The past year has been difficult for everyone, especially those invested in financial markets. Moreover, if you are a central bank with a large amount of money, there may be few viable investment opportunities. While a private investor may choose to "sit this one out", central banks may not have that option due to monetary policy and other reasons.

Summary

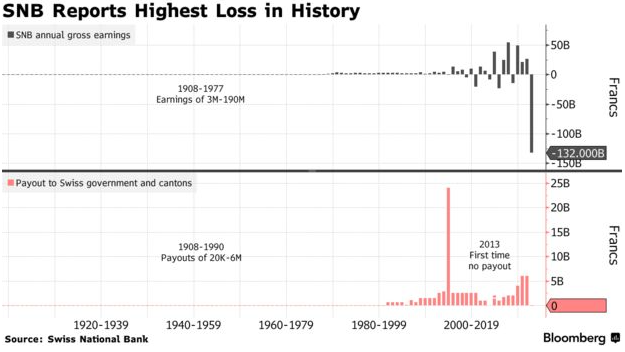

- Swiss National Bank has reported a loss of 132 billion CHF for the first three quarters of 2022 – 5 times larger than the previous record.

- Over the years, SNB had engaged in aggressive foreign exchange purchases accumulating a 1.05 trillion CHF balance sheet intending to keep the Swiss franc from appreciating.

- The large exposure to foreign assets suffered massive losses during the first three quarters of 2022 as most currencies, fixed-income securities, as well as equities depreciated.

- Due to this, SNB has already announced that it will not be able to provide the annual payout to the Swiss government and cantons (for the second time only since 1908).

- Questions remain - will this change investors' view of the franc as a safe haven and is the SNB planning to make changes to its current monetary and investment policy that will not lead to such a loss?

Swiss National Bank surprised everyone with the most significant loss in its history, posting an annual loss of around 132 billion CHF, more than 5 times the previous record.

Source: Bloomberg

Why did it happen?

The bulk of the loss - 131 billion Swiss francs - came from the collapse in the value of foreign currency investments accumulated over decades of buying to weaken the national currency.

Indeed, Switzerland has continuously invested large sums in foreign exchange markets and bought foreign equities to keep the franc from appreciating. After the EUR/CHF exchange rate fell from 1.67 in November 2007 to 1.12 in July 2011, the SNB announced that it had decided to do whatever was necessary to keep the EUR/CHF exchange rate above 1.20. Looking back, we know that "whatever it takes" amounted to almost 300 billion CHF until early 2015 when the 1.20 exchange rate ceiling was abandoned.

The last hit was the Covid-19 pandemic which pushed Switzerland to spend 110 billion CHF on the foreign currency markets while trying to apply brakes on the Swiss franc's appreciation as investors fled to safer currencies and other assets. In fact, as a result, the US labeled Switzerland a currency manipulator due to its aggressive foreign exchange market interventions. The US has not been the only country to express objections to Switzerland's activities to keep its currency from appreciating. During its 1.20 exchange rate pledge, it started purchasing German government bonds pushing their yields into negative territory.

Graph: investing.com, comments: author

As a result of the aggressive policy of the Swiss National Bank, it accumulated enormous amounts of foreign currencies and other assets on its balance sheet. By the end of 2021, the SNB's balance sheet exceeded 1.05 trillion CHF, which equals 144% of the country's GDP. To put this into perspective, the US Federal Reserve's balance sheet at the time was only 34% of the country's GDP, ECB's balance sheet – 67%, and China's – 32%.

Since then, the SNB has started to reduce its balance sheet - by December 2022, SNB had reduced its foreign exchange reserves to 784 billion CHF. That affected the national currency, which slipped below the parity against the euro for the first time in history (except one day when the 1.20 rate limit was renounced).

SNB's holdings

Now, the considerable exposure to foreign currency holdings does not induce losses per se. But last year, financial markets wiped out not one fund and portfolio. And in times like these, it is more important than ever to be well diversified. At the end of the third quarter of 2022, the SNB's foreign exchange holdings included mainly fixed-income securities, equity securities, and cash. At the end of 2021 – before the plunge in the US tech sector – SNB held US stocks worth 166 billion USD, including shares in Apple, Microsoft, Amazon, Tesla, Alphabet, Meta, and others.

Source: Swiss National Bank interim results

The above graph shows that all key foreign currencies depreciated against the Swiss franc, except the US dollar. Unfortunately, nearly half of the investments in the US dollar were through US stocks, which greatly lost value during this period.

Furthermore, last year was unique because bonds, typically considered a safer alternative to equities during downturn periods, fell together with riskier assets due to increasing interest rates. In total, during the first three quarters of 2022, Swiss National Bank reported a loss of 70.9 billion CHF due to price fluctuations in bonds, a loss of 54.2 billion CHF due to price fluctuations in equities, and an additional loss of 24.4 billion CHF related to exchange rate changes. The full-year report is expected to be published in March 2023.

What now? The Swiss cantons are tightening their belts.

As a result of the large loss, not only the bank's shareholders will not receive the awaited payments in the form of dividends. Swiss National Bank will not be able to make its yearly payment to the government and cantons. Although the SNB's annual payments tend to fluctuate widely and are not binding, many of the 26 cantons have already started to adjust their spending plans for this year to reflect the lack of payment.

Does this affect Switzerland's attractiveness in the eyes of investors?

The conclusions drawn by the SNB and investors may be different and uncertain. It is possible that the SNB has abandoned its target of a EUR/CHF rate above 1.20. We can see that although the exchange rate is well below this level, SNB has stopped increasing its balance sheet (potentially due to the harsh earnings results at the end of Q3).

The Swiss National Bank's large loss may also be a lesson to other central banks that it is challenging (if not impossible) to regulate the value of the national currency, especially by acting alone, and even more so when the currency represents a negligible part of the world's foreign exchange reserves.

While some investors may have had an impression that the Swiss franc’s value is being affected by its central bank already before, recent developments and the extreme loss of the SNB have attracted the attention of a myriad of investors all around the world. It may lead to investors rethinking their opinion of the Swiss franc as a stable, safe currency that can be trusted during turbulent times.

Furthermore, it will certainly be interesting to monitor the Swiss National Bank and whether or not it chooses to amend its monetary policy to avoid similar situations in the future.

Santa Zvaigzne-Sproge, CFA, Head of Investment Advice Department at Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement, or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.41% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.