The World Bank decided to cut forecasts of global GDP growth due to the decline in global trade growth and decline in global investments. This is another forecast showing that 2019 may be one of the weakest in the last decade.

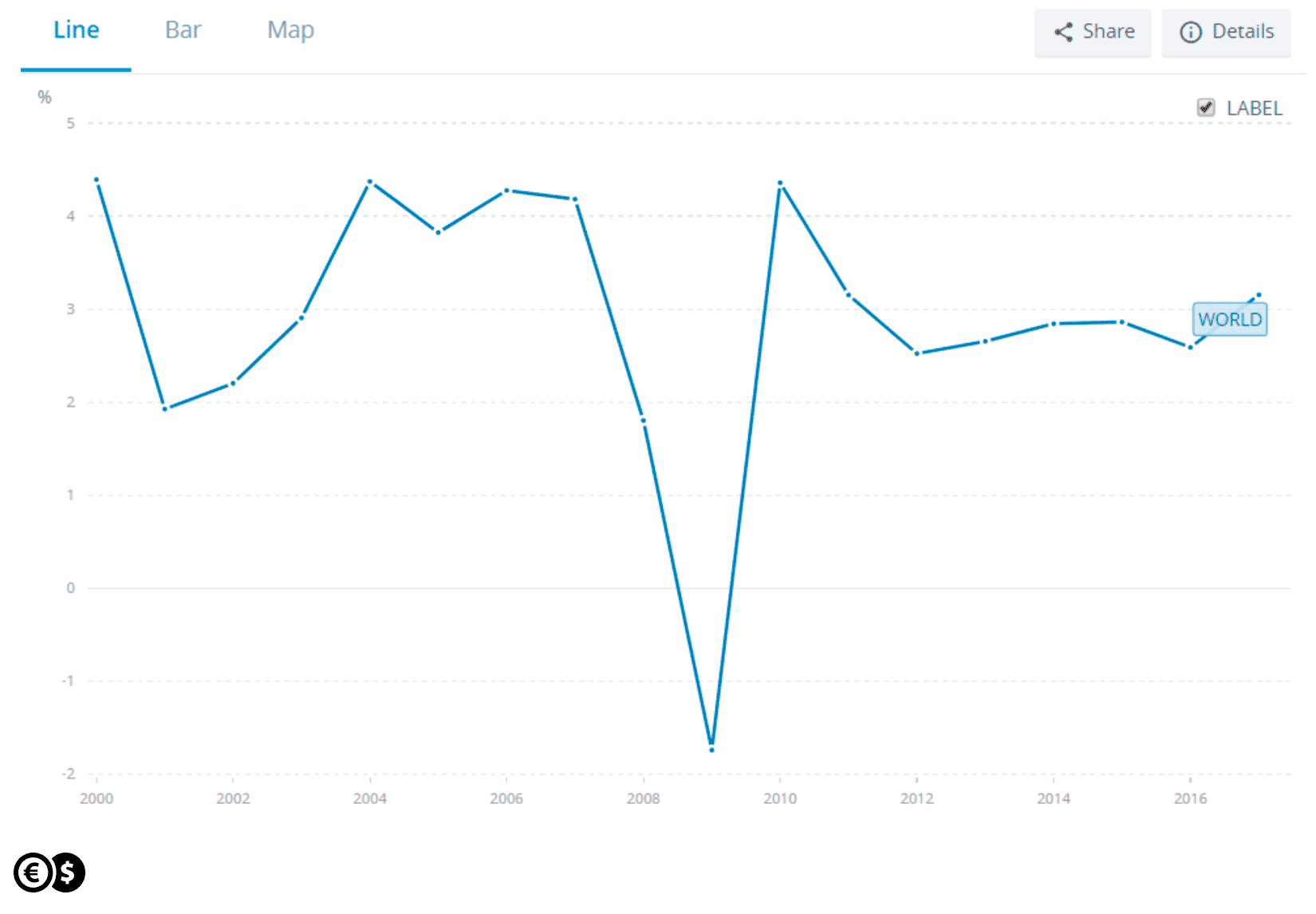

In January, the World Bank assumed that global GDP in 2019 would increase by 2.9 percent, and in the previous year, estimates indicated a 3 percent. The current forecast assumes that the global economy will grow by 2.6 percent. The last time, we observed a comparably low GDP growth rate in 2016 and 2012 - according to the World Bank data. Then, the economic growth was just over 2.5 percent. The positive news is that next year the World Bank assumes GDP growth at the level of 2.7 percent.

GDP growth (annual %). Source: data.worldbank.org

For the euro area, the forecast for 2019 and 2020 has been lowered, by 0.4 pp and 0.1 pp, respectively to 1.2 percent and 1.4 percent. The weakening of exports and investments is the main factor affecting the downturn. "Economic conditions in the Eurozone have deteriorated rapidly since mid-2018. Especially in the manufacturing sector" according to the Global Economic Prospects report.

The next part of the publication shows that it is the euro zone that looks worst, because the forecasts for the US and China have not changed. Growth in the US is expected to slow down to 2.5 percent this year, then up to 1.7 percent and 1.6 percent in subsequent years. Meanwhile, the Chinese economy is to develop in 2019 at the level of 6.2 percent, and a year later the rate of growth is expected to reach 6.1 percent.

Theoretically, therefore, the euro zone has a chance to expand after the current slowdown at a time when the United States will experience a greater slowdown. This, in turn, may translate into monetary policy in the near future, and as a consequence may also have a significant impact on the EUR/USD currency pair.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.