More and more economists and central bankers are beginning to announce that we are facing a second wave of inflation linked to the rising prices of key commodities on the markets. Since the beginning of the year, the price of oil has risen by 16%, the price of copper has gained 15% and gold has risen by 16%. Most experts agree that we will not reach the high levels we saw a year ago. Nevertheless, this factor pushes expectations for the first interest rate cuts by central banks, which are now predicted to be around September this year. In the coming week, we will look forward to US GDP and PCE inflation data. However, it seems that many investors' attention will focus on the Bank of Japan's interest rate decision. At its last meeting, Japan was the last country to end its negative interest rate policy.

Table of contents:

- US quarterly gross domestic product (GDP) (Q1).

- Japan interest rate decision

- US personal consumption expenditures (PCE) price index (March)

- Stocks to watch

Thursday, 25.04, 14:30 CET, US quarterly gross domestic product (GDP) (Q1).

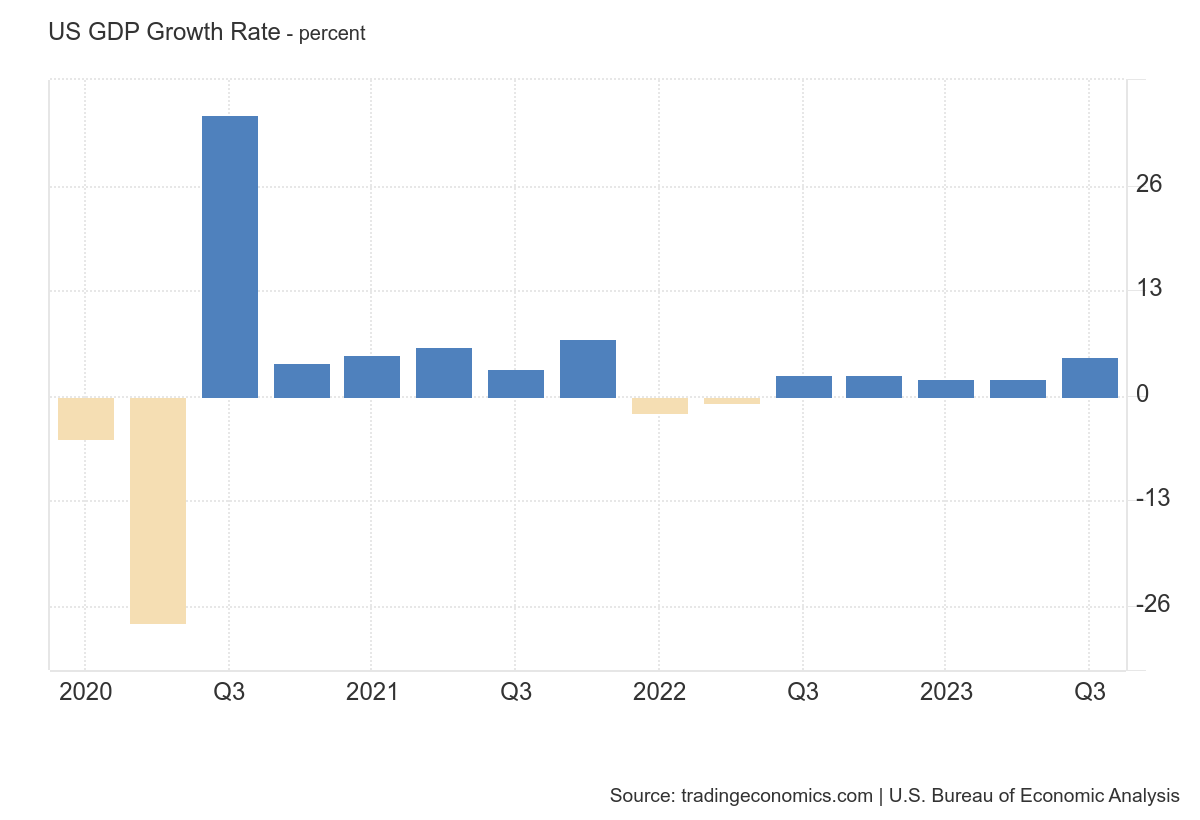

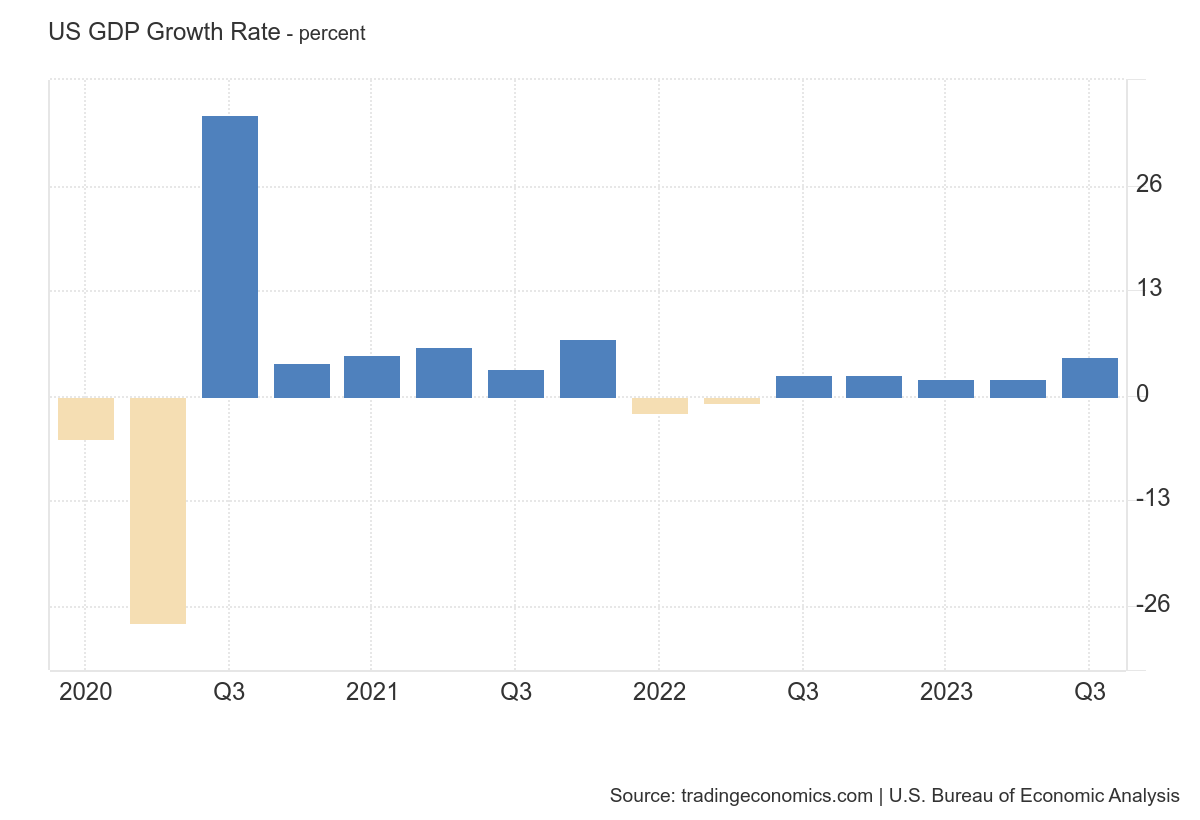

In Q4 2023, the US real Gross Domestic Product (GDP) grew at an annualised rate of 3.4%. This was mainly driven by increased consumer spending, non-residential investment and government spending. Despite this, imports, which are dragging down GDP, have started to rise again, indicating that the US economy is recovering.

The current analyst forecast is for GDP growth to slow in Q1 to an annual rate of 2.8%

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the USD, while a lower-than-expected reading could be bearish for the USD.

Impact: US500, EUR/USD

Friday, 26.04, 5:00 CET, Japan interest rate decision

On 19 March 2024, the Bank of Japan ended its eight-year policy of negative interest rates by raising them to 0-0.1%, the first hike since the 2008 crisis, as inflation had been above the central bank's 2% target for more than a year, while the country's largest companies agreed to raise wages by 5.28%, the largest wage increase in more than three decades. However, this did not help the Japanese yen. The USD/JPY exchange rate weakened above the US$150 level. In response to the weakening yen, Japan's main monetary authorities are considering currency interventions to prevent speculative moves. The last such intervention took place in October 2022 and reduced the USD/JPY exchange rate by 16%. Currently, the key level for the USD/JPY currency pair is 152.

Analysts' forecast is for interest rates to remain at the current level of 0-0.1%.

Source: Tradingeconomics.com

A higher-than-expected interest rate could be bullish for the JPY, while a lower-than-expected interest rate could act bearishly on the JPY.

Impact: JP225, USD/JPY

Friday, 26.04, 14:30 CET, US personal consumption expenditures (PCE) price index (March)

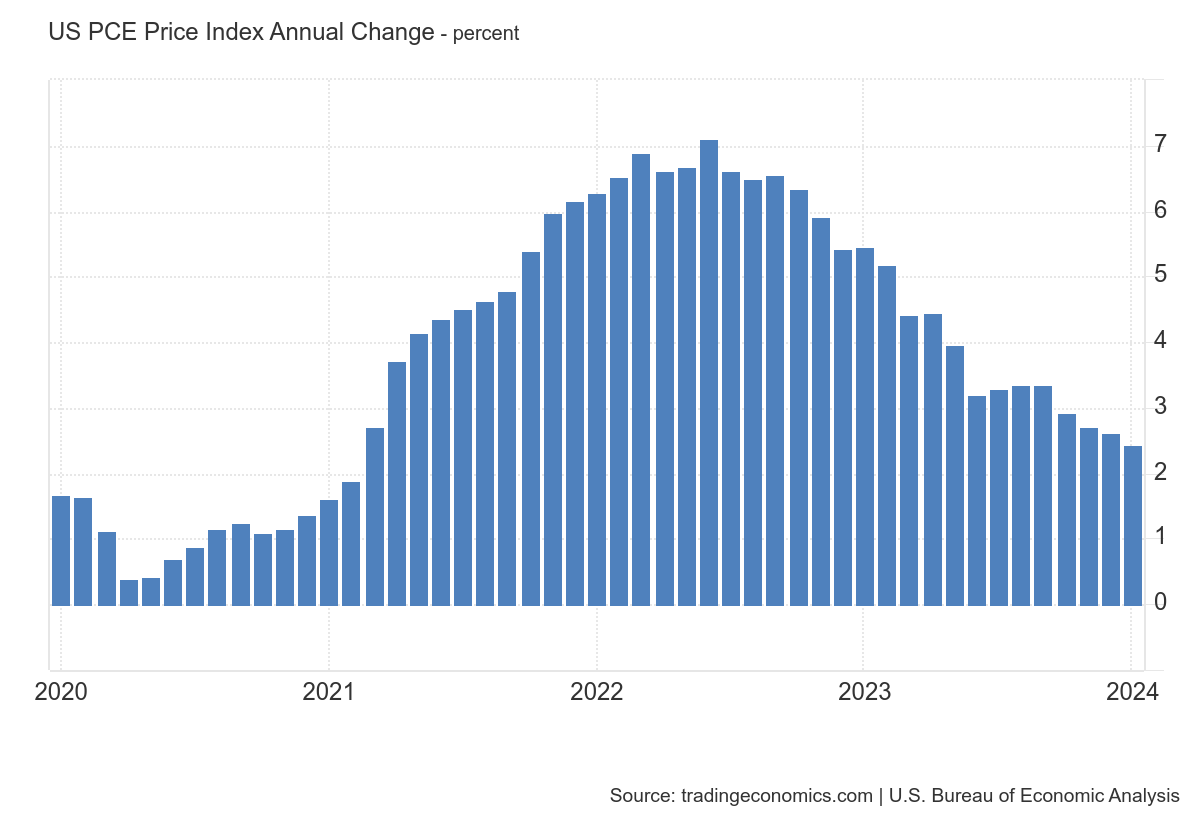

The annual change in US PCE inflation remained at 2.45% in February, the lowest level in two years. The annual change in PCE inflation in the United States averaged 3.30% from 1960 to 2024.

The current analyst forecast is for an increase in the level of PCE inflation to 2.6%.

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the USD, while a lower-than-expected reading could be bearish for the USD.

Impact: US500, EUR/USD

Stocks to watch

- Tesla (TSLA)

Tesla will report first quarter results on Tuesday. Sales of electric cars in the US have declined, revealing a slowing market and a drop in Tesla's share from 62% in early 2023 to 51% today. Tesla's sales were down more than 13% compared to the first quarter of last year, in contrast to significant sales growth at new competitors.

The electric carmaker's shares are now at one-year lows.

- Meta Platforms/Facebook (META)

Meta Platforms (formerly Facebook) will announce its first quarter results on Wednesday. The company has integrated its advanced artificial intelligence, Meta AI, into its applications and services, enabling real-time processing and seamless transitions between applications. Meta AI, enhanced by the Llama 3 model, makes it easier for users to give commands through chats and social media.

The tech giant's shares are near their historic highs.

- Alphabet/Google (GOOGL)

Alphabet (Google) will report first quarter results on Thursday. The company achieved a record price for its shares, bringing its market value closer to $2 trillion. The increase comes on the back of investor optimism about the company's potential in the area of artificial intelligence (AI) and stable advertising revenues. Analysts predict that Alphabet will surpass the $2 trillion mark, with a price target set at $185 per share. Alphabet has posted an average annualised investment return of 19% over the past decade, outperforming the S&P 500 but underperforming its peers over $1 trillion. Despite earlier mixed reactions to AI offerings, the company's prospects have improved as Google emerges as an AI leader and considers AI search fees.

Alphabet shares are near their historical highs maintaining their upward trend.

- Microsoft (MSFT)

Microsoft is set to unveil its first quarter results on Thursday. They are expected to be driven by advances in artificial intelligence (AI). Analysts at Citi note that AI products such as Azure and Copilot could significantly boost the company's revenues.

Microsoft shares are currently in a price correction.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,48% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.