With all the talk of a recession and the US government's default, let us take a breath of fresh air and look at a company outside the US market, representing a sector that may perform better in a recessionary environment.

Summary

- Over the last few years, Danone has faced significant underperformance compared to its peers. This led the management to introduce an initiative called "Renew Danone".

- Due to its relatively inelastic demand, Danone's product mix may provide crisis resilience to the company.

- The Company managed to grow its sales in Q1 2023, although nearly all of it came from an inflationary environment rather than organic volume growth.

- Danone has a relatively leveraged balance sheet, which, together with its weak liquidity ratios, may not be beneficial in a recessionary environment.

- Geopolitical risks need to be considered before investing in any multinational business.

Danone S.A. is a consumer staples company based in Paris, France, renowned for its popular bottled water brand. While the company continues to operate its successful legacy water business, it also possesses several other brands with leading market positions in their respective product categories.

However, due to various factors, Danone has faced significant underperformance compared to its peers in recent years. These include under-investment in its brands, over-diversification into too many products leading to cannibalisation of sales, high input cost, inflation and economic weakness in Europe. As a result, the company's stock has underperformed its peers in Europe and the US. Since the beginning of 2017 (excluding the period between April 2019 and February 2020), Danone's share price has fluctuated between 46 and 59 EUR. As a result of the rally in the past three months, Danone's stock has now reached the upper margin of this corridor, and it might experience a correction in the near future.

Source: Tradingview.com

Introduction of ‘Renew Danone’

One possible reason for the recent rally is the company's reorganisation efforts. In the spring of 2022, management openly acknowledged its missteps and committed to rejuvenating growth through an initiative called 'Renew Danone'. This plan included a revamp of the board of directors, which is 80% independent, many of whom are current or former CEOs of consumer goods companies. While it is difficult to determine whether management's efforts or the economic environment are driving the recovery, Danone has already shown signs of progress.

As part of its 'Renew Danone' strategy, Danone is expanding its plant-based product range, which, together with its dairy product line, accounted for more than 54% of the company's sales in the first quarter of 2023 and was the world's number one player in both the dairy products and the dairy alternative protein movement. In addition, according to the company's FY2022 financial report, Danone is the world's second-largest supplier of packaged water and infant nutrition.

Crisis resilience

Although not the most exciting sector, consumer staples could provide investors with much-needed stability during a recession. Most goods produced by Danone may be considered highly inelastic, meaning that the demand for these products may not fluctuate much depending on the economic cycles. These goods fall into the category of necessities, such as dairy products, plant-based alternatives, water, and specialised nutrition, including infant and medical nutrition for elders. As a result, the company seems unlikely to face significant threats on the demand side, even during difficult times or potential market downturns. Once the company has established a market presence, it can easily maintain its stability, predictability and sales advantage.

Danone sales' resilience to market fluctuations has been reflected in its correlation with the overall market over the past years. 5-year beta for the company is 0.49, meaning that for every 1 EUR that the market grows (or falls), Danone's stock price would grow (or fall) by 49 cents on average.

1Q 2023 results and other financial information

In the 1Q 2023, consolidated sales for Danone reached 6,962 million USD, representing a significant increase of +10.5% compared to a like-for-like basis. This growth was primarily driven by a +10.3% contribution from price adjustments and a +0.2% contribution from changes in volume and product mix. On a reported basis, sales experienced a notable rise of +11.6%, benefiting from a slightly positive foreign exchange impact of +0.7% and a positive effect of +1.4% resulting from hyperinflationary conditions. However, when taking a closer look, we can see that the Essential Dairy and Plant-based product category has actually experienced a -3.2% drop in sales volume, which has been more than reversed by the strongest price growth among all Danone product lines.

Source: Danone 1Q 2023 investors presentation

Although more successful during a recessionary environment, consumer staples companies' standard profit margins generally remain in the single digits. In 2022, with sales amounting to 27.6 billion EUR and a net profit slightly above 1 billion EUR, the net profit margin was approximately 3.6%. In contrast, in 2021, the net profit margin was much higher at 8.1%, with a net profit of 1.99 billion EUR and sales of 24.28 billion EUR. This indicates significant fluctuation in the net profit margin. The primary reason for this fluctuation could be attributed to disruptions in the supply chains and particularly high inflation last year. Therefore, it may be possible to conclude that while the company is relatively resilient to sales declines, it may be sensitive to cyclical increases in production costs. Generally, net profit margins for Danone have ranged between 8% and 10% in recent years, and data show us that the company has not been significantly affected by the Covid-19 pandemic in this regard.

The company falls short when comparing its net profit margins with its competitors, such as Nestle and PepsiCo. In 2022, Nestle had a net margin of 10%, ranging from 13.9% to 19.5% between 2019 and 2021. Similarly, PepsiCo's net margin was higher than 10%. Hence, the company's profitability is relatively lower compared to the industry.

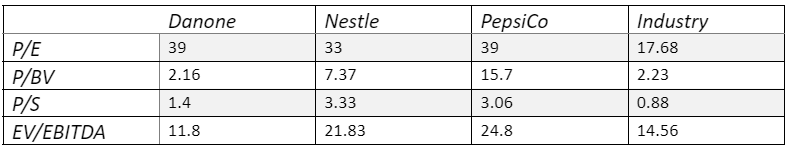

The price one pays for a share of Danone's profits is equal to or higher than that of other companies. Although Danone's P/E ratio of 39 is around the same level as of its competitors, such a ratio is considerably higher than the industry average and may indicate that Danone stock (along with its competitors) might be overvalued. However, in terms of valuation multiples, such as Price-to-Book Value and EV-to-EBITDA, Danone seems undervalued not only in comparison to its competitors but also to the industry average. Although the Price-to-Sales ratio is higher than the industry average, it is more than twice less than that of Nestle and PepsiCo.

Source: Zacks.com

Danone's 2022 balance sheet data show that while the equity itself fails to cover its fixed assets and long-term liabilities, it gets the job done. Total liabilities exceed 27.2 billion EUR, significantly surpassing equity, which stands at 17.99 billion EUR. The debt-to-equity (D/E) ratio is 1.5, indicating relatively high leverage. The liquidity ratio (current assets/current liabilities) is a mere 1.001. When modified to the quick ratio by subtracting inventories from current assets, it drops to 0.78, indicating that the company may not be able to cover its short-term liabilities swiftly if needed. With cash holdings of 1.051 billion EUR and total assets exceeding 45 billion EUR, cash accounts for only 2.3% of assets. Consequently, the company could face liquidity and debt issues in the future. Furthermore, it may lack prospects for debt-financed growth due to already high leverage.

Geopolitical risk

As a result of Russia's aggression in Ukraine and the sanctions imposed by the Western world, Danone had to deal with its stake in Russia's market. According to the 2020 Universal Registration Document, Russia and four other countries were the company's main markets, together accounting for half of the company's total sales. Notably, Russia contributed 6% to the company's sales figures, primarily driven by popular offerings like Prostokvashino yoghurt, the delightful Danissimo treat, and a range of fresh or ultra-high temperature processed milk products. After months of uncertainty, Danone made a decision in October 2022 to offload its operations, representing about 90% of its business in Russia, retaining only its infant nutrition unit. It has been estimated that the retaliation from the Russian market could cost the company around 1 billion EUR in write-offs. Nevertheless, markets perceived this as good news driving up the company's stock price by 1% in the pre-market.

Similarly, it is worth noting that China and North Asia and Oceania are the fastest-growing markets for Danone (16% growth in Q1 2023). Given the trade war between China and the US and their deteriorating overall relations, which could escalate into another military operation, Danone could also risk losing at least part of this market.

Conclusion

Danone has many well-known brands and a strong position in the global market. Given its product mix, Danone may be more resilient to an economic slowdown from a sales perspective. However, its relatively high leverage and low liquidity may indicate a potential threat in the event of an economic downturn. Finally, Danone's geopolitical risks are worth noting. However, most global companies face geopolitical challenges to some extent.

Santa Zvaigzne-Sproge, CFA, Head of Investment Advice Department at Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis, and opinions contained, referenced, or provided herein are intended solely for informational and educational purposes. The personal opinion of the author does not represent and should not be constructed as a statement, or investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73,18% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.