rather imply a practical lack of dependence of the gold price on the level of inflation.

Source: Fred

Gold price forecasts for 2024

From the analysis presented, we can conclude that the price of gold is actually influenced by a simple supply and demand relationship. While gold extraction over time is tightly constrained at 1 to 2% per year, gold demand is highly volatile.

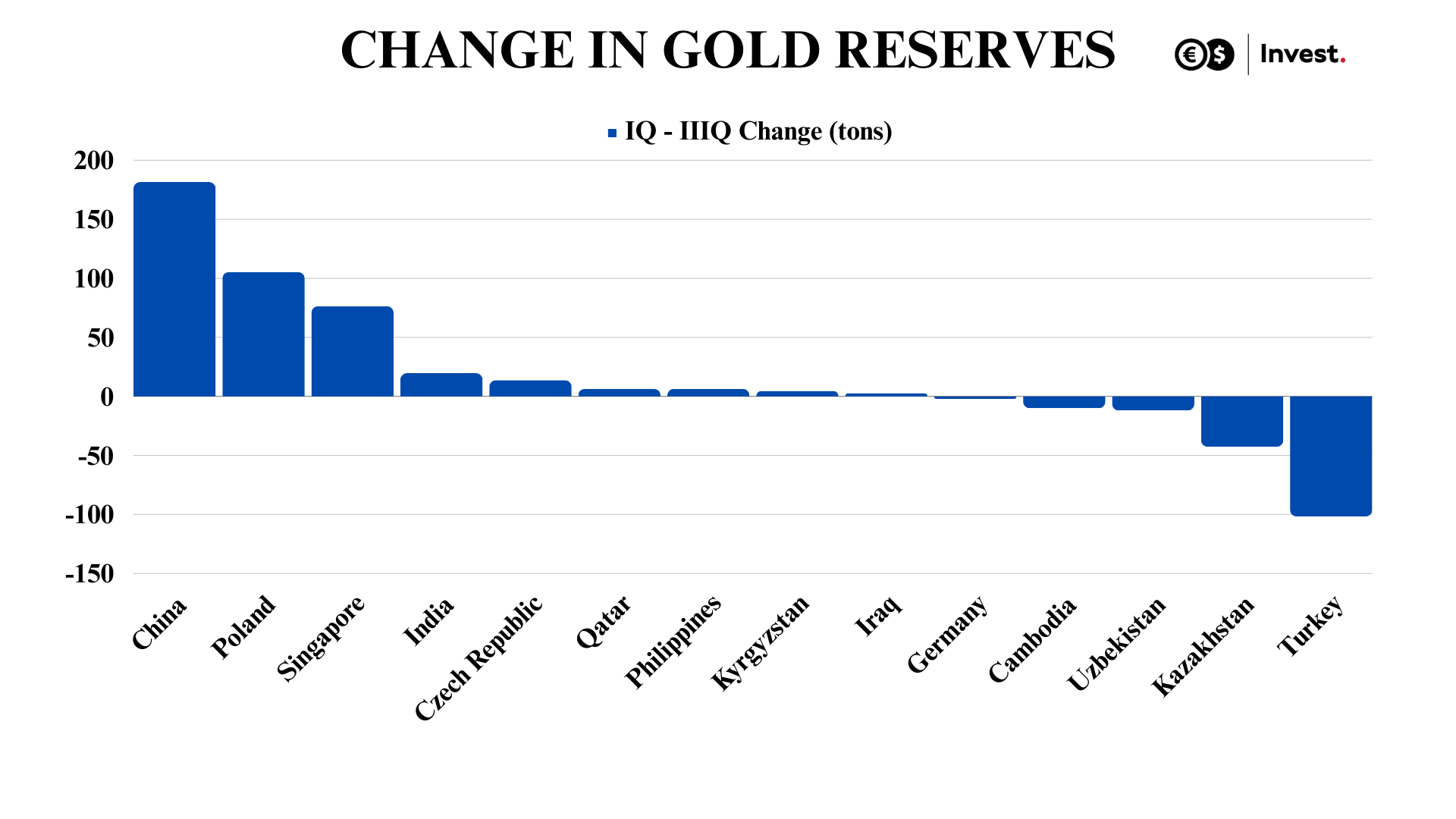

In the three quarters of this year, gold demand fell by 7.5% year-on-year, the price of gold bullion rose by an impressive 12%, surpassing the US$2,000 level. Among the largest buyers of gold are China, Poland and Singapore. China's reserves increased by 12.5% (purchasing 181 tonnes), Poland's by more than 44% (105 tonnes) and Singapore's by 50% (76 tonnes). In the three quarters, as many as 24.8% of central banks increased the share of bullion in their reserves, while only 16.2% reduced.

Source: WGC data

Demand for gold from central banks may continue. This is evidenced, among other things, by the announcement of the President of the National Bank of Poland, Adam Glapinski: "We will continue to buy gold. We dream of reaching a 20% share of gold in our reserves'. Currently, the share of gold in NBP reserves is 11.2%.

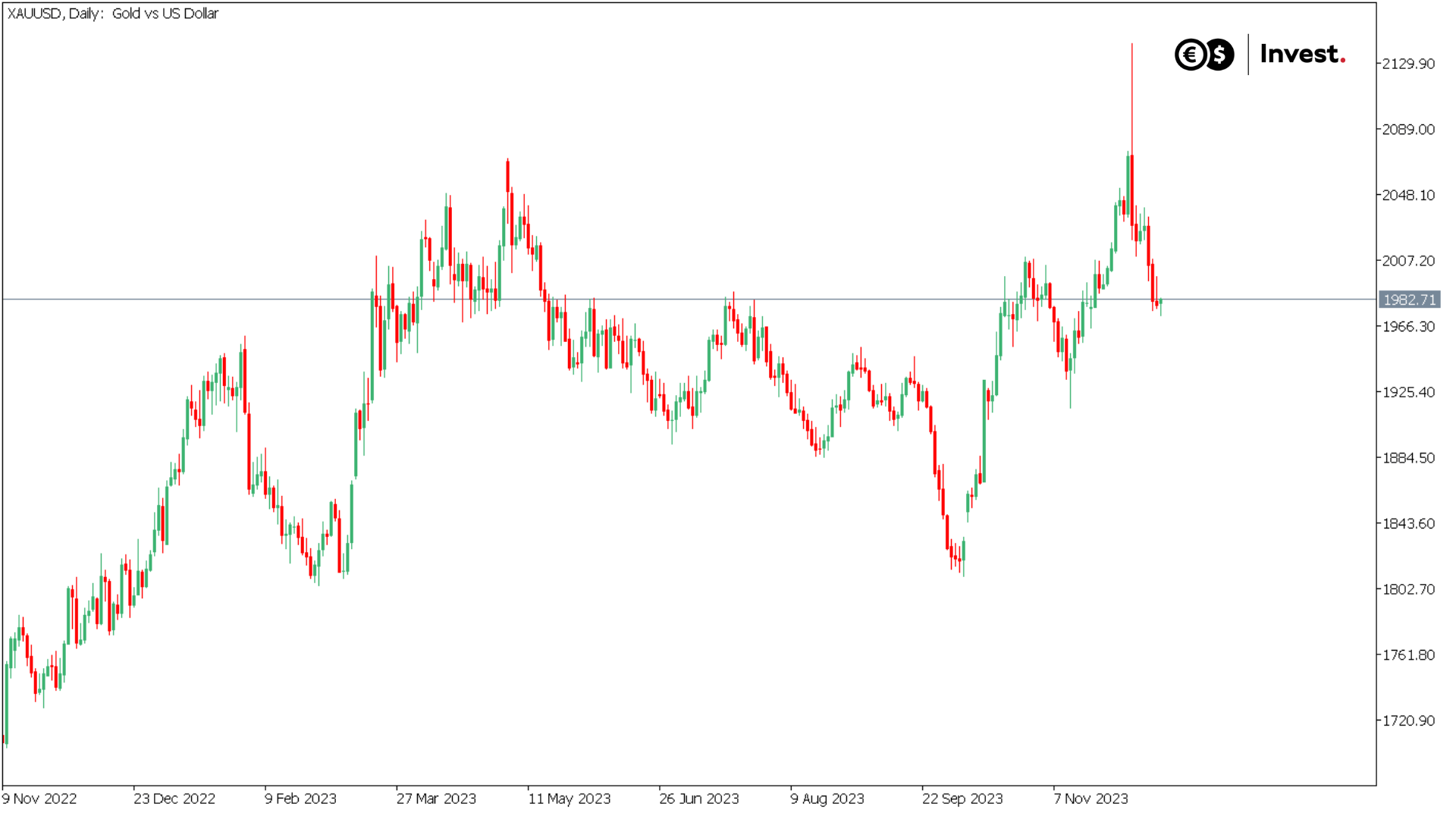

The situation seems to be heading towards a repeat of the mercantilist era, when countries competed to have as much of the precious metal in their treasuries as possible. Why? Among other things, it is to increase the credibility of the state in the eyes of investors, to increase the security of the financial system or to diversify reserves. In the current times, characterised by growing geopolitical unrest related to, among other things, the war in Ukraine and the conflict in Israel and Gaza, gold often becomes a safe haven for investors' capital, which may sustain demand in 2024, and a permanent breakthrough of the USD 2 000 per ounce level seems again only a matter of time.

Source: Conotoxia MT5, XAUUSD, Daily

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.95% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.