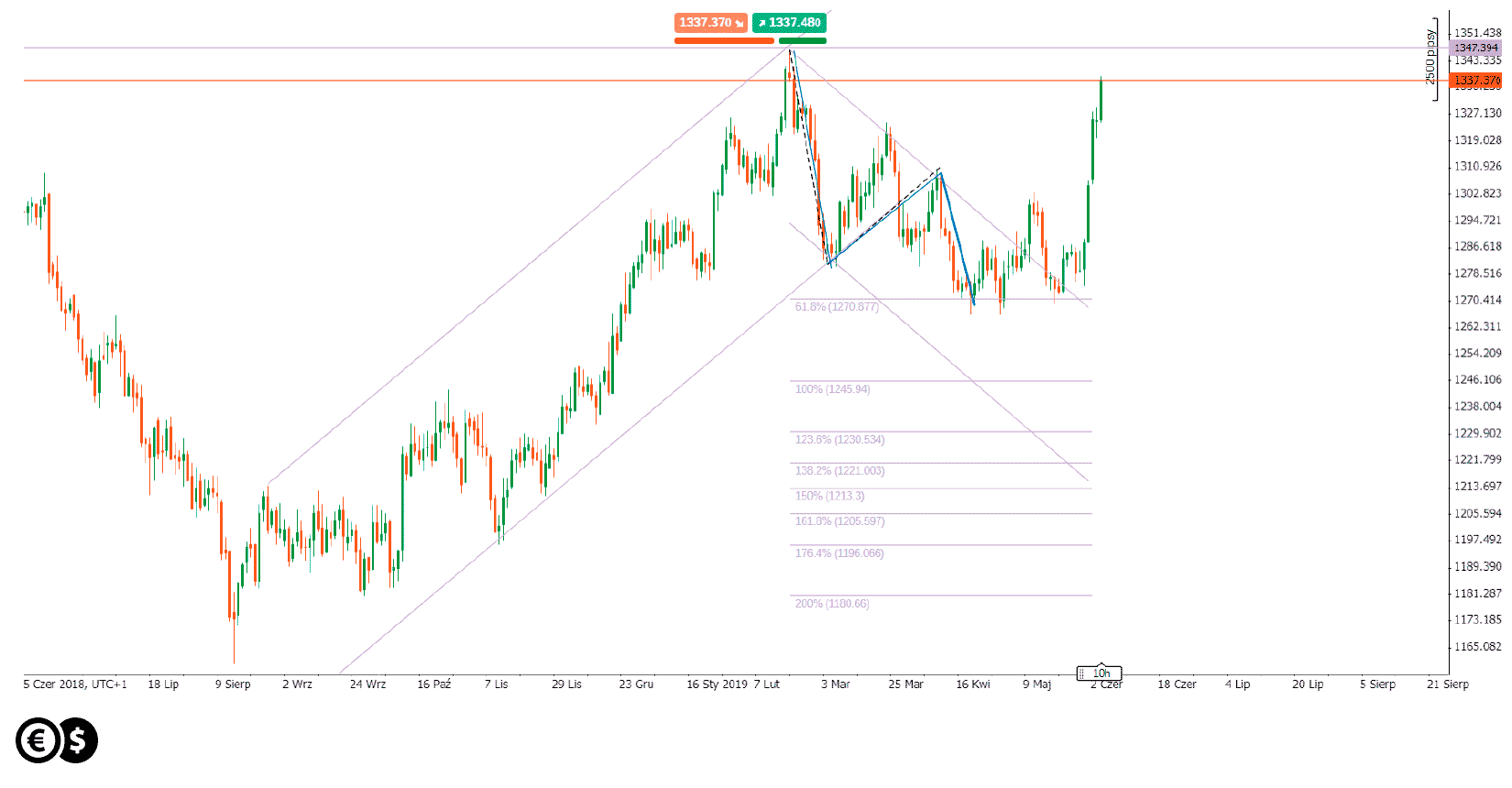

The price of gold has increased over the last five sessions by over 5 percent. As a result, we see the largest increase in gold prices this year, which started from around USD 1270 per ounce and lasts to the current level around 1337 USD.

As a result, the price of this precious metal reached the levels we last observed in the second half of February this year. In our previous comments on gold, we mentioned that it can be a pretty good alternative in uncertain times. We pointed out that gold is able to gain even when the dollar reached two-year highs.

Growing concerns about the economic slowdown in the world, as well as the escalation of the trade war, cause investors to return to security. The rise in US-China tensions, the imposition of tariffs on Mexican products and the increase in the likelihood of a recession, as well as the sharp decline in bond yields, seem to be additional arguments for gold price increases.

The daily chart of gold. Conotoxia trading platform

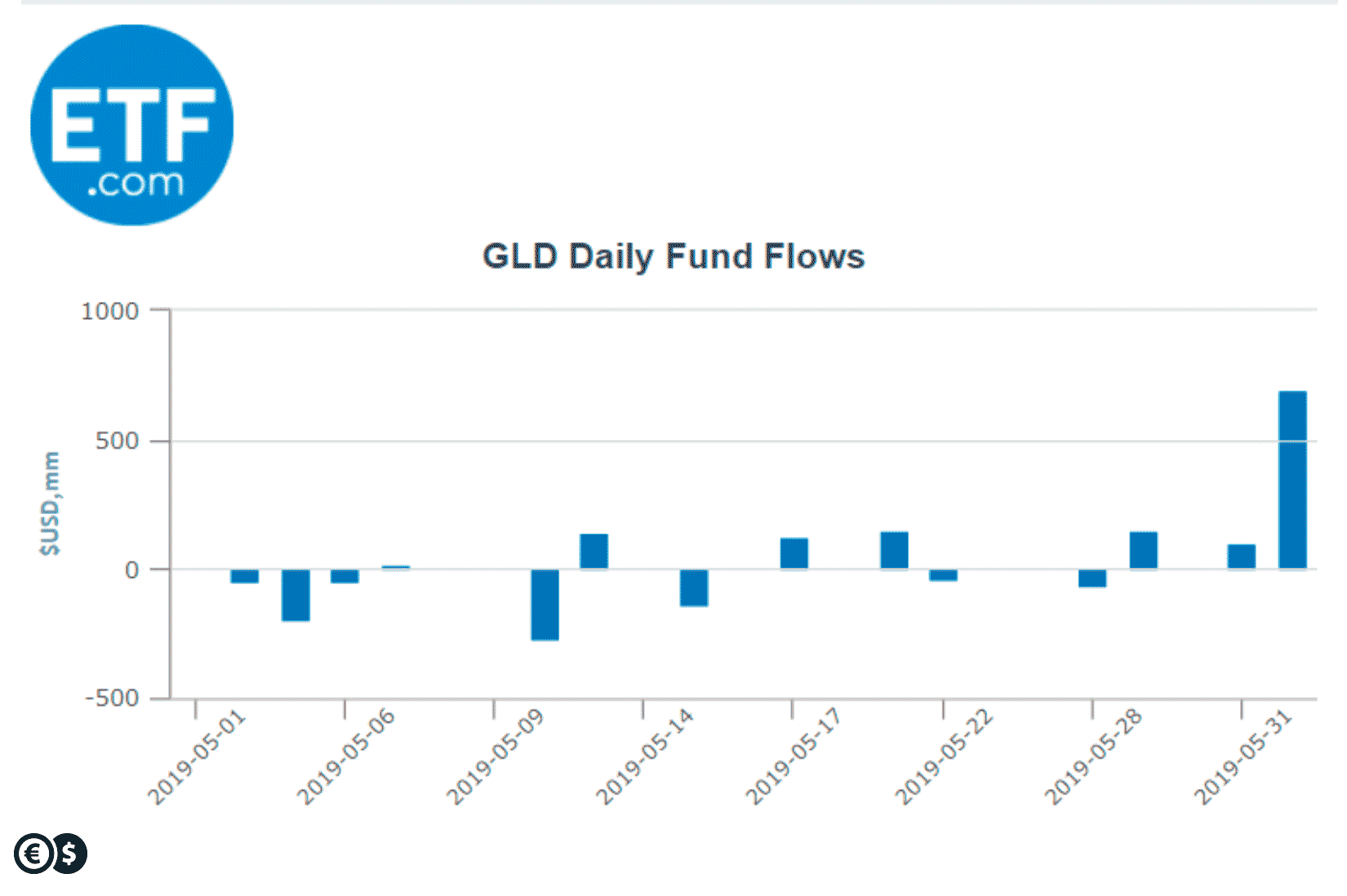

It is also worth noting that at the turn of May and June this year there was an outflow from global equity funds. Global equity funds saw an outflow of USD 10.3 billion in the last week of May, because the trade conflict between the US and China could have led investors to return to safe bonds or gold.

This is illustrated by the scale of recent capital inflows to the largest ETF fund for gold - the SPDR Gold Trust, which has recently received nearly USD 700 million of new funds.

Capital flows to the largest Gold ETF fund. Source: ETF.com

Summing up, the continued uncertainty in the markets, the lack of greater opportunities to ease the trade conflict, the increase in the likelihood of recession or depreciation of the dollar seem to be currently favorable factors for gold prices.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.