The yen is often referred to as a currency that is a safe haven to which capital comes back when there is growing fear in the financial markets and aversion to risk increases. Meanwhile, the Japanese currency has fallen to the US dollar to the levels we last observed five weeks ago.

The weakening of the yen may result from the recent improvement in sentiment on the financial markets, due to the optimism that emerged after the meeting of the US and Chinese presidents, which even led to a strong increase in stock prices globally. Nevertheless the US dollar is traded close to a two-week high, pending the testimony of the Federal Reserve chairman, Jerome Powell. The market may look for guidance on the central bank's policy.

According to the traders cited by the Bloomberg news agency, the USD/JPY exchange rate also increased due to the strong demand from the Tokyo funds before Powell's testimony on Wednesday and Thursday. As a result, the USD/JPY approached the level of 109.00, which has not been observed for five weeks. Such information may also show how important the Fed chairman's speeches will be this week.

The first testimony will take place on Wednesday at 16:00, and the second on Thursday at the same time. Jerome Powell will present a semi-annual report on monetary policy before the committee of the House of Representatives and the Senate respectively. The content of the report should appear on Wednesday before 16:00.

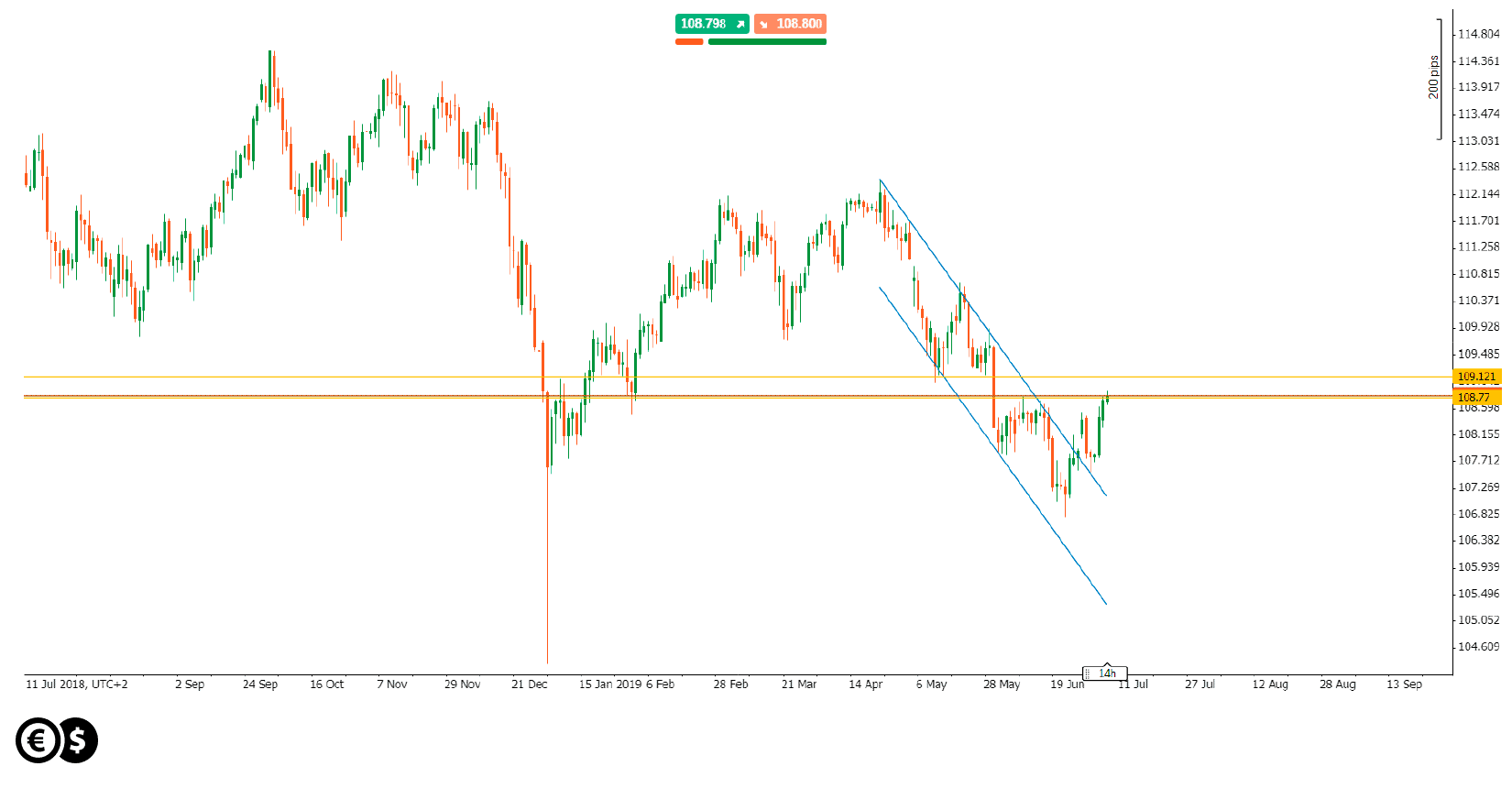

USD/JPY daily chart. Conotoxia.com

From the technical point of view the USD/JPY has broken the upper limit of the downward channel in which the pair moved from the end of April for two months. It seems, therefore, that there may be an attempt to change the last trend, but it can be better confirmed by breaking resistance at 108.77-109.12.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.