Yuga Labs, which is the largest NFT project in the world (Bored Ape Yacht Club), has become the next target of an SEC probe. The debate on the definition of a financial asset is fiery again.

Unregistered offerings?

The Miami-based project is famous for creating the Bored Ape Yacht Club, which was one of the first generic NFT collections in the world and resonated with the crypto ecosystem. Among the holders of the collection are well-known figures such as Mark Cuban, Madonna, Justin Bieber, Neymar Jr and Post Malone. These typically include actors, artists, and investors.

The SEC (Securities and Exchange Commission), the main regulatory body for financial markets in the US, has launched a preliminary investigation into the unregistered issuance of financial instruments by Yuga Labs. The allegations are said to relate to certain NFTs, which the SEC believes may be more akin to equities. And by extension, shouldn't they also comply with the rules that apply to them?

Yuga Labs has never been sued by regulators yet, and the probe does not necessarily mean that the company will face any penalty.

"It’s well-known that policymakers and regulators have sought to learn more about the novel world of web3. We hope to partner with the rest of the industry and regulators to define and shape the burgeoning ecosystem," - Yuga Labs said in a statement to Bloomberg News.

Is Crypto regulation coming in a big way?

The SEC's probe, along with other involvement from regulators in web3, in recent months may be evidence that the time of complete freedom may be coming to an end. Crypto, like other asset classes, may face regulation regarding project controls, token issuance, ratings and much more. The law will possibly have to be adapted to the specific characteristics of the ecosystem, for example, the difference between the PoS (Proof of Stake) and PoW (Proof of Work) blockchains.

What does this mean for ApeCoin?

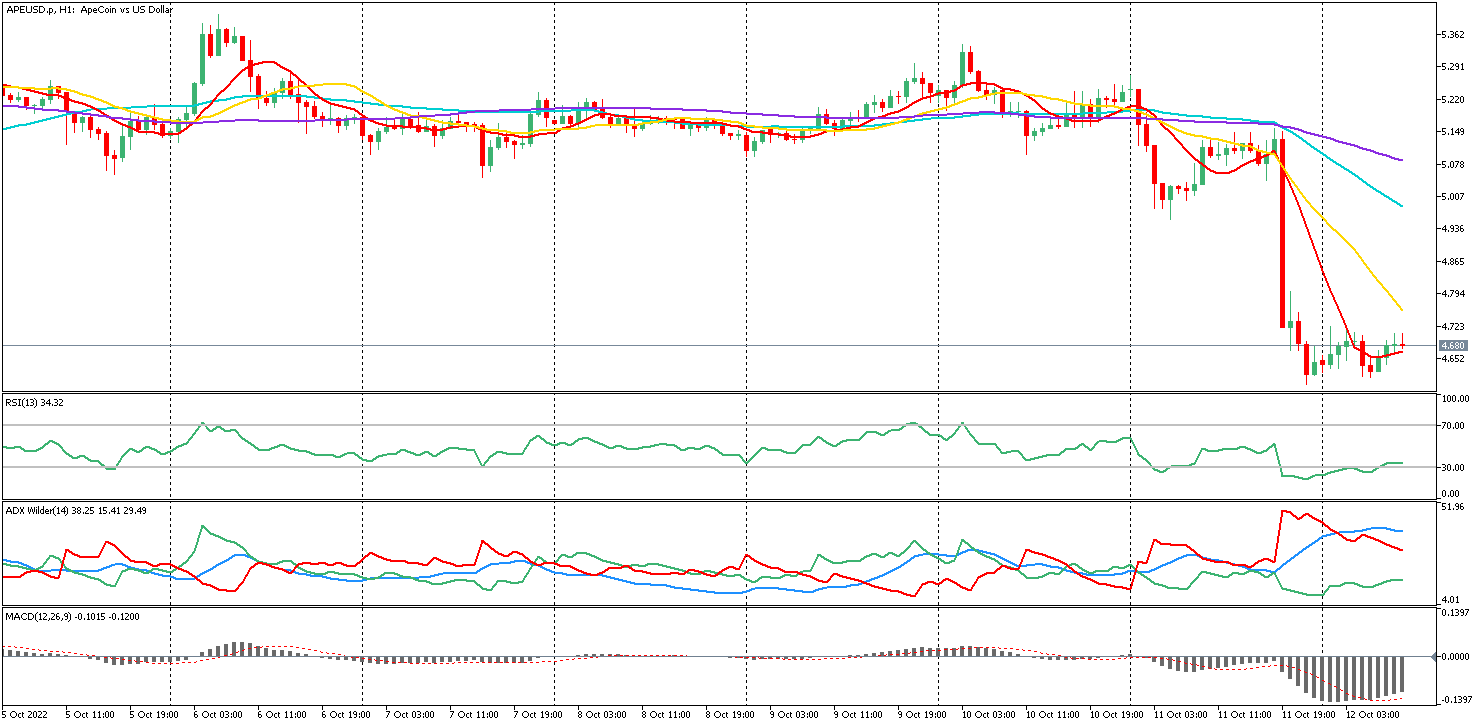

ApeCoin price, hourly candles

Source: Conotoxia MT5

On the Conotoxia MT5 platform at 13:00, ApeCoin has lost 10.3% of its value since news of the SEC investigation was announced. After an initial drop of nearly 11%, the token today is recovering from a local low by gaining 1.4%. The token emerged in March this year and then scored a rally, gaining around 190%. Since its peak at the end of April, ApeCoin has fallen by around 80%.

Did you know that CFDs allow you to trade on both falling and rising prices?

CFDs allow you to open buy and sell positions, and thus invest when quotes rise as well as fall. At Conotoxia, you can choose from CFDs on more than 5,000 financial instruments, including more than 140 CFDs on cryptocurrencies. Wanting to find a CFD on the cryptocurrency of your choice, all you need to do is follow 4 simple steps:

- To access Trading Universe - a state-of-the-art center for financial, information, investment and social products and services with a single Smart account, register here.

- Click "Platforms" in the "Invest&Forex" section.

- Choose one of the accounts: demo or live

- On the MT5 or cTrader platform, search for the CFD cryptocurrency you are looking for and drag it to the chart window. Use the one-click trading option or open a new order with the right mouse button.

Rafal Tworkowski, Junior Financial Markets Analyst, Conotoxia Ltd. (Cinkciarz.pl investment service)

The above trading publication does not constitute an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of 16 April 2014. It has been prepared for information purposes and should not form the basis for investment decisions. Neither the author of the study nor Conotoxia Ltd. accepts any responsibility for investment decisions made on the basis of the information contained in this publication. Reproduction or reproduction of this study without the written consent of Conotoxia Ltd. is prohibited.