Financial markets, especially in the United States, which appear less affected by the energy crisis than Europe's, seem to be waiting for important inflation data. Today, information will be published showing the price increases faced by producers (PPI inflation), while tomorrow there will be data on consumer inflation (CPI).

Inflation data and expectations

Before we move on to the discussion of the latest inflation data or the market consensus for the current reading, we can take a look at several other data, the task of which may be to express an opinion on the expected future inflation. The Federal Reserve Bank of New York reported that the median of one-year inflation expectations fell by 0.3 percentage points to 5.4 percent, the lowest value since September 2021.

A survey of consumer expectations conducted by the New York Fed in September 2022 also showed that the three-year inflation expectations rose by 0.1 percentage point to 2.9 percent, and the five-year one rose by 0.2 percentage point to 2.2 percent, the BBN website reported. Household spending expectations, on the other hand, have plunged sharply, recording the largest one-month decline since the franchise was launched in June 2013, the New York Fed wrote in a report.

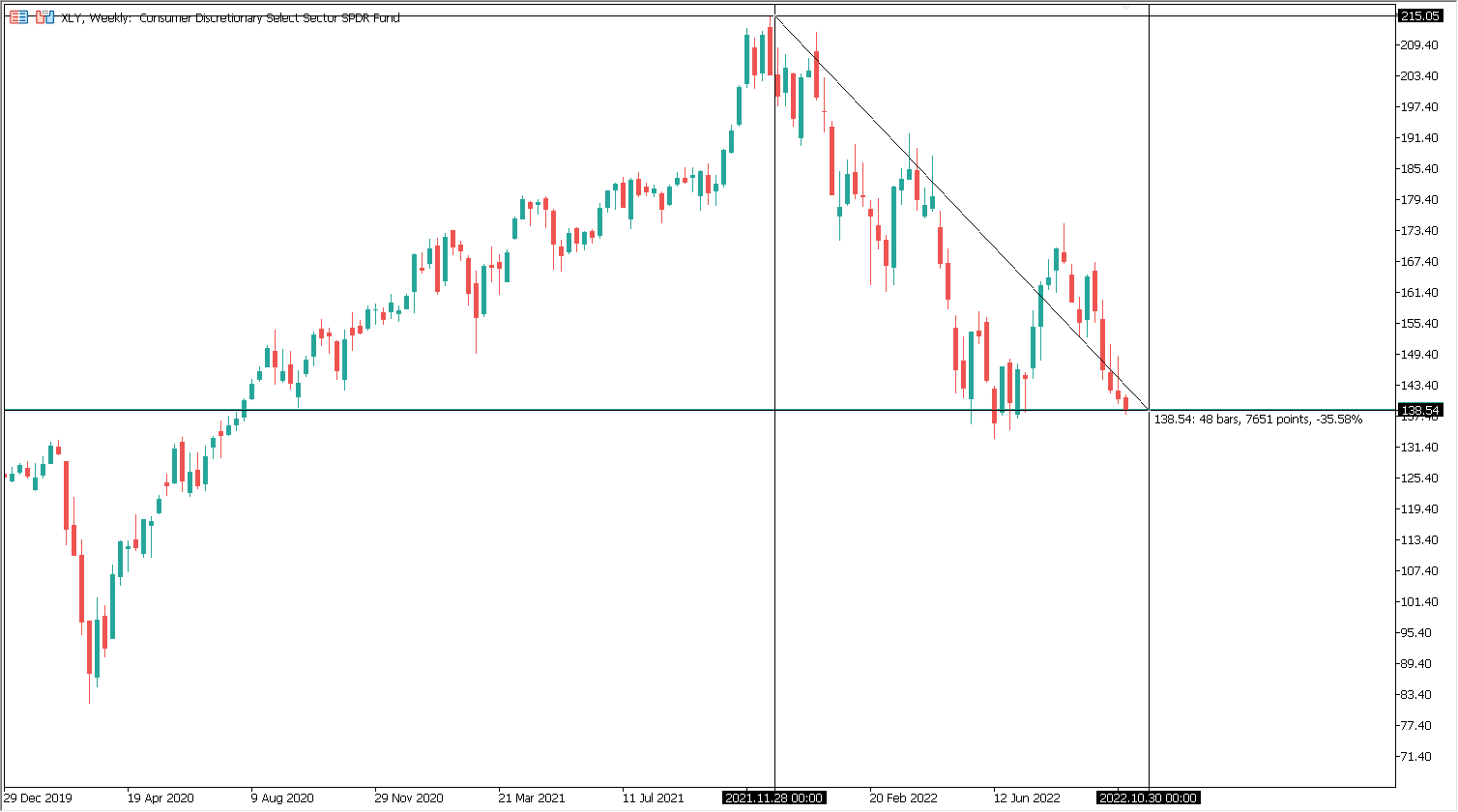

Source: Conotoxia MT5, XLY, W1

Limited disposable income and its possible impact on the market

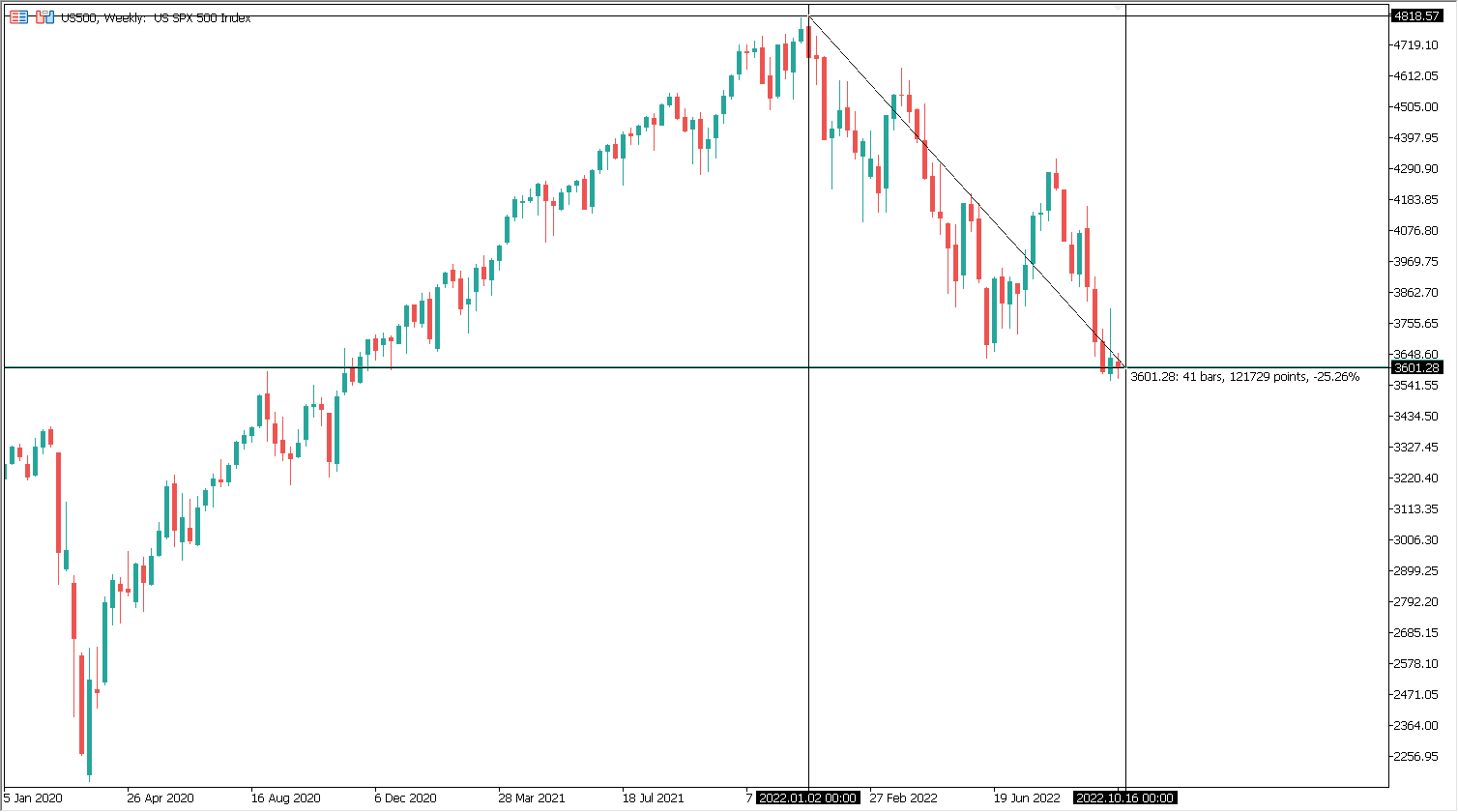

The US economy appears to be largely based on consumption, including consumption on credit. Currently , such consumption seems to be slowing down due to the increase in food prices or higher costs of maintaining a household. In turn, Americans' disposable income has decreased. This may mean that consumers shift their spending from goods that they do not need to live, towards basic necessities. This could be also seen in the strong weakness of the ETF DMA quotations on the XLY Consumer Discretionary, i.e. the ETF with exposure to companies producing so-called discretionary goods. In other words, they are goods without which we can live in worse times, and they make our lives easier in better times. XLY fell 35% from its peak to yesterday's close, more than the broad S&P500 index, which fell 25%.

Source: Conotoxia MT5, W1

This may quite show that high inflation may inhibit purchases of unnecessary goods, and its fall could fuel this demand again. We will find out about inflation in the US in September tomorrow at 14:30 GMT + 2. This may be one of the most awaited macroeconomic data of the week. Today, in turn, apart from the publication of PPI inflation, the market will learn in the evening the minutes of the last FOMC meeting (20:00 GMT + 2).

Daniel Kostecki, director of the Polish branch of Conotoxia Ltd. (Cinkciarz.pl investment service)

The above commercial publication does not constitute an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of April 16, 2014. It has been prepared for information purposes and should not constitute the basis for making investment decisions. Neither the author of the study nor Conotoxia Ltd. are responsible for investment decisions made on the basis of the information contained in this publication. Copying or reproducing this work without the written consent of Conotoxia Ltd. is prohibited.