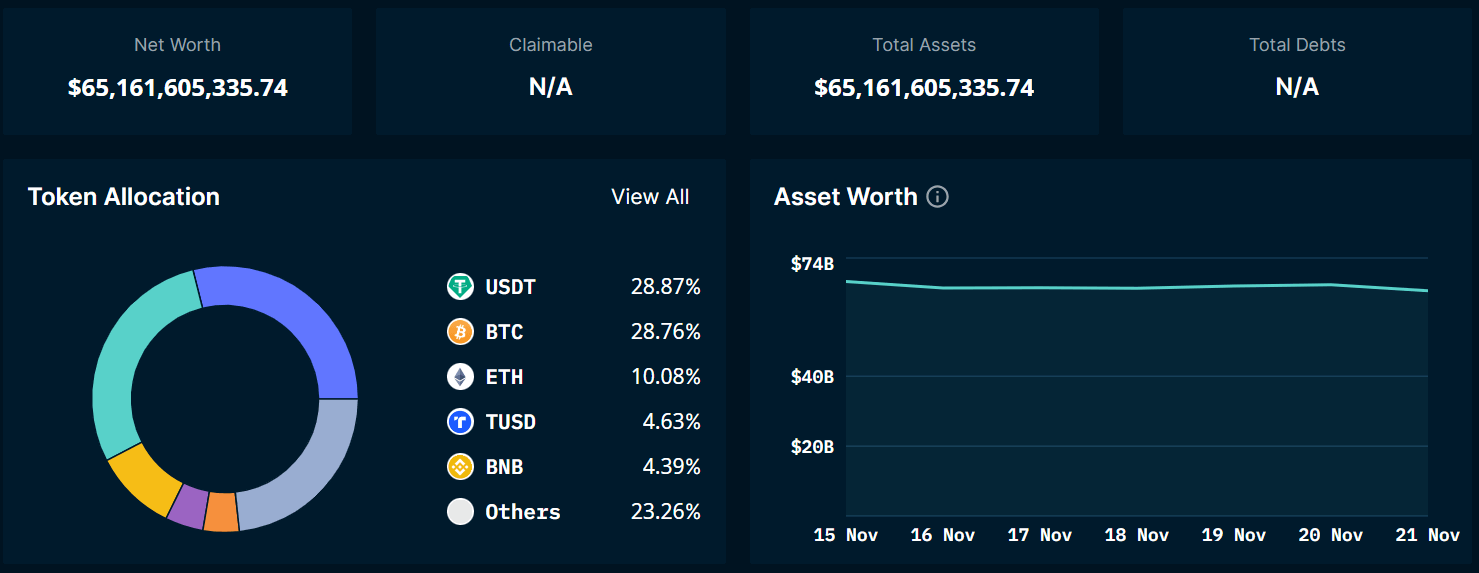

Yesterday (21.11), Changpeng Zhao, CEO of Binance, resigned from his position and accepted his guilt in a case of negligent failure to protect against money laundering in the United States. This came after federal prosecutors filed charges against the world's largest cryptocurrency exchange. The company also pleaded guilty to criminal issues relating to money laundering and violating international financial sanctions. It agreed to pay more than $4.3 billion in penalties, US officials announced on Tuesday. The consequence, according to Nansen, was an outflow of more than US$1bn of its US$65bn in funds. Let's take a look at what consequences this has had on the cryptocurrency market, and how will it affect its future?

Table of contents:

- What is the agreement about?

- How has the situation affected BTC, BNB and the cryptocurrency market?

- What does the future hold?

What is the agreement about?

According to court documents, Binance's alleged abuses took place from at least August 2017 until October 2022. During this period, the exchange may have failed to report well over 100,000 suspicious transactions related to, among other things, child sexual abuse, massive hacking, drug trafficking and groups such as al-Qaeda and ISIS. As a result of the current agreement, Binance becomes one of the entities to incur one of the largest corporate fines in US history.

The agreement also settled a case brought by the Commodity Futures Trading Commission (CFTC), which accused Binance and Zhao of operating illegally in the United States. According to the CFTC's civil indictment, the majority of the group's reported trading and profits came from "extensive solicitation and access" to US customers, contradicting the exchange's claims. In June, the US Securities and Exchange Commission filed 13 civil charges, accusing Binance of violations including mixing billions of dollars of customers with a separate trading company owned by its CEO and operating an unregistered exchange and clearing agencies. The Securities and Exchange Commission (SEC) was not named in the announced settlements.

As the exchange itself emphasises in the announcement: "We take our responsibility as a custodian very seriously and maintain 1:1 backing for every user asset. This means that users can withdraw 100 percent of their assets from the platform at any time. Of note, in our resolutions with the U.S. agencies they:

- do not allege that Binance misappropriated any user funds, and

- do not allege that Binance engaged in any market manipulation."

However, according to Nansen's data, more than US$1 billion flowed off the exchange in a single day, down 1.5% in total funds.

Source: Nansen

How has the situation affected BTC, BNB and the cryptocurrency market?

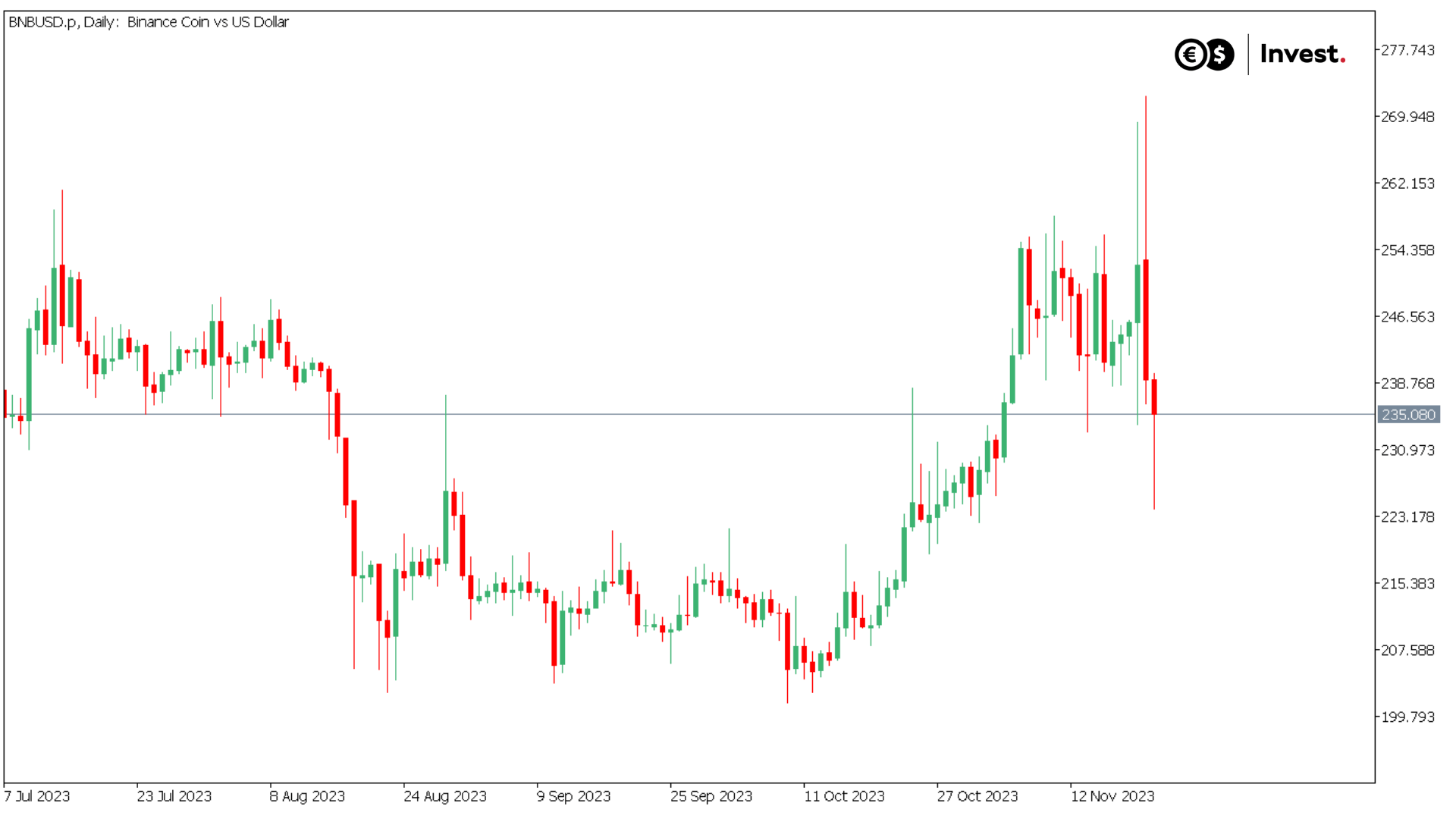

After the momentary shock of the agreement announcement, there is no significant impact on most assets. The cryptocurrency that seems to have suffered the most, losing more than 9%, is the BNB token from Binance. Of the top 100 cryptocurrencies, as many as 98 have seen a noticeable rebound over the past 24 hours.

Source: Contoxia MT5, BNBUSD, Daily

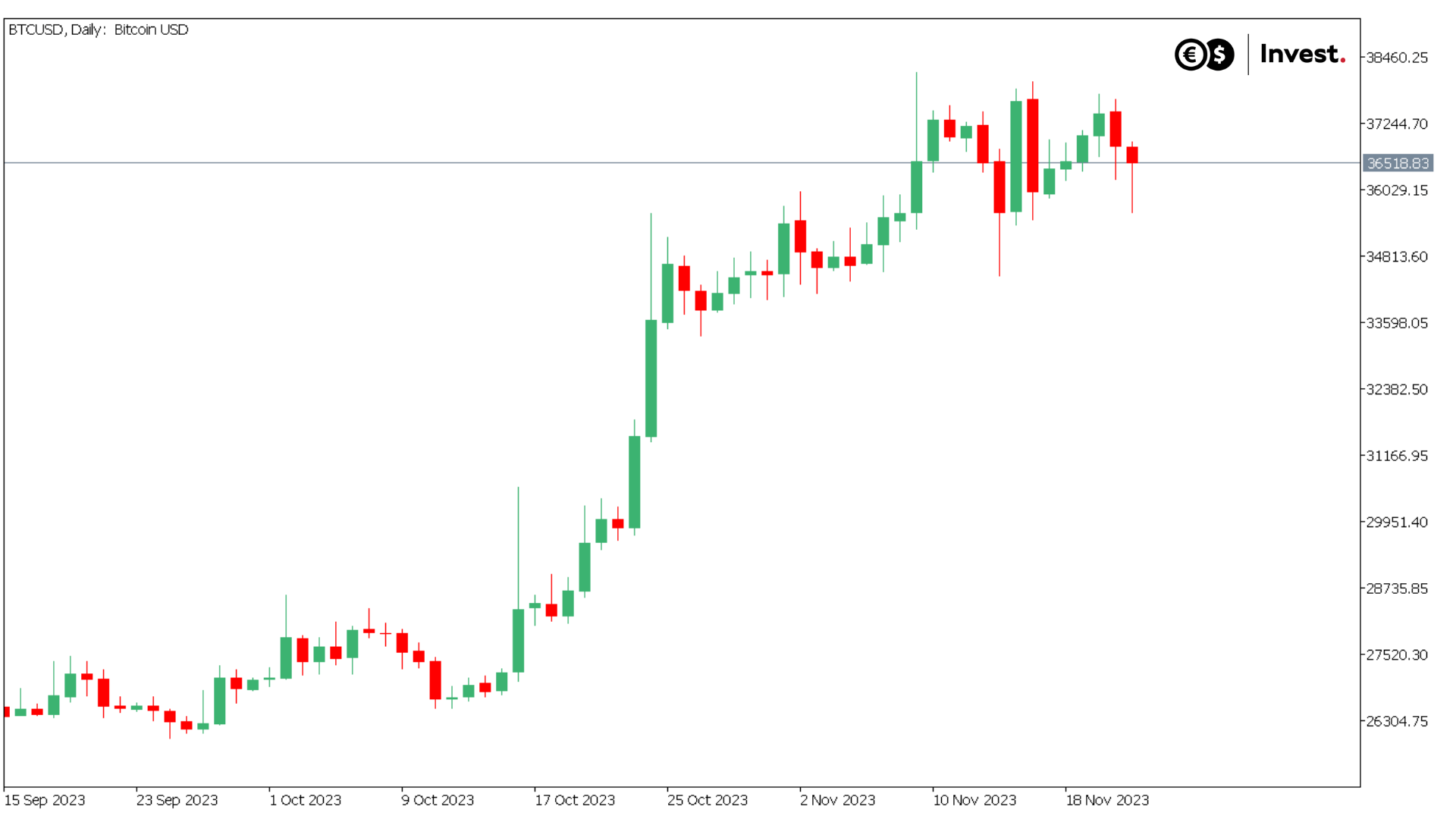

Bitcoin, meanwhile, fell 4% before rebounding and remaining with a loss of 1.3%.

Source: Conotoxia MT5, BTCUSD, Daily

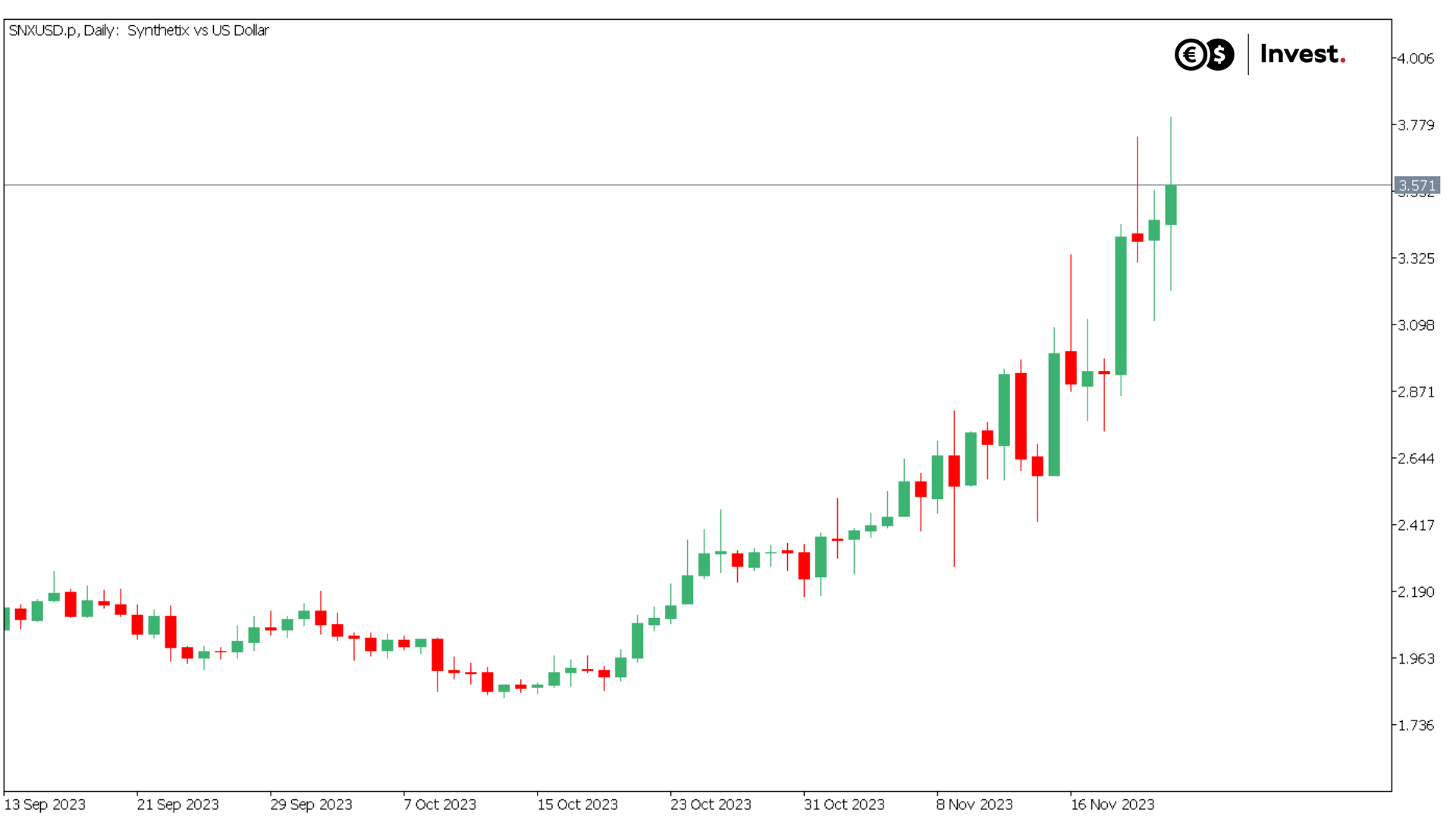

One of the cryptocurrencies that has gained the most since then is syntetix. The price of this asset has risen by 10.9% since the announcement, while maintaining a robust growth rate of 156% since the beginning of the year.

Source: Conotoxia MT5, SNXUSD, Daily

What does the future hold?

It seems that the current perturbations can be seen more as a temporary confusion than a crash in the cryptocurrency world. The months-long disputes with regulators may be largely behind us. This, in turn, may accelerate the adaptation of cryptocurrencies to the economy. The Binance exchange itself has pledged to increase security measures, including the appointment of a new CEO, who previously served as CEO at the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSA) and was director of regulation for the Singapore Exchange (SGX). This, combined with the likely imminent approval of an ETF based on bitcoin quotes, could positively impact the market in the long term. However, investors may still be concerned about the unfinished business with the Securities and Exchange Commission (SEC).

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.95% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.