The theme of artificial intelligence and its dynamic development seems to have dominated investors' actions and decisions since the beginning of this year. Despite Nvidia's spectacular results, it is not the US indices that have been leading the increases since the beginning of the year. So let's take a look at which national stock exchanges are rising fastest and why.

Table of contents:

1st place Japan

By far the fastest-growing domestic stock market is Japan, as can be seen in the iShares MSCI Japan ETF (EWJ), which has gained, as much as 26 per cent since the beginning of the year. The main reason for the rise in domestic equities seems to be the strong weakening of the Japanese yen. The USD/JPY exchange rate has risen from the vicinity of 140 to a level of 156 in this period, which is significantly supporting the exports of domestic companies. Another factor could be the highest inflation in three decades reaching 4.3 per cent at its peak and driving corporate profits up.

Source: Conotoxia MT5, EWJ, Daily

The Bank of Japan's recent monetary intervention to rescue the weakening yen exchange rate has not been successful, and the weakness of the Japanese currency and continued inflation continue to affect the growth of companies in this economy. Japan is making a significant effort to regain its status as a world leader in the production of semiconductors, which are essential to the development of artificial intelligence, by investing $67 billion in its domestic chip industry. The plan includes the creation of a government-backed company focused on advanced semiconductor technologies, aiming to mass-produce advanced 2-nanometre chips by 2027.

2nd place India

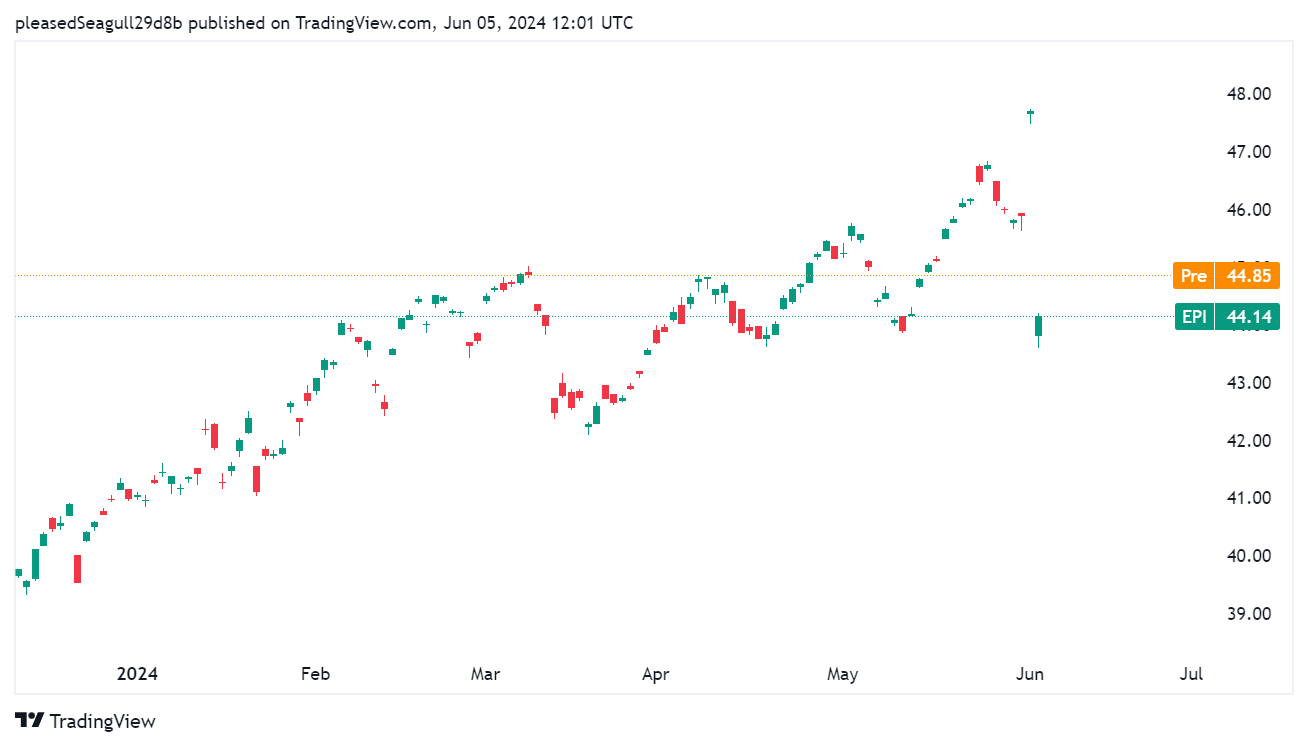

India is the second fastest growing stock market in the world. The WisdomTree India Earnings Fund (EPI) has gained 16 per cent since the beginning of the year, registering a significant increase in volatility over the past few sessions due to the results of the general elections, in which the currently ruling BJP party failed to win an independent majority for the first time since the last three elections. The high growth of this stock market is largely due to the world's fastest GDP growth among major economies at 7.8 per cent. According to the latest International Monetary Fund report, India is the economy of the future, with an average GDP growth of 6.5 per cent.

Another factor contributing to the robust growth in the Indian stock market is the development of the country's financial sector. The notional value of derivatives on Indian stock exchanges reached in March 2024. USD 104.65 trillion, more than double the value a year ago. India is now the largest market in the Asia-Pacific region, already overtaking the US and accounting for 47.4 per cent of the total value of the global derivatives market. This is particularly important for Indian equities, which are largely made up of the booming financial sector.

Source: Tradingview

At present, there are no signs that India is set to slow down its rapid growth, especially as the country still has a lot of catching up to do with other major world economies. However, it should be mentioned that there is a lot of concern in the market due to the upcoming changes in the government, which for the first time in many years will be uneven.

3rd place Italy

The last place on the podium is occupied by the Italian stock market. The iShares MSCI Italy ETF (EWI) has gained 15.7 per cent since the beginning of the year. Despite this, stocks on this market are still severely undervalued, as they have still not reached the levels seen before the 2008 financial crisis. The Italian stock market, which is made up of as much as 37 per cent of financial services, was particularly hard hit by the crisis.

Source: Tradingview

It now appears that most of the problems stemming from the financial crisis have been resolved, and the country's economic recovery is particularly evident, with steadily falling unemployment (6.9 per cent) and low inflation (0.8 per cent). Nevertheless, Italy still faces a number of challenges, such as low levels of economic growth and high levels of public debt, which reached 164 per cent of GDP in 2023.

4th place China

The Chinese stock market has lost as much as 22 per cent of its capitalisation over the past two years. However, since the beginning of this year, the situation seems to be improving, as the China 50 index has rebounded, gaining 15 per cent. Nevertheless, Chinese stocks are still among the cheapest compared to developed countries, as they have a price-to-earnings ratio of 13. By comparison, the same ratio for the US S&P 500 index is currently 27.5, meaning that Chinese stocks are relatively twice as cheap as their US counterparts.

Source: Conotoxia MT5, China50, Daily

China's future depends on the real estate situation. The 2020 ‘three red lines’ policy ended a pattern of high debt for developers, leading to their insolvency. A falling number of newlyweds and a reduction in demand for housing led to a 3.1 per cent year-on-year decline in property prices in April. The property sector remains a key engine of growth, generating 20 per cent of fiscal revenue, 70 per cent of household wealth, 24 per cent of GDP and 25 per cent of bank lending. China needs to intervene quickly and decisively, through, for example, interest rate cuts, increased fiscal spending and restructuring of adverse assets, to avoid a crisis similar to the one we have seen in Japan since 1991.

5th place Taiwan

By far the world's biggest giant in the semiconductor sector and the development of artificial intelligence technology is Taiwan and its company TSMC, which supplies chips to companies such as Nvidia, Apple and AMD. By 2023, Taiwan accounted for as much as 68 per cent of the total semiconductor manufacturing market. The iShares MSCI Taiwan ETF (EWT) has gained 13 per cent since the beginning of the year, mainly due to TSMC's high stake in the local stock market, which accounts for as much as 22 per cent of the total value of the Taiwanese stock market. The rise in Taiwanese stocks was largely due to a jump in TSMC shares, which have gained 46 per cent since the beginning of the year.

Source: Conotoxia MT5, EWT, Daily

The key importance of semiconductors in the development of new technologies means that the potential of this market still appears to be underestimated, especially in the context of a 15 per cent increase in semiconductor orders compared to the previous year.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

The above trade publication does not constitute an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No. 596/2014 of April 16, 2014. It has been prepared for informational purposes and should not form the basis for investment decisions. Neither the author of the publication nor Conotoxia Ltd. shall be liable for investment decisions made on the basis of the information contained herein. Copying or reproducing this publication without written permission from Conotoxia Ltd. is prohibited. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,48% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.