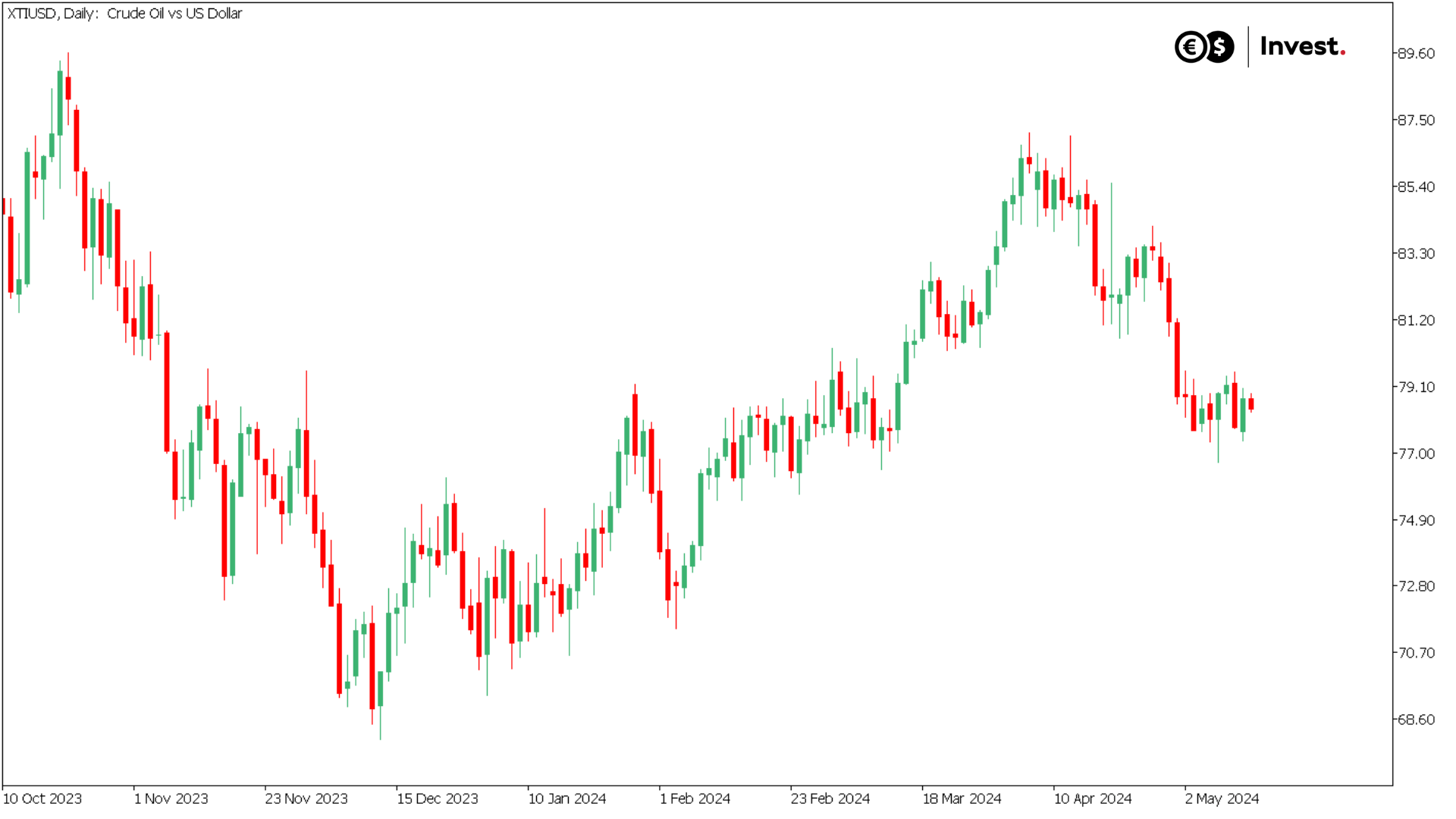

Since the beginning of the year, the price of oil has risen by 10%, yet OPEC has consistently maintained its crude shortage forecasts for the next two years in its monthly report since the second quarter of 2023. Let's take a closer look at this report and how oil prices might evolve in 2024.

Table of contents:

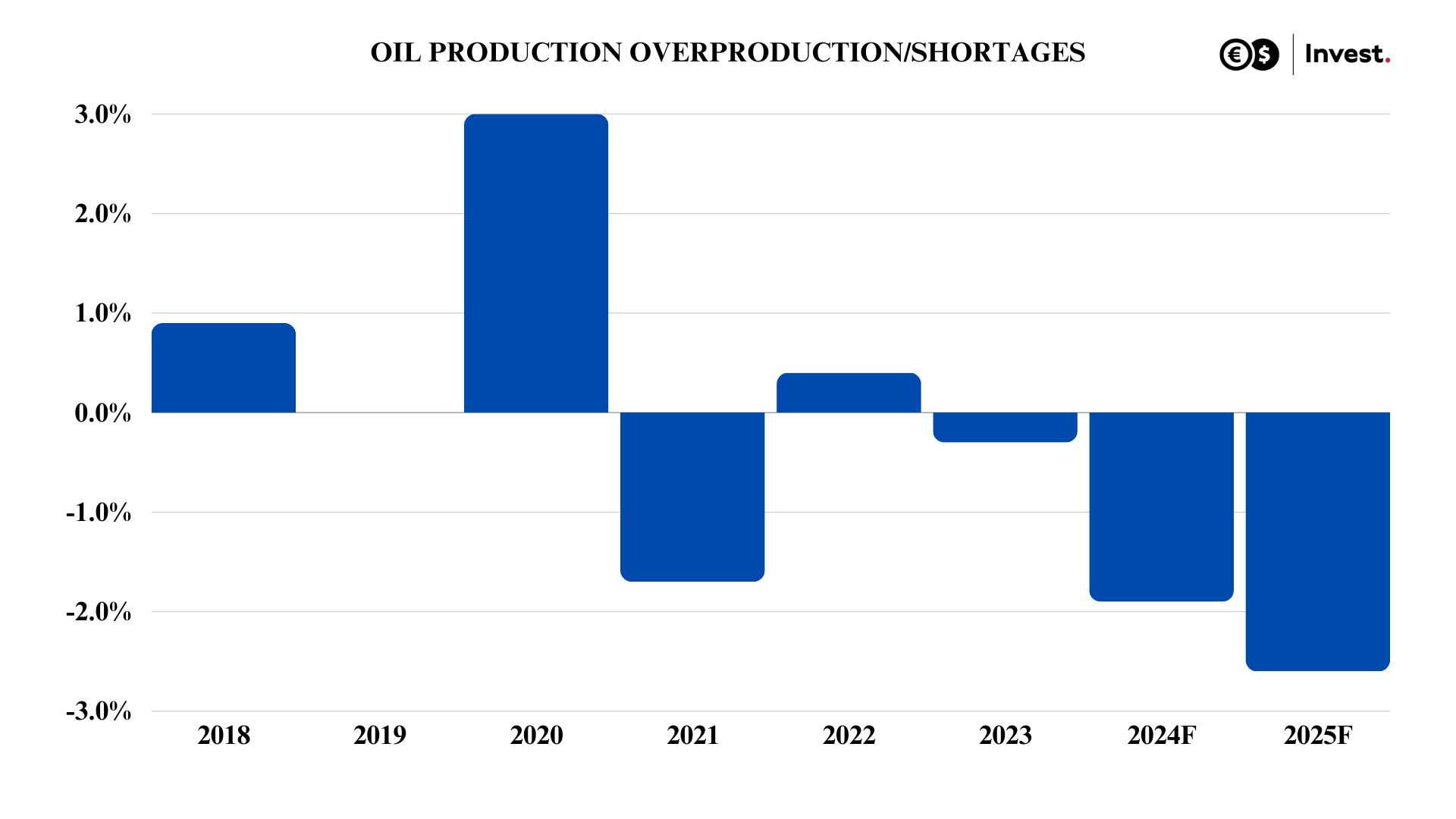

Forecasts of oil shortages on the markets

Shortages are forecast to be 1.9% of demand volume in 2024 and as high as 2.6% in 2025. This compares with a shortage level of 1.7% in 2021, when almost continuous price increases were observed.

Source: Conotoxia own study, OPEC data

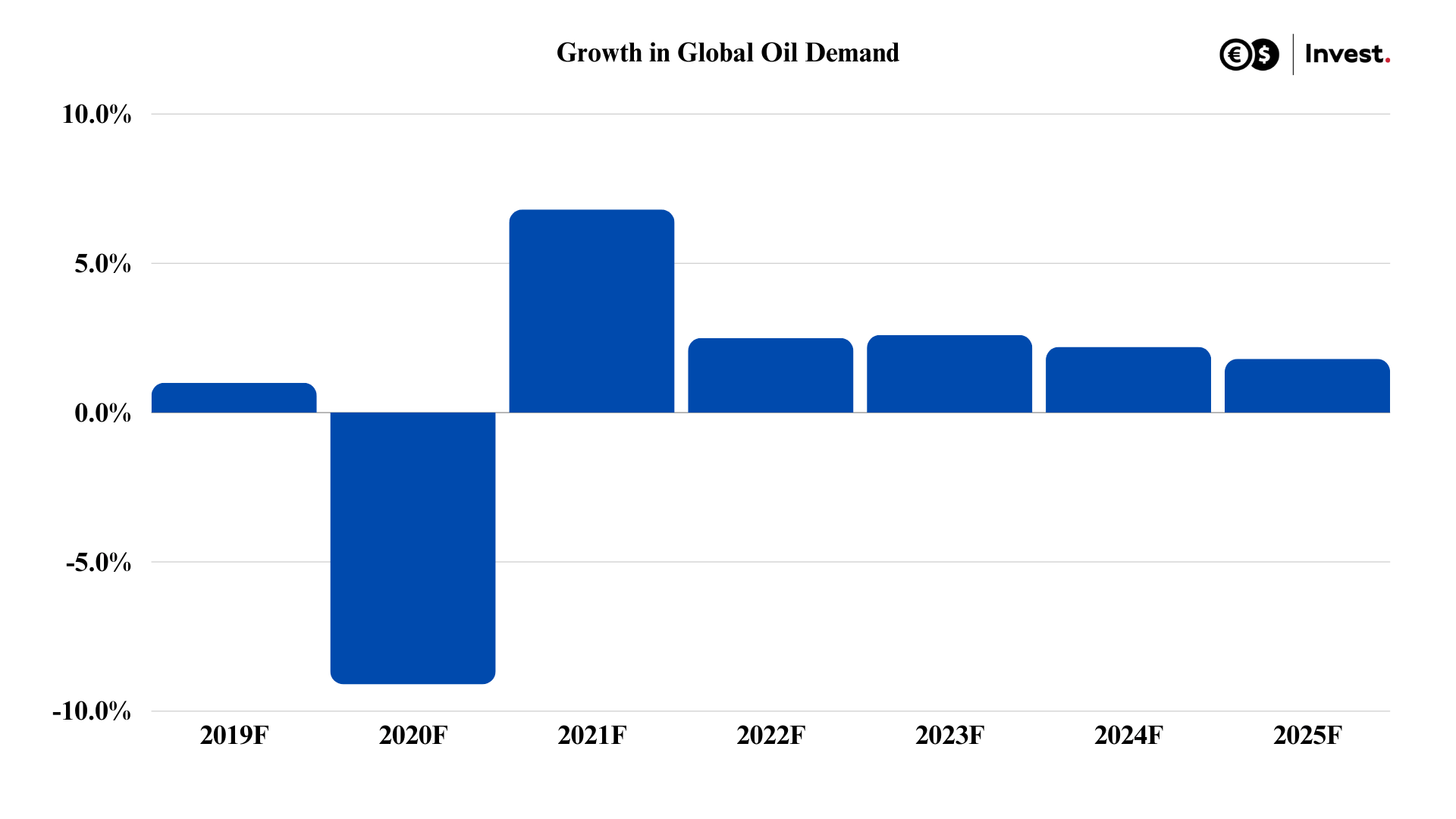

This means that countries have to use their strategic stocks to compensate for shortages, which can lead to local shortages. This is despite analysts' forecasts expecting global oil production to increase by 0.6% in 2024. The reason for this can be attributed to much higher demand growth, which is reported to increase by 2.2% in 2024 and by 1.8% in 2025, mainly due to growth in India (+4.4%) and China (+4.3%). Meanwhile, OECD countries may remain stagnant with growth of just 0.6%.

Source: Conotoxia own study, OPEC data

US still the leader

In its latest report, OPEC is virtually unchanged in its oil production forecasts for the coming quarters, predicting a shortfall in supply relative to global demand in virtually every quarter until the end of 2025. The cartel's projections show that oil demand will increase by 2.2% in 2024 and by 1.8% in 2025, while global production will increase by 0.6% and 1.1% respectively. The United States will be responsible for the largest increase in global production.

Source: EIA

What's next for the oil price?

The price of crude, due to growing shortages - the largest in past years - is likely to continue to rise this year. According to OPEC data, it could even break through the $100 per barrel level. However, the US EIA does not foresee such drastic increases, assuming that the average WTI crude price in 2024 will be USD 88 per barrel, 12% higher than current levels. Whatever the source of the forecasts, they assume increases in the price of crude.

Source: Conotoxia MT5, XTIUSD, Daily

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

The above trade publication does not constitute an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No. 596/2014 of April 16, 2014. It has been prepared for informational purposes and should not form the basis for investment decisions. Neither the author of the publication nor Conotoxia Ltd. shall be liable for investment decisions made on the basis of the information contained herein. Copying or reproducing this publication without written permission from Conotoxia Ltd. is prohibited. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,48% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.