It appears that optimistic expectations of falling inflation in the US have not yet been reflected in the data. CPI inflation turned out to be higher than forecast, remaining virtually unchanged above 3% since July 2023. It seems that the minutes of Wednesday's FOMC meeting will provide information on interest rate projections for the coming months. In addition, the final CPI inflation reading for the euro area will be presented on Thursday, and on Friday we will find out whether Germany's economy has entered a recession.

Table of contents:

- Federal Open Market Committee (FOMC) meeting minutes

- Eurozone consumer price index (CPI) annualised (January)

- Germany's gross domestic product (GDP) by quarter (Q4)

- Stocks to watch

Wednesday, 21.02, 19:00 GMT, Federal Open Market Committee (FOMC) meeting minutes

Federal Open Market Committee (FOMC) meeting minutes are documents detailing the discussions and decisions made during FOMC meetings. Published a few weeks after each meeting, the minutes provide insights into the committee members' deliberations regarding the country's economic condition, the economic outlook and other relevant factors influencing monetary policy decisions. They are a key source of information for investors, analysts and economists, providing a deeper understanding of the potential direction of the Federal Reserve's actions and their impact on the economy.

We learned from Fed Chairman Jerome Powell's recent January speech that it was decided to keep interest rates unchanged, with future potential changes dependent on incoming economic data. The Committee does not expect to change interest rates until it is more confident that inflation is steadily heading towards the 2% level. The Committee also communicated a continuation of its reduction in Treasury bonds and other debt assets in line with previously announced plans.

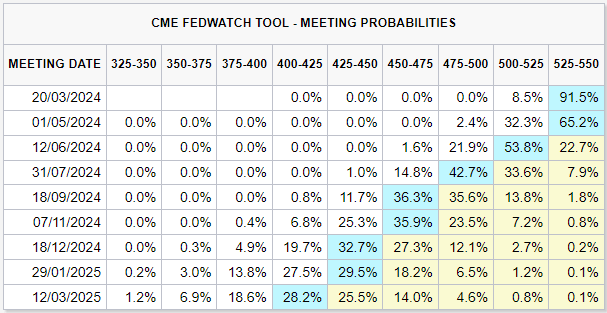

It looks like we will have to wait for interest rate cuts. According to the FedWatch tool, which analyses market valuations of the probability of interest rate changes, with a probability of 77.3% we can expect them in June this year.

Source: CMEGroup

More hawkish signals from the FOMC meeting minutes could have a bullish impact on the USD, while more dovish signals could be bearish for the USD.

Impact: USD

Thursday, 22.02, 10:00 GMT, Eurozone consumer price index (CPI) annualised (January)

The CPI monitors changes in the prices of consumer goods and services. The CPI is an important indicator because it helps us to understand trends in consumers' purchases and the impact of inflation on their purchasing power. It is calculated on the basis of a basket representing typical consumer spending, covering various categories such as food, housing, transport, etc. Regular measurements of the CPI allow us to track how the prices of these products and services change over time. A positive CPI indicates an overall increase in the prices of goods and services.

On the other hand, a negative CPI means that prices are lower than the year before. It is an important tool for economists and policymakers to help them understand the impact of inflation on the economy and take appropriate action. For consumers, it is information about how their money is losing value in the context of rising or falling prices, allowing them to adjust spending, plan savings and make financial decisions.

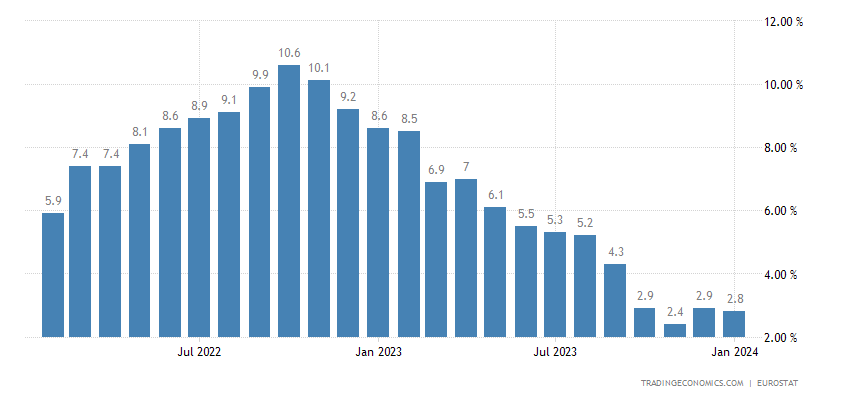

Preliminary readings told us that the January inflation rate in the euro area fell from 2.9 to 2.8% on an annual basis. Meanwhile, the core inflation rate, which excludes volatile food and energy prices, continued its decline to 3.3%, above forecasts of 3.2%, but reaching its lowest level since March 2022. Energy prices fell by 6.3% (compared to a decline of 6.7% in December), while services inflation remained stable at 4.0%. Price growth slowed for food, alcohol and tobacco (5.7 vs 6.1%) and non-energy industrial goods (2 vs 2.5%). On a monthly basis, consumer prices fell by 0.4 in January, following an increase of 0.2% in December.

The current analyst forecast is to confirm the January CPI inflation reading of 2.8%.

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the EUR, while a lower-than-expected reading could be bearish for the EUR.

Impact: EUR

Friday, 23.02, 7:00 GMT, Germany's gross domestic product (GDP) by quarter (Q4)

Gross domestic product (GDP) indicates the total value of goods and services produced in a country for a certain period. GDP is an important indicator of the health of an economy because it gives an overall picture of how well or poorly it is doing. If the GDP growth is higher than expected, the economy is in good shape and growing faster than expected. On the other hand, if the GDP growth is lower than expected, the economy performs weaker than anticipated. Furthermore, if the GDP growth is negative for two consecutive quarters, it may be considered a technical recession due to contracting economic output.

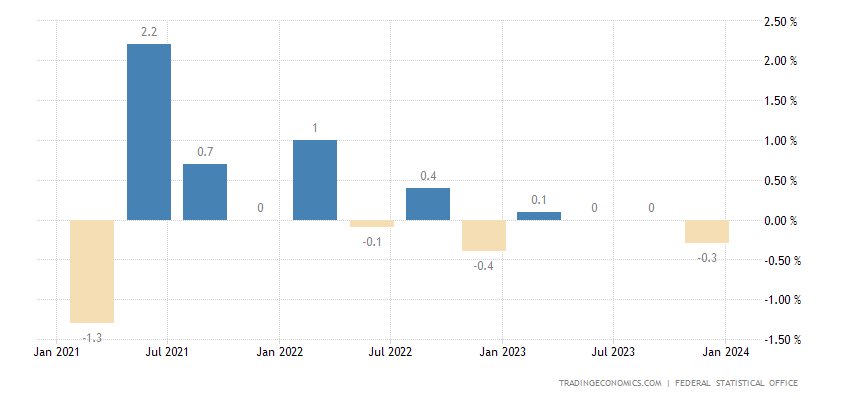

We know from preliminary estimates that the German economy slowed by 0.3% in the last quarter of 2023, a decline after two quarters of economic stagnation. Europe's largest economy encountered increasing difficulties, struggling with the consequences of rising prices and increased borrowing costs, which hit the industrial sector in particular. Net fixed assets showed a significant decline, primarily due to a reduction in investment in the construction sector and in the purchase of machinery and equipment. On an annual basis, the economy contracted by 0.2% in Q4 2023, entering a technical recession for the first time since the 2020-21 period.

The current analyst forecast is to confirm the quarterly GDP reading at minus 0.3%.

Source: Tradingeconomics.com

A higher-than-expected reading could have a bullish impact on the EUR, while a lower-than-expected reading could be bearish for the EUR.

Impact: EUR

Stocks to watch

Walmart (WMT) announces financial results for the quarter ending January 2023. Forecast EPS: 1.63. Positive earnings surprise in 9 of last 10 reports. Deadline: Tuesday, 20 February.

NVIDIA (NVDA) announces financial results for the quarter ending January 2023. Forecast EPS: 4.54. Positive earnings surprise in 8 of last 10 reports.

Deadline: Wednesday, 21 February.

Booking (BKNG) announces financial results for the quarter ending January 2023. Forecast EPS: 29.66. Positive earnings surprise in 10 of last 10 reports. Deadline: Thursday, 22 February.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.98% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.