As many analysts recall the anniversary of Black Monday and discuss the possibility of a repeat performance this October, with the S&P 500 and other stock market indices potentially losing more than 20% in a single day, rising Treasury yields could affect many different areas of the economy. One of these - the housing market - is often considered to play a pivotal role in the economic well-being of a nation, serving as both a significant driver of economic activity and an indicator of overall economic health. When the housing market weakens, it may send ripples across various sectors of the economy, impacting everything from consumer spending to the financial system. In this article, we will explore the current state of the US housing market and how the deepening cracks in it could reverberate throughout the broader economy.

Table of contents:

- How do rising Treasury yields affect the housing market?

- Recent developments in the US housing market

- Weakening housing market's effect on other parts of the economy

- Conclusion

How do rising Treasury yields affect the housing market?

First things first, let us delve into the interconnectedness between Treasury yields and the housing market. The housing market and the broader financial landscape are intrinsically connected. One of the key indicators of this relationship is the influence of rising Treasury yields on the housing market. As Treasury yields climb, they may create a chain reaction that touches various aspects of the real estate sector.

Before we explore their effects, let's briefly explain what Treasury yields are. The US government issues treasury bonds, notes, and bills to raise funds for various purposes. The yield on these securities represents the return an investor can expect to acquire on their investment. Treasury yields are influenced by economic conditions, inflation expectations, and the Federal Reserve's monetary policy. The recent increase in Treasury yields has been mainly attributed to the market's expectations of rising interest rates to combat inflation.

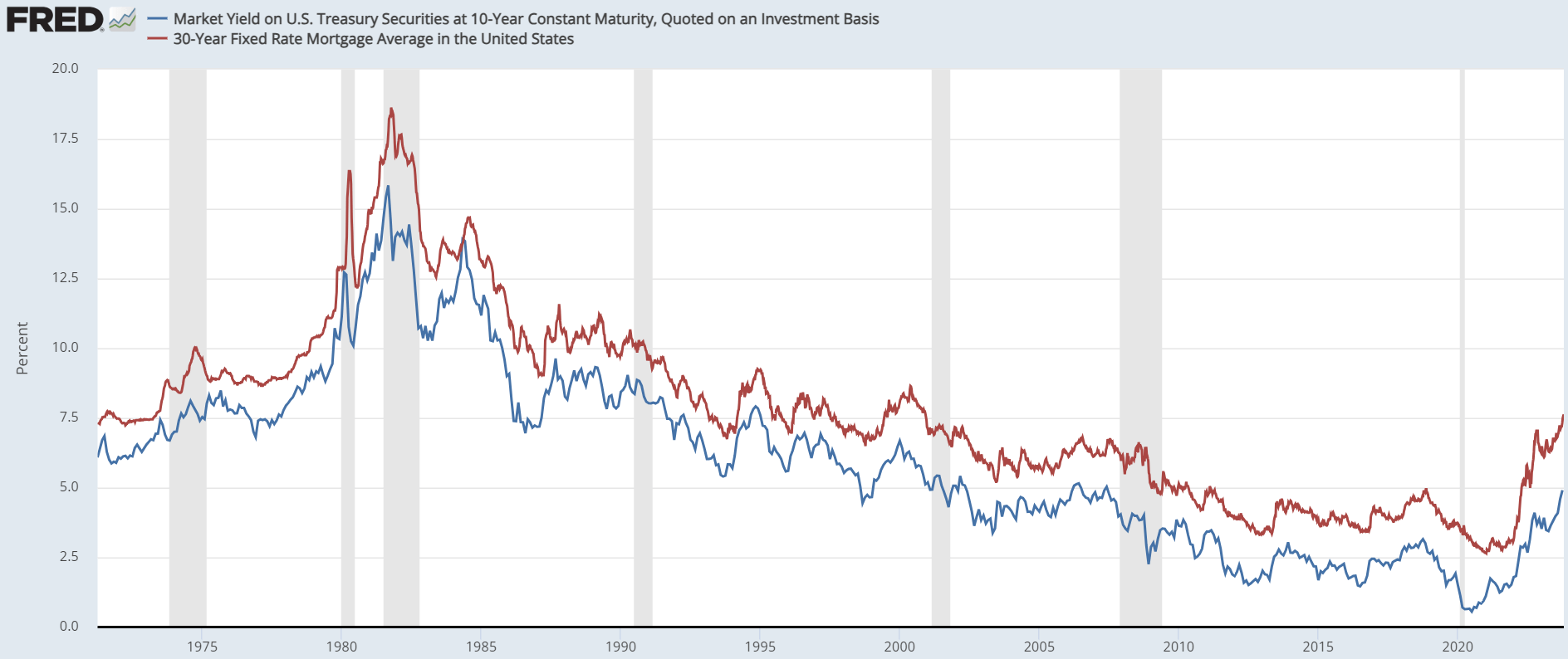

Rising Treasury yields often lead to an increase in long-term interest rates, including mortgage ones. As Treasury yields rise, financial institutions typically adjust their lending rates in response. Higher mortgage rates may deter potential homebuyers as the cost of borrowing becomes more expensive. Below is a graphic visualisation of the close relationship between the 10-year Treasury yield and the 30-year fixed mortgage rate in the US.

Source: fred.stlouisfed.org

Historically, the spread between the two rates has mainly fluctuated between 1.00 and 2.00, with an average spread of 1.82 since 2004. The spread tends to increase during periods of falling government bond yields, which can be explained by the slower reaction of financial institutions to adjust mortgage rates accordingly. However, the spread between the two measures has increased significantly since March 2022 and is now around 3.00, despite the fact that Treasury yields have risen rather than fallen. The only two times when the spread approached 3.00 (but never exceeded it) were during the Great Financial Crisis in 2008 and the early Covid-19 pandemic in 2020 due to a sharp decline in Treasury yields. As a result, homebuyers are now challenged with not only unusually high Treasury yields but also with interest rate markups as high as never before.

This, in turn, may slow down home sales and affect the demand for housing. Furthermore, as mortgage rates increase, demand for homes could weaken, putting downward pressure on prices. However, some sellers may be less inclined to lower their asking prices, leading to a potential slowdown in the rate of price appreciation rather than outright declines.

Real estate investors often take cues from Treasury yields. As bond yields rise, the fixed-income investment becomes more attractive, potentially diverting investment away from the housing market. A shift in investor sentiment can impact the demand for homes and affect housing market dynamics. And lastly, the perception of rising interest rates may influence consumer and investor sentiment. It may lead to concerns about the overall economic landscape and the stability of the housing market. These worries could further affect demand and real estate market activity.

Recent developments in the US housing market

Housing market measurements may act as a crucial indicator of the processes within the economy. Looking at the graph below, a slow but strong trend of rising numbers of houses sold and median sales prices may be observed from the Great Financial Crisis in 2008 until the beginning of the Covid-19 pandemic. Close-to-0 interest rates paired with extensive Covid-19 government aid resulted in a sharp increase in new one-family houses sold in 2020 and long-lived growth in sales prices, which reached its peak only in October 2022. Unusual for both measures, the number of houses sold and average prices have been moving in opposite directions since early 2020. Since its peak, the median sales price has decreased from 496,800 USD to 430,300 USD (a 13% drop).

Meanwhile, in the same period, the number of houses sold has increased from 577,000 to 675,000 (a nearly 17% growth). However, the latest number of new one-family houses sold showed a drop of 8.7% compared to the previous month. It was also worse than expected (700,000), indicating that the US housing market may face some challenges.

Source: fred.stlouisfed.org

The graph above may suggest that until now, Treasury yields have had a higher impact on the sales prices rather than the number of houses sold. In the meantime, the number of homes sold could be increasing due to falling sales prices. However, it is worth monitoring further developments in the housing market and whether the previous month's drop in the number of houses sold may show a new trend of lowering activity within the housing market.

Meanwhile, the Mortgage Bankers Association has reported that as the 30-year fixed mortgage rate exceeded 7%, the number of US mortgage applications for home purchases fell to the lowest level in 28 years last month. It may be explained by the historically high level of annual income needed to afford a house in the US at a median price of 412,000 USD. Calculated at a 7.20% mortgage rate, with a down payment of 20% and assuming 30% of income spent on housing costs, an individual should earn at least 114,000 USD annually to afford the above-mentioned scenario. However, the median salary in the US has been estimated at 70,000 USD, according to the Federal Reserve. Such a situation may not be sustainable in the long term and could provoke some turbulence in the housing market.

Weakening housing market's effect on other parts of the economy

The housing market is linked to many other parts of the economy, as it not only provides shelter to every household through ownership, renting or other arrangements but also stimulates or slows consumer spending, affects construction and other parts of the labour market, and even potentially influences a general economic slowdown through GDP growth estimates. Below is a broader insight on how the housing market may affect other parts of the economy:

- Consumer Spending - one of the most direct effects of a weakening housing market is on consumer spending. As home prices stagnate or decline, homeowners may find their wealth eroding. Consequently, they become less willing to spend on other goods and services. This reduction in discretionary spending could affect industries such as retail, restaurants, and entertainment.

- Construction and Real Estate - the construction and real estate sectors are particularly vulnerable to housing market downturns. As demand for new homes diminishes, job losses in construction and related industries often follow. Real estate agents, mortgage brokers, and property developers may also experience reduced income and fewer job opportunities.

- Financial Institutions - financial institutions, especially those heavily invested in mortgages, feel the impact of a weak housing market. Falling home prices devalue mortgage-backed securities, leading to potential losses for banks and investors. This can jeopardise the stability of the financial system, as it did during the Great Financial Crisis in 2008.

- Labour Market - the housing market significantly contributes to employment, both directly and indirectly. A slowdown in the housing market could lead to job losses in the construction, real estate and related sectors, with a knock-on effect on the overall unemployment rate. The labour market is one of the key indicators that the Fed monitors to determine whether further monetary tightening is viable. Unemployment rates have been historically low since the beginning of 2022. However, a slight increase has been observed in the last two months.

- Consumer Confidence - a weak housing market may undermine consumer confidence. When homeowners witness the value of their homes declining, they often become more cautious about their financial prospects. Lower confidence levels could lead to reduced spending and slower economic growth. The US Conference Board's Consumer Confidence Index is currently above 100. However, it has been decreasing for the last two months. Furthermore, the Expectations index has fallen below 80, historically signalling a recession within the following year.

- Home Equity Loans and Mortgages - as home values fall, homeowners may encounter difficulty in refinancing their mortgages or obtaining home equity loans. This limitation can impact homeowners' ability to access credit, influencing their spending habits and financial flexibility. However, the US housing market is certainly not there yet. In fact, the US Mortgage Bankers Association estimates that home prices may continue to appreciate for the next three years due to low inventories.

- Government Revenues - weaker housing markets can lead to reduced property tax revenue for local governments, potentially leading to budgetary challenges. Additionally, financial distress among homeowners due to declining home values may increase the demand for social services, further straining government resources.

- Supply Chain Effects - the construction industry relies on a vast network of materials and supplies. A housing market slowdown may disrupt suppliers and manufacturers in the construction supply chain, which may have a broader impact on the manufacturing and distribution sectors.

- Economic Growth - a slump in the housing market could drag down overall economic growth. Housing contributes significantly to GDP through construction and related spending. Thus, a downturn in the housing market could contribute to a broader economic slowdown. As GDP growth data are generally reported at a later stage (a lagging indicator), we may be able to measure the damage done to the economy as a whole but not anticipate it as the housing market weakens.

Conclusion

The impact of a weakening housing market on the broader economy is substantial and multifaceted. However, the severity of the downturn, the overall economic climate, and government policy responses may all influence the extent of these effects. Government intervention and fiscal policy often play a crucial role in mitigating the effects and stabilising both the housing market and the wider economy. Nevertheless, the Federal Reserve's current monetary policy is focused on reducing inflation, which is expected to slow the overall economy, including the housing market. Fed officials are monitoring macroeconomic data to assess whether further tightening may be needed, and recent reports on employment and other data suggest that the economy is still too resilient to end monetary tightening. This may mean that there is still room for interest rates to rise, putting further pressure on the housing market and other parts of the economy.

Santa Zvaigzne-Sproge, CFA, Head of Investment Advice Department at Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis, and opinions contained, referenced, or provided herein are intended solely for informational and educational purposes. The personal opinion of the author does not represent and should not be constructed as a statement, or investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.95% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.