Alibaba recently announced that it was joining the trend of splitting its various businesses into separate entities. The initial reaction from investors was positive, as the company's share price jumped 14.3% following the announcement. Now that the initial excitement has worn off let us look at what Alibaba's spin-offs offer and other important factors that investors should be aware of.

Summary

- Alibaba Group is moving towards a corporate restructuring that will split its businesses into six separate entities.

- Alibaba Group is a cash-rich company with healthy valuation multiples due to the sharp decline in its share price in recent years.

- Focusing on each future entity separately, Taobao Tmall Business Group is the only profitable business under the holding, although other groups are improving their operating margins.

- Cloud Intelligence Group may have the most considerable potential for growth in the upcoming years as the cloud infrastructure market in mainland China is expected to grow at a CAGR of 20.8% in the forthcoming years. Alibaba currently dominates the market in this field.

- Alibaba investors need to be aware of the potential uncertainties and risks associated with China's legislation and its relationship with the US.

The spin-off

As the spin-off was announced relatively recently, there are still some uncertainties about the technical details, such as how exactly shareholder ownership will change in relation to all six newly created entities. Nevertheless, it is possible to look at each business that will become a separate entity.

According to the Alibaba Group's publication on the SEC website on 28th March 2023, the company will split into six separate business groups:

- Cloud Intelligence Group (including cloud, AI, DingTalk and other businesses),

- Taobao Tmall Business Group (including Taobao, Tmall, Taobao Deals, Taocaicai, 1688.com and other companies),

- Local Services Group (including Amap, Ele.me and other businesses),

- Global Digital Business Group (including Lazada, AliExpress, Trendyol, Daraz, Alibaba.com and other companies),

- Cainiao Smart Logistics,

- Digital Media and Entertainment Group (including Youku, Alibaba Pictures and other companies).

Based on the fact that Alibaba Group's announcement included the statement that after the split, each business group will retain "the flexibility to raise outside capital and seek an initial public offering, except for Taobao Tmall Business Group, which will remain wholly owned by Alibaba Group", it may indicate that the newly established entities will not be publicly traded companies. Therefore, the shareholders of the current Alibaba group will not become the owners of each business entity after the split. Instead, the shareholders of Alibaba Group may retain ownership of the holding company, which in turn owns each business entity, which over time may seek other ownership (all except Taobao Tmall Business Group) through sale or IPO.

If the scenario outlined above is realised, such a split may still make a lot of sense in terms of improving the decision-making process, increasing flexibility and enabling each business unit to respond more quickly to market changes in their respective areas.

We have previously discussed the benefits of corporate spin-offs in this article.

Furthermore, Alibaba's decision to decentralise its business lines and decision-making authority aligns with one of Beijing's key objectives during its extensive crackdown on the tech industry. The government has been critical of the dominance of online platforms, specifically those operated by Alibaba and Tencent Holdings Ltd. As a result, this restructuring is likely to be backed by regulators who have expressed concern that tech monopolies are stifling innovation. This could mean that Alibaba could benefit from more favourable treatment from the Chinese government in the future.

Alibaba Group's finances

Despite higher-than-ever revenues, Alibaba Group suffered a depreciation in profits in the financial year ending in March 2022. While the financial results for the full FY2023 have not yet been announced, we may compare the 12 trailing months ending in December 2022 with previous financial years.

In addition to the general inflationary pressure on the company's expenses and bottom line, a notable change in Alibaba's financial statements is its net interest expense, which fell from over 10 billion USD in FY2021 to nearly -4 billion USD in 12 trailing months ending in December 2022. The change was due to increased interest rates and zero interest and investment income during this period.

Source: Seekingalpha.com

Similar to other tech companies around the world, Alibaba was not spared the need to lay off employees in 2022 in order to cut costs. In total, Alibaba is reported to have laid off 19,000 employees in 2022.

As a result of the fall in Alibaba's share price over the past year, it now looks undervalued relative to its industry and the S&P 500 average. At the time of writing, with a share price of 90.74 USD, Alibaba's P/E ratio is 11.92, using the EPS of 7.61 for 12 trailing months ending in December 2022. For comparison, the industry's average P/E is 21.87, and S&P 500 P/E is 17.99. Historically, Alibaba's P/E has been as high as 49.71, and its 5-year median is 27. Similarly, Alibaba's EV/EBITDA is 10.59, while the same multiple for S&P currently stands at 13.52 and is negative for the industry. Furthermore, Alibaba is a cash-rich company. It holds three times more cash than its total debt. Its net debt is -47.57 billion USD, and its total debt-to-equity ratio is 17.37%.

Looking at each business unit separately according to the company's restructuring plans, it is easy to see that only Taobao Tmall Business Group is currently a profitable segment in the group. Despite this, its profits are large enough to cover the other units.

Source: Seekingalpha.com

According to the Alibaba Group's statement, Taobao Tmall Business Group will remain the only wholly owned business unit by the Alibaba Group, assuring its shareholders that the key profit-making entity is staying under their ownership. Meanwhile, other loss-bearing business units will become more flexible for raising capital and becoming profitable.

Although still losing money, other Alibaba businesses are moving in the right direction to become profitable. The Global Digital Business Group has managed to improve its operating margins from -20% in FY2021 to around -8.53% in the latest period. Cainiao Smart Logistics improved its operating margin from nearly -11% to -6.59% over the same period. Similarly, the Digital Media and Entertainment Group has improved its operating margins from around -100% in 2016 to less than -20%. Finally, Cloud Intelligence Group's operating margin was 22.5% in 2018, a significant improvement from almost -90% two years ago. The operating margin in this group deteriorated during the Covid-19 pandemic but is now approaching the positive zone again.

Let's look closer at the Cloud Intelligence business, as this unit may have the greatest growth potential of all Alibaba's segments. There is also a sense of special treatment from Alibaba Group towards the Cloud Intelligence Group - after the spin-off, it will be under the leadership of Daniel Zhang - the chairman and CEO of Alibaba Group itself. The whole spin-off, among other reasons, might be a way to separate the Cloud Intelligence Group from other unrelated (and unprofitable) businesses and prepare it for a successful IPO in the near future.

Cloud computing market

Cloud computing is a critical element of digital technology and a major contributor to the digital economy, and has become a pillar of China's digital transformation. It enables the on-demand provision of computing resources to a large number of end users via a web-based infrastructure, allowing information to be stored and additional computing capacity to be provided without the need for costly hardware and servers. The global cloud computing market was valued at approximately 546 billion USD in 2022 and is expected to reach approximately 2,321 billion USD in 2032, with a compound annual growth rate (CAGR) of 16% projected between 2023 and 2032.

Source: https://www.globenewswire.com/

In China, the public cloud services market has grown at a rate of 49.7% year-on-year, reaching a total market size of 19.38 billion USD in 2020. It is projected to grow further. The cloud infrastructure market in mainland China is expected to reach 85 billion USD by 2026, representing a five-year CAGR of 25% and expand further to 547.2 billion USD by 2030, trailing a CAGR of 20.8% over the period from 2022 to 2030. Furthermore, China's share of the global public cloud service market is expected to rise from 6.5% in 2020 to over 10.5% by 2024, in line with the country's goal of increasing the value-add of digital economy businesses to its GDP to 10% by 2025.

Alibaba Cloud currently dominates the private cloud industry in China, with a 37% market share as of 2021. It has increased its market share by 30% by developing its business in traditional sectors and securing long-term consumption commitments from major customers. Technology Magazine has also ranked it as the fourth largest cloud provider in the world in 2023. With a global market share of 5%, Alibaba Cloud ranks among cloud giants such as Google Cloud Platform (GCP), Microsoft Azure and Amazon Web Services.

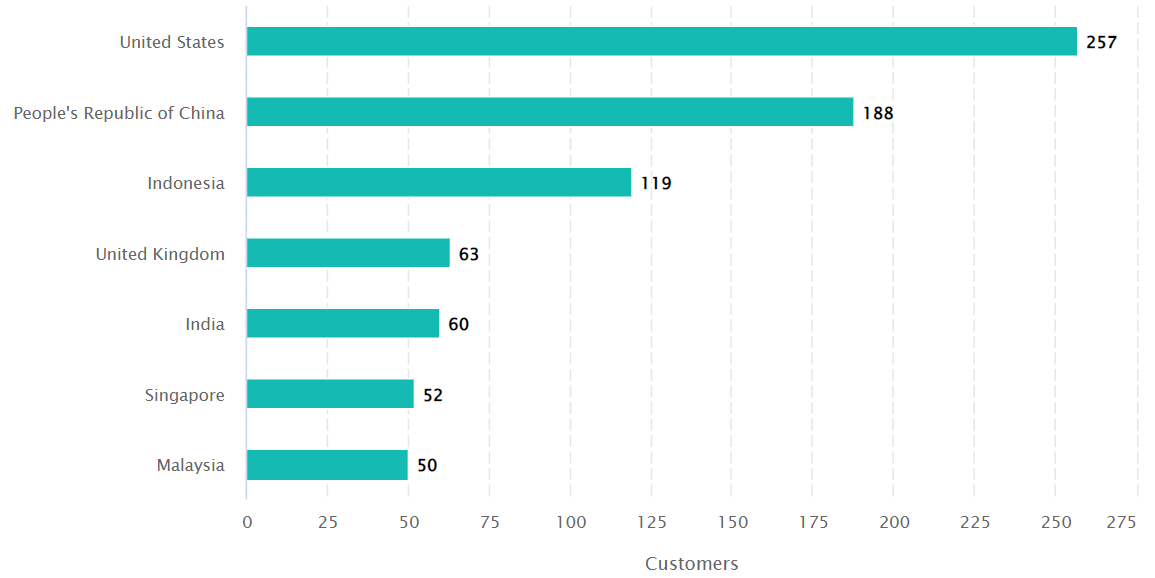

As of 2023, more than 1,047 companies worldwide have adopted Alibaba Cloud as a tool for cloud operations management. As counter-intuitive as it may seem, the majority of these companies, 257 in total, are based in the United States, accounting for 23.01% of all Alibaba Cloud customers. China is in second place with 188 customers (16.83%), and Indonesia completes the top 3 with 119 customers (10.65%). It should be noted that the large US customer base may have implications in the future if US-China relations continue to deteriorate.

Source: 6sense.com

Risks

While there may be considerable potential for the company, especially after the spin-off, investing in Alibaba is related to certain risks generally connected to the fact that it is a Chinese enterprise. First and foremost, according to Chinese law, foreign investors are not allowed to own shares of Chinese internet companies. Therefore, all BABA shares (ADS) traded on the NYSE are actually shares of Alibaba Group Holding Ltd registered in the Cayman Islands. In short, this means that investors owning BABA shares do receive part of the company's profits but have no voting rights or rights to its assets.

Furthermore, as reflected by Alibaba's financial statements, the Chinese government's crackdown on the country's tech sector, in combination with the damage done by the zero Covid policy, companies' success and profits may be highly dependent on its government's rulings. On the bright side, recent rulings, such as the Chinese regulator's decision to decrease the fine on Alibaba's affiliate company Ant Group, may indicate that the political environment in China is becoming more favourable. Also, the recently announced restructuring of Alibaba Group may earn extra points in the eyes of the Chinese governors.

Finally, the tension between the US and China, especially US's efforts to throttle China's technological advancements and even the potential military escalation over Taiwan, pose uncertainties for Alibaba Group.

Santa Zvaigzne-Sproge, CFA, Head of Investment Advice Department at Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis, and opinions contained, referenced, or provided herein are intended solely for informational and educational purposes. The personal opinion of the author does not represent and should not be constructed as a statement, or investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.18% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.