According to Token Terminal data, Ethereum protocol revenues are down a whopping 86% in the third quarter, alongside the falling price of the token itself.

Declining Ethereum network revenues

At its peak last year, revenues generated in November were as high as $1.6 billion. However, the amounts have dropped significantly in previous months. They stood at $82.1, $65.6 and $52.4 million in July, June, and September this year respectively. These sums cannot be considered as revenue for Ethereum's founders and administrators, as there is no centralized company as such. Instead, these revenues were mainly due to the miners and validators of the network, who were de facto responsible for its operation.

Will this have an impact on the price of ETH?

Revenue from the Ethereum protocol comes primarily from fees charged by the ETH protocol (gas fees). These depend on the demand for Ethereum, which ultimately translates into the token price and fees. Therefore, a strong correlation between the ETH price and revenue is apparent. When the price of the coin fell this year, so did revenues.

Ethereum's protocol revenue may remain low for a long time because the move to Proof-of-Stake (PoS) blockchain has reduced the energy consumption and thus the cost, which for the other side of the transaction is the protocol revenue.

After merge, the token may no longer generate as much revenue as it once did through the current lack of cryptocurrency digging, which absorbed a large part of the cost. In theory, increased demand even with PoS blockchain could translate into increased commissions and network revenue, but it would have to require a gigantic influx of buyers.

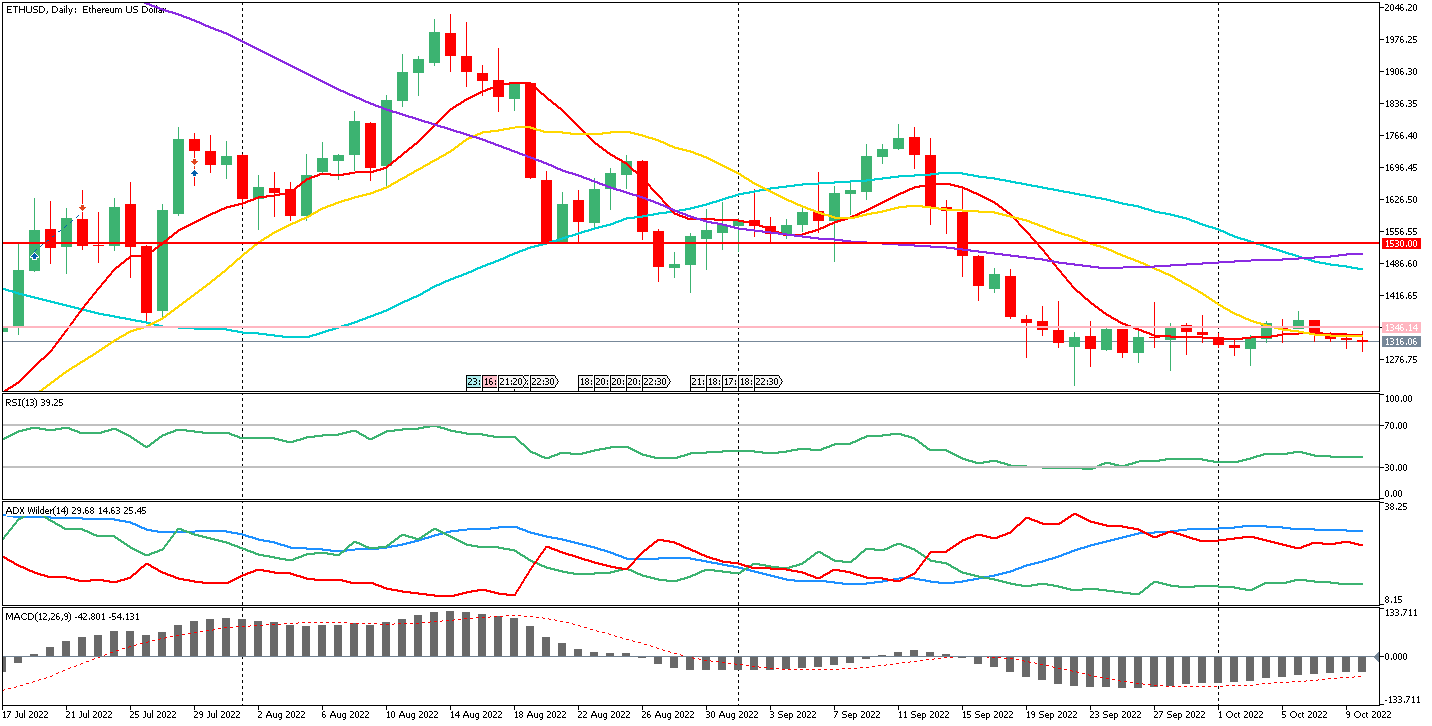

Ethereum Price, daily candles

Source: Conotoxia MT5

Ethereum has been moving in a sideways trend for almost three weeks. Today at 16:00 GMT+3 ETH is losing around 0.3%.

Did you know that CFDs allow you to trade on both falling and rising prices?

CFDs allow you to open buy and sell positions, and thus invest when quotes rise as well as fall. At Conotoxia, you can choose from CFDs on more than 5,000 financial instruments, including more than 140 CFDs on cryptocurrencies. Wanting to find a CFD on the cryptocurrency of your choice, all you need to do is follow 4 simple steps:

- To access Trading Universe - a state-of-the-art center for financial, information, investment and social products and services with a single Smart account, register here.

- Click "Platforms" in the "Invest&Forex" section.

- Choose one of the accounts: demo or live

- On the MT5 or cTrader platform, search for the CFD cryptocurrency you are looking for and drag it to the chart window. Use the one-click trading option or open a new order with the right mouse button.

Rafał Tworkowski, Junior Market Analyst, Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.