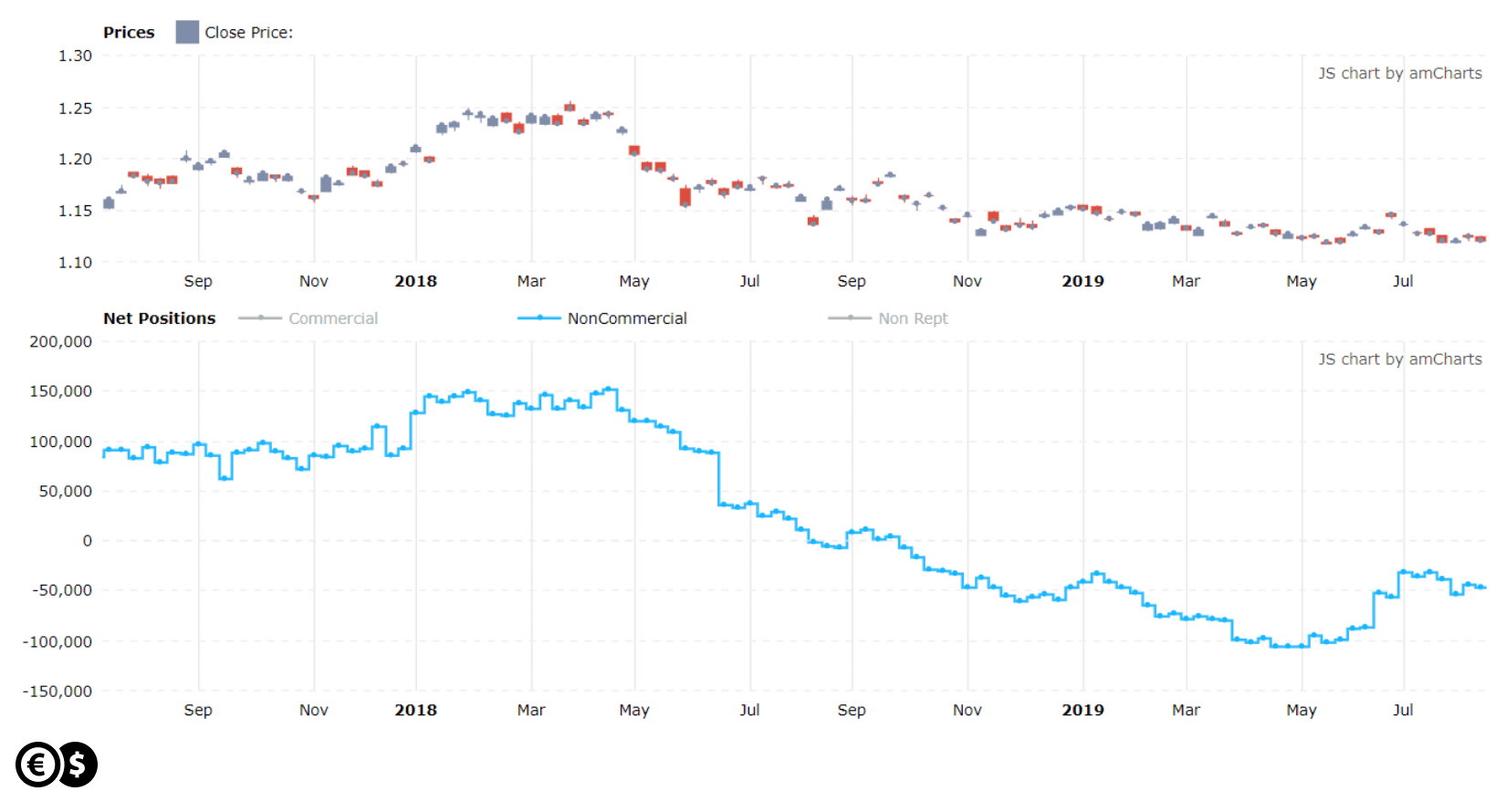

Since the beginning of last year, the euro has been systematically depreciating against the US dollar, which resulted in the EUR/USD exchange rate falling from around 1.2500 to 1.1050. As a result, the dollar reached the highest level to the euro since May 2017.

The single currency was primarily affected by weakening macroeconomic data, which pointed to a worsening economic situation in the euro area. At the same time, interest rates were raised in the United States, which created divergence in the monetary policy of the two central banks. Along with the falling price of the euro, investors began to increase their involvement in short positions on the futures market.

A short position may gain as the price of a given financial instrument decreases, in this case the euro. According to the American CFTC commission, 86,000 short positions among non-commercial investors were open in April 2018. However, already in April 2019 their number exceeded 250,000. It seems natural that as the market situation develops, investors follow the price and get more and more involved in a given trend.

Nevertheless, there has recently been a significant discrepancy between price and investor behavior. Namely, the EUR/USD exchange rate reached a new two-year low two weeks ago, while investors on the futures market did not increase their involvement in the short positions.

EUR/USD and non-commercial net long positions

In the chart above, we can clearly see that the net long positions (difference between long and short positions) had their low in May with the decrease of EUR/USD. Meanwhile, the latest euro fall did not lead to greater investor involvement, and no new low appeared in net long positions. This may mean that the desire to sell the euro is decreasing, which would consequently seem to end the long-term downward trend.

However, for this to happen, new data from the economy and central banks as well as political impulses will be needed. A strong dollar bothers US President Donald Trump, and the Fed has room for surprise. In turn, the cut of interest rates in the euro area by 20 basis points is almost entirely priced in by the market.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.