Mexican peso, South African rand, Turkish lira or Polish zloty - emerging market currencies in the MSCI classification are doing very well and are returning to previously observed trends, which is supported by the central banks policy.

Since the beginning of June, the Mexican peso has gained over 4.5 percent against the US dollar. From the second week of May, the Turkish lira strengthened to USD by over 11 percent, while ZAR from June gained almost 9 percent. Zloty against the dollar at that time strengthened by about 3 percent. However, these currencies may not only benefit from the weakness of the dollar, as they have also gained against the euro. The Turkish lira is the strongest against the EUR since April, as well as the South African rand, and the Polish zloty is the strongest since May 2018.

Such important trends seem to be a consequence of changes in the attitude of the major central banks of the world regarding monetary policy. Both the Federal Reserve of the United States, the European Central Bank, and recently also the Bank of England speak with one voice about the possible easing of monetary policy. Lower interest rates in developed countries are theoretically reducing the attractiveness of investments in the assets of these countries, currencies or bonds. For example, today the yields of 10-year German bonds fell to a record low, exceeding the level of the ECB deposit rate -0.4 percent.

Interest rates and debt yields of these countries are at much higher levels, and with the optimism prevailing in the markets, they may become attractive to investors. In addition, the carry trade may continue again on high interest-bearing currencies, such as TRY, MXN and ZAR. Carry trade also seems to favor low expected volatility.

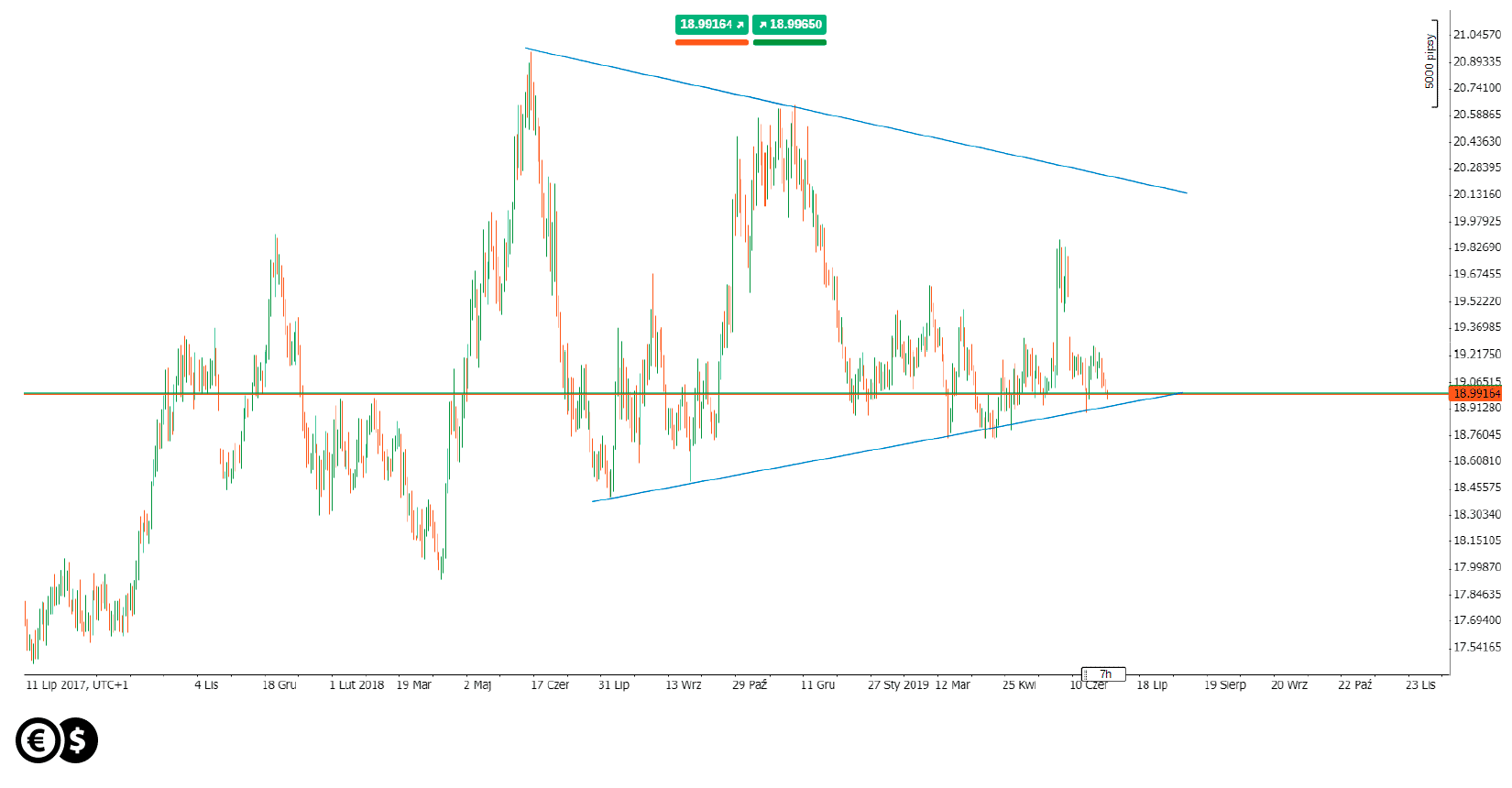

From the interesting patterns on the charts it is worth paying attention to the Mexican peso, which once again tests the trend line or the lower limit of triangle pattern.

Chart: USD/MXN, D1. Conotoxia trading platform

Theoretically, if this line was to be broken, the USD/MXN could continue the downward movement. From fundamental factors this can be supported by the statements of Donald Trump. US President Donald Trump reiterated this week that tariffs against Mexico are off the table as the country has stepped up efforts to stem migrant flows.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.