Next week will be very interesting in terms of macroeconomic data and publications, including decisions on interest rates in the United States. The US Federal Reserve will release a decision on Wednesday, and, like every month, there will be a press conference of the FED chairman.

After this meeting, no macroeconomic projections will be published, as they appear every second meeting of the Federal Open Market Committee (FOMC). It is worth recalling, however, that the last projections showed a very cautious view of the economy. At the end of March, the FED lowered the projections for economic growth in relation to December projections to the level of 2.1 percent in 2019 and 1.9 percent in 2020. The projections for PCE inflation were also reduced accordingly to 1.8 and 2.0 percent from 1.9 and 2.1 percent. However, the most important thing was to lower expectations regarding further interest rate increases. The March projections showed that in 2019 we will not see any increases, and in turn until 2021 only one decision on an interest rate increase may take place.

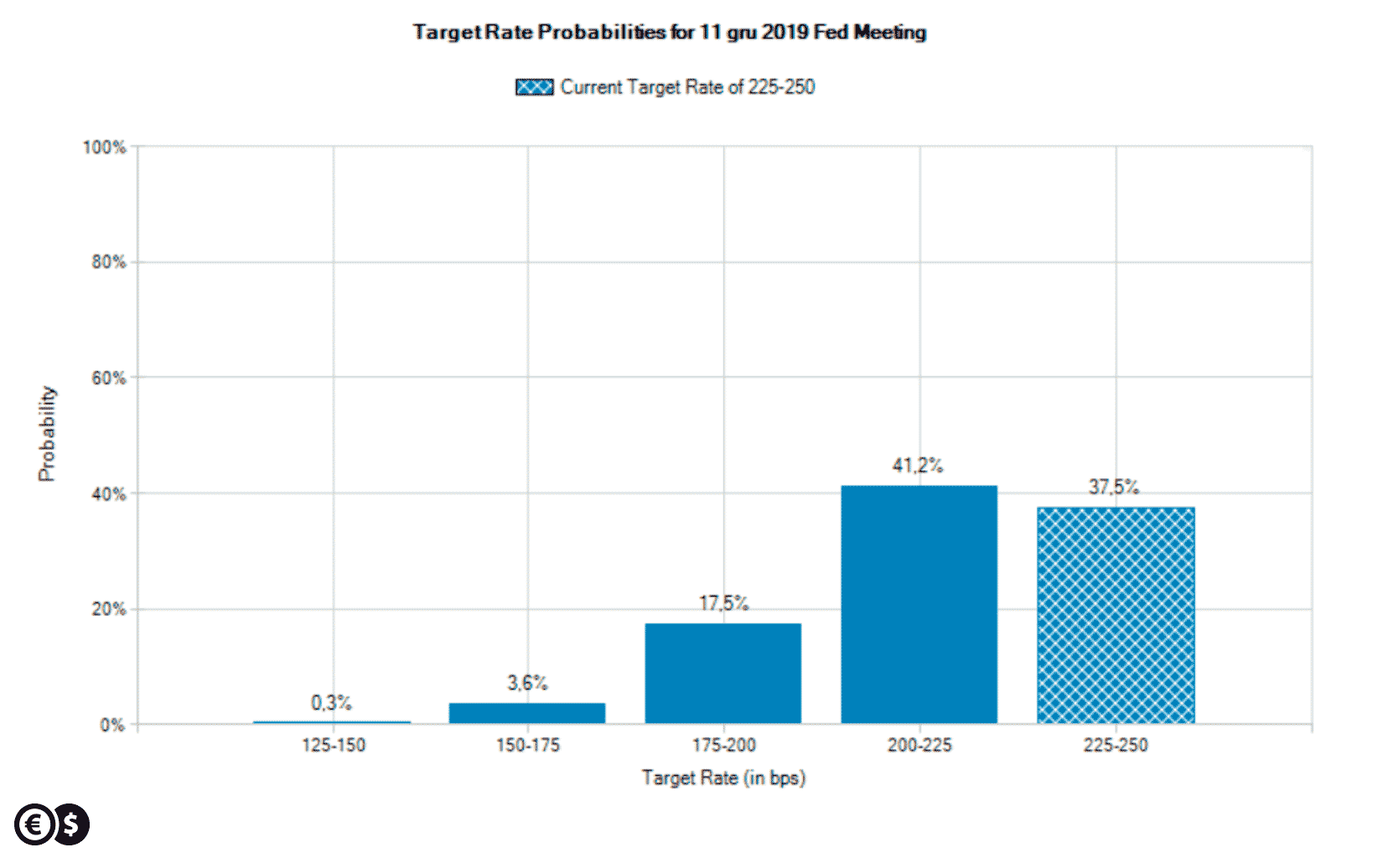

Meanwhile, market expectations are completely different. The interest rate market estimates, with over 60 percent probability, that by the end of this year the FED will cut the federal funds rate from 2.25-2.50 to 2.00-2.25 percent. Meanwhile, with almost 20 percent probability, two interest rate cuts are possible.

Target rate probabilities for December Fed meeting. Source: CME Group.

For this reason, the pessimism of the market and the moderate optimism of the FED in the context of further fate of monetary policy in the US are clearly visible. Nevertheless, the first quarter, apart from government shutdown, was not the worst for the American economy. Therefore, the message after this decision may be cautious, but with a slightly optimistic tone. One should also bear in mind the possibility of ending the trade war between the US and China, which can also affect the improvement of sentiment.

The FED decision will be announced next Wednesday, May 1 at 20:00. The press conference will start at 20:30.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.